- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Are overdraft fees taking a toll on your finances? Discover how to reclaim your money by getting overdraft fees refunded. This article suggests ways to cut your overdraft fees or get it refunded.

Some banks may return an interest fee if you contact customer service and explain your situation, mainly if you have been a loyal customer or don’t commonly make mistakes with your account.

Overdraft fees are not always for overcharges. Delve deeper into this comprehensive guide to gain insights into the overdraft fees world. This article contains valuable information to help you achieve your financial goals.

Table of Contents

How to Get Overdraft Fees Refunded? Fees Amount

The cost of an overdraft varies depending on the bank. However, it presently costs $25 in aggregate. Each payment that exceeds your limit will incur a separate cost.

As we know from above, overdraft transactions can add up quickly if several expenditures hit your account in one go, like the day following a national holiday.

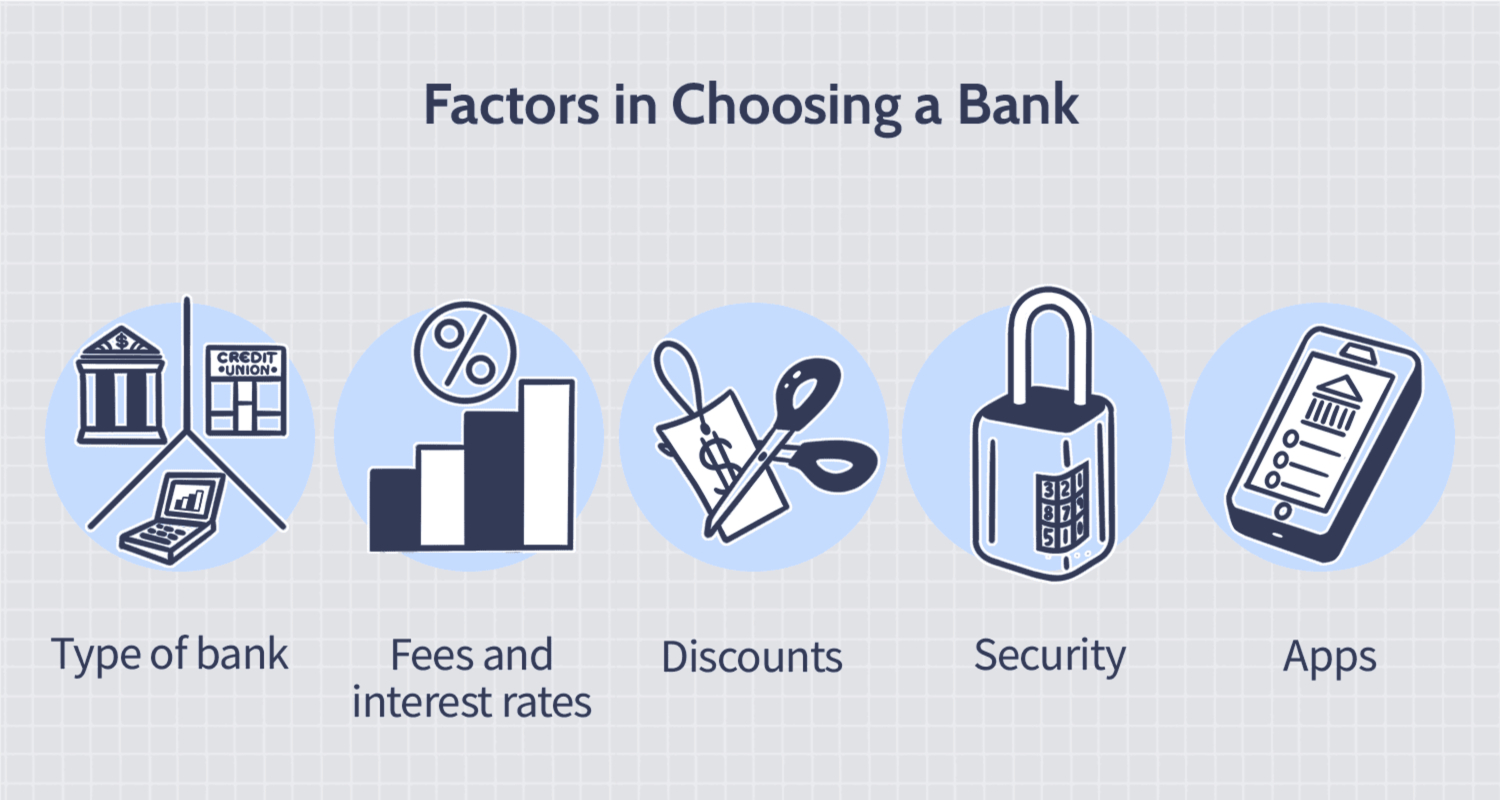

You might discover that overdraft costs charged by online banks are much lower than those charges applicable by conventional brick-and-mortar banks.

According to the Forbes Advisor 2021 Checking Account Costs Study, online banks cost an average overdraft price of $16.98 compared to traditional banks. Credit unions’ aggregate overdraft rate is $29.50.

There can be a method to recover your funds if you have been charged overdraft charges.

An overdraft may result when you attempt to invest more money than is available in your outstanding balance. Over drafting frequently results in overdraft costs and interest charges. You may be able to seek payback on your overdraft penalties.

This can also quickly build up, whether a payment was not clear as soon as you can anticipate everything would.

You weren’t paying attention to your bank statement. Let’s examine how to obtain reimbursement for overdraft charges and what you can do to prevent these charges initially.

Can you persuade your bank not to charge you for overdrafts?

Some banks may return an interest fee if you contact customer service and explain your situation, mainly if you have been a loyal customer or don’t commonly make mistakes with your account.

Several institutions might have an established program that either approves or helps you avoid overdraft penalties.

For instance, Wells Fargo provides the Overdraft Rewind feature. According to the financial institution, your overdraft service charge would waive if you deposit money via direct down payment.

Payment made is to make up the shortfall by 9 a.m. the following morning. You will profit from this function effectively with a straight deposit account.

You may link up to five more accounts with Bank of America’s Balancing Connect. Then shift extra capital when you have to do so to avoid paying an overdraft charge.

Huntington Bank is another institution that can assist you in avoiding overdraft fees. The $50 Safety Zone ensures you won’t have to assess an overdraft fee whenever your account is debited by $50 or less. Additionally, there is a grace period of 24 hours during which you can deposit money and evade overdraft charges.

See Also: 5 Best Credit Cards for Young Professionals

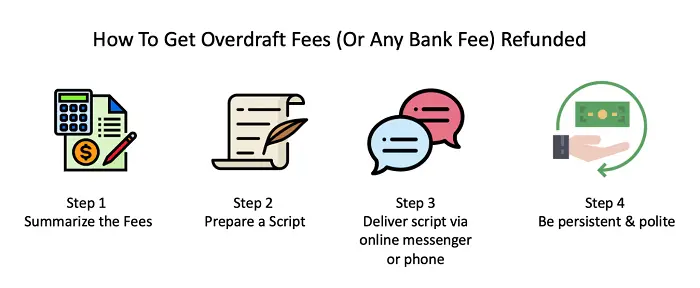

How to Get Overdraft Fees Refunded?

Even though you may be able to obtain a reimbursement of your overdraft charges, it’s preferable to stay away from them entirely.

Here are some pointers for doing so.

Maintain an eye on your balance.

Ensure you are constantly conscious of the money coming into and out of your account. By monitoring your account on a desktop or smartphone, you can record this regularly on paper or digitally.

Register in low balance notifications then your bank gives will inform whenever your account falls below a set level.

Link to an additional account

Your bank may use money from some other examining, and savings account to make up the difference.

This occurs if your bank lacks enough currency to support the purchase. The requirement is to link to an alternative account. Talk to your bank to learn if this is an option.

A bank without overdraft fees is the one to choose

While this may imply that they don’t provide overdraft protection services, certain banks don’t levy overdraft charges on all current accounts.

Switching to a bank without overdraft costs may be worthwhile if your current bank costs overdraft penalties and you frequently overtighten your account. Just be mindful of additional costs like ATM and bounced check fees.

Refusing to use overdraft protection

You can avoid paying overdraft charges by choosing not to use overdraft protection. However, remember that if you try to make a transaction but do not possess enough money in your account, the debit card will refuse the transaction.

You will not pay overdraft fees, so it will not matter the humiliation.

What is the crucial information about overdraft fees?

Overdraft charges are expensive. You could pay somewhere between $30 and $35 for each transaction. Some financial institutions may impose several daily overdraft penalties or prolonged overdraft costs.

This implies that your account balance is negative for a predetermined period. Because of this, a single overdraft fee might amount to a sizable sum of money. So try not to overdraft, or else try how to get overdraft fees refunded.

Next, what?

Overdrawing your checking account may not be a big deal because mistakes happen occasionally.

You may not consider your expenses sufficiently or purchase more than you make. This happens if you frequently overdraw your account. Take a deeper look at one monthly plan. See if there are any adjustments you can make to cut overdraft charges.

See Also: 10 Best Budget Planner Books to Manage Your Finances

FAQs

Can I request that my bank waive the overdraft payment?

Make Your Demand Inform the bank if you want the overdraft cost waived. You may say, 'I observed an overdraft penalty was levied to my account on the date, but I'd like to get everything withdrawn.' Giving the bank some context on what caused the overdraft can be helpful.

How frequently may I overdraw?

While not all banks operate similarly, yours likely has no restrictions on how frequently you can overdraw your money. Nevertheless, the sum of an overdraft that your bank could pay may be capped.

Can you have your overdraft charges reimbursed?

Yes, you can request an overdraft charge return from your bank. Even though it probably benefits from having a great connection with the bank. Completing your transactions on time and infrequently incurring overdraft fees, it's as easy as approaching your bank and requesting them to reimburse the fees.

How much time is given to repay an overdraft?

Depending on your bank, you usually have 5 business days to transfer funds into your account to make up the overdraft. The bank retains the authority to charge additional overdraft charges.

Conclusion

Now, it is of your knowledge how to get overdraft fees refunded. The bank may eliminate the overdraft fee shortly. Until then, if you have asked to purchase one, the solution is frequently surprisingly straightforward: Request if you may acquire a pass for this particular occasion.