- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Budget planning is for everyone, whether you are running a business or your household affairs. Budget planning means creating a plan for your money, be that receipts or payments. Here we have compiled the 10 best budget planner books of 2024.

Budget planning ensures that you spend your money wisely and save enough for future use. It also accounts for all your income, so you can manage your payments well.

Some people also like to budget for extraordinary expenses they may need to incur in the future, like vacations, weddings, child-care, etc.

Table of Contents

How to make a budget?

Budgeting can seem like a daunting task, so we have broken it down into 5 easy steps –

Calculate net income

It is the first thing to do in any budgeting process. Net income is your income after accounting for taxes and employee welfare expenses, forming the base for your budget.

Calculate spending

The next step is to calculate where your money is going. Start by calculating fixed expenses like electricity, interest payments, rent, utilities, etc. Then move on to variable costs for shopping, eating out, on-demand cable, etc.

Define your goal

Whether your goal is to save enough for a vacation or buy a house, clearly state it with a tentative achievement date in mind. But make sure that you set a realistic goal.

Make a plan and adjust your expenditure

Now that you know how much you earn and spend combine it with how much you want to save to create a plan. Keep the achievement date in mind, and plan how much you need to save monthly to reach your goal.

Adjust your monthly expenditures slightly to accommodate for additional savings.

Regularly review your budget

Lastly, regularly reviewing your budget keeps you accountable and helps you stay on track. In case of an unprecedented change in your finances, don’t hesitate to make relevant changes to meet your budgeting goals on time.

Best Books for Budget Planning in 2024

Irrespective of the budgeting reasons, we firmly believe that everyone can benefit from it. Even if you are a newbie, there is no time to start a good habit like the present.

Although, creating a budget and following it isn’t always easy. Just accumulating your financial information on loose sheets of paper isn’t the most efficient way to stay on top of your finances.

However, budget planner books can help you plan your finances, stay accountable, and make your payments on time. When you plan your budget, you control where your money goes and avoid unnecessary spending.

Although, finding the right monthly budget planner for your needs requires some research. But worry not, because we have cumulated a list of the best budget planner books so that you can reach all your financial goals:

Blue Sky 2024 Monthly Planner

The Book, which runs from January 2024 to December 2024, remembers for profundity month-to-month view pages that contain past and one month from now reference schedules for long haul arranging.

The Book additionally has a notes segment for significant undertakings or records that don’t precisely squeeze into a different region of the organizer. Another helpful element is that covered tabs make it a breeze to flip to where you should be.

Limitless Mindset Budget Planner

Why purchase a comprehensive financial plan book when it can take the most recent two years?

This one accompanies Undated pages, however long the time of two years.

It Comes With Monthly Columns that permit you to hold your measurements under control.

Aside from having 6 different variety choices, It has a cowhide restriction, which gives the Book a great inclination.

It likewise has a schedule page so you can check an important date.

It accompanies free 3 money envelopes, a custom pen, and 2 sticker sheets to make the planning fascinating.

Clever Fox Planner

There’s an explanation this organizer is so broadly applauding. The updated week-by-week organizer vows to help with efficiency, time effectiveness, and objective setting.

Notwithstanding space for arrangements and the everyday things you could sign in an organizer, its pages order your day into five key regions: efficiency, enthusiasm, inspiration, satisfaction, and concentration.

It additionally accompanies 150 brilliant organizer stickers to assist you with recognizing the primary considerations, a pen circle to guarantee you generally have a composing instrument close by, and an internal pocket to hold meaningful reports, receipts, and other separate records.

Busy Family Bill Organizer

Firstly, this monthly bill planner is the best decision for individuals investigating family arranging and financial plans.

This large Book accompanies 12 included pockets to keep your bills and receipts in a single spot.

There are many clear spaces for you to take note of your day-to-day expenses.

There are graphs given to provide you with a superior standpoint of your planning situation.

The Book accompanies a strong hardcover restricting going through predicaments despite saying something very similar.

The Manufacturer has additionally added three free money envelopes.

See also: Best ways to get cheaper Spotify premium

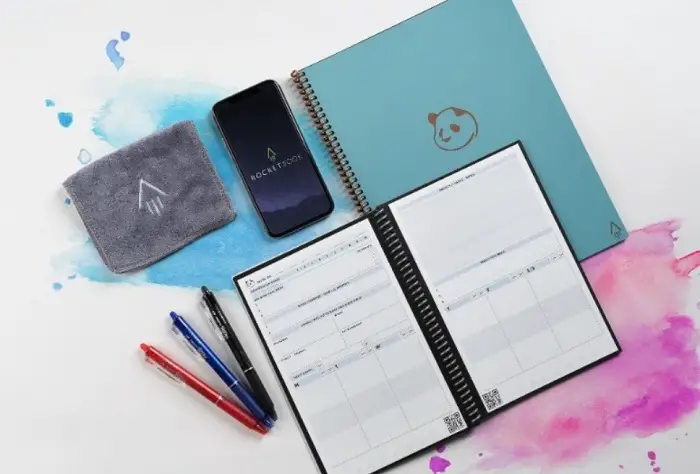

Rocketbook Panda Planner

This comprehensive organizer is separated into the day-to-day, week by week. Month to month areas, so you can pick what technique for association turns out best for yourself and bet everything on it — or, you can utilize the entirety of the abovementioned, so you have an unshakable hold on what’s on your schedule consistently.

The individuals who love computerized instruments will likewise see the value in this organizer’s exceptional capacity to adjust with your number one advanced device.

You can save automated adaptations of your organizer pages to cloud administrations like Google Drive, Dropbox, Evernote, box, OneNote, Slack, iCloud, email, and more utilizing the free viable Rocketbook application for the two iOS and Android.

Erin Condren Petite Budget Planner

Another planner perfect for those just starting with budget planning. This planner is sleek and stylish and is available in two cover options. You can keep track of your monthly and weekly budget with this planner.

It allows for 12 months of budget planning and comes with savings tracker pages, monthly expenditure summary pages, debt tracking pages, and sticker sheets. You also get a convenient pocket for your bills and stickers.

By keeping track of your debt and payments, you can track your savings and reach closer to your financial goals.

GoGirl Budget Book

If you are a college student wanting to keep track of your finances, this is the monthly budget planner for you. This compact budget planner will keep you motivated and on track with a minimalist style and beautiful layouts.

You can record your bills, debts, savings, and overall cash flow and get reminders so that you consistently pay your bills on time. There is enough space to track your expenditure habits to improve in the future.

It has a 12-month layout to track finances, calendar spreads, and expense breakdown pages. You also get holiday tracker pages and yearly summary pages to hone in on your financial position.

This affordable planner has a pen holder and several accordion pockets to store your bills systematically.

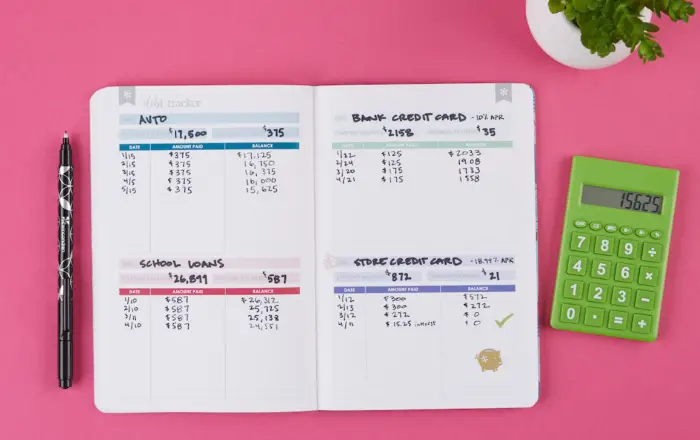

Boxclever Press Budget Planner

A sturdy matte cover, beautiful designs, 13 pockets for bills and cash, and an elastic to secure it make this planner one of the best on our list.

It is suitable for office and household financial planning because its big size allows you to execute detailed financial plans. It is also available in a portable version for ease and functionality.

Several useful pages like payment tracker, debt tracker, bill tracker, holiday and Christmas expense tracker, annual summary pages, calendar, and monthly review pages are available.

Legend Deluxe Budget Planner

With an embossed, high-quality faux leather cover, this gorgeous planner will keep you on track to achieve your financial goals.

Its compact size (A5) makes it suitable for carrying around. You can track bills, debts, expenses, goals, and income. There are also some financial goal pages available to help help you stay motivated throughout the year.

The pages are undated, so you can start planning from any date. It comes in several colors and has a ribbon bookmark, a pocket for your bills, 109 stickers, and bleed-resistant pages.

There are several tracker pages for bills, debts, and expenses. Standard planner pages like calendars, monthly breakdowns, and reviews are also included.

This planner also comes with a unique money-back guarantee and hassle-free return policy to give you the best bang for your buck.

Mead OrganizeHer Budget Tracker

This is a one-of-its-kind budget tracker. It is comprehensive and one of the biggest planners, so you can plan your finances in detail. It is a durable option resistant to wear and tear.

You have enough space for calendars, checklists, and debt and savings tracking. It also has 12 monthly pockets for bill organization, 2 clear folders, and a plastic sheet protector.

Besides its large size, another feature sets this planner apart from the others. Once you have filled all the sheets, you can download more online.

These downloaded sheets can easily be attached because of the planner’s Three Tech Lock poly rings. This feature makes the planner reusable and durable in more ways than one.

Tips And Methods For Using A Budget Planner

Following are the tips that a budget planner can follow:

- List every bill you have for the month on the bill schedule page. When you first begin using it, do this. This gets carried over from month to month in my planner. The remainder of the year will go much more smoothly if you get it right in the first month.

- Decide on your monthly budgetary goals. Do you intend to pay off debt? Use my debt payment calculator to create a payment schedule, then enter the results into your budget to help with the repayment.

- Look at your expenditures over the previous three months on groceries, dining out, clothes, shopping, and other random purchases. Consider this: the last three months, you spent $500 on eating out in May, $350 in June, and $275 in July. After adding them all up, I divide the total by 3. I receive an average of $375 as a result. The $375 will serve as my monthly dining-out budget for August.

- Set your first budget, #4. Place the bills from the page with the bill organizer on the page with the monthly budget planner. Add your budget for groceries, other expenses, dining out, clothing, etc. You are utilizing the three-month averages calculation in step 4.

- Use the weekly calendar pages to plan your days and finances together. Start making a schedule for when payments are due, what tasks to complete each day, and your shopping and meal preparation.

- Every month’s final Sunday is when I create my budget. I set aside money on the last Sunday of June for July. I can use this to prepare for the entire month in advance, avoiding surprises and allowing me to change my expenditures as needed.

Types Of Budgets

A budget compares and plans for income and expenses over a given period in its most basic form. It would help if you deducted expenses from revenue while creating a budget. A deficit occurs when expenses are higher than revenue, and a balanced budget is one in which income and expenses are equal.

Personal budgets are those that regular people create to manage their income and expenses; they tend to be simpler than corporate or governmental budgets because there are fewer expenses to keep track of. Different budget strategies could be more effective for various individuals.

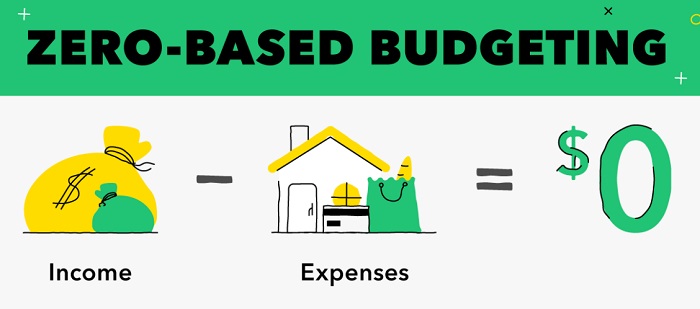

Zero-Based Budgeting

In a zero-based budget, every dollar of your revenue is, and every dollar must be put to use. Governments, businesses, and other institutions can all adopt this budgeting strategy.

Cash Envelope Budgeting

Using a cash envelope system, each is given a particular budget category, and each envelope contains the designated sum for that budget category. When you exhaust all the cash in an envelope, you can no longer make any purchases in that budget area for the month.

See also: 9 Best YNAB Alternatives

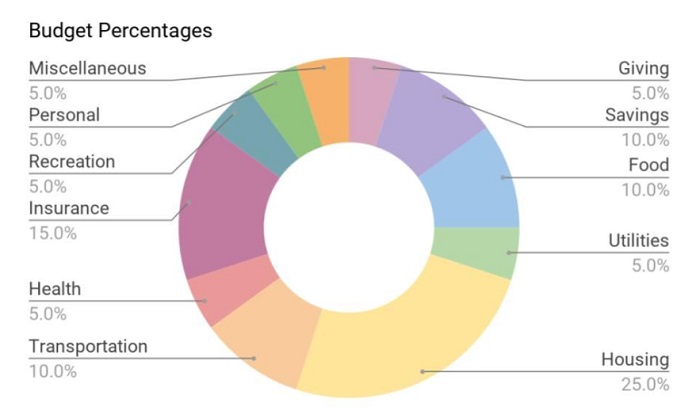

Budgeting By Percentage

With percentage-based budgeting, funds are distributed among various categories. Consider allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. “All Your Worth: The Ultimate Lifetime Money Plan,” a best-selling 2005 book about the 50/30/20 rule, co-authored by U.S. Senator Elizabeth Warren and her daughter Amelia Tyagi Warren.

Frequently Asked Questions (FAQs)

What features should I look for in a budget planner book?

A good budget planner should have calendar pages and the space to track your income, expenses, debt, and upcoming bills.

How can the pockets in a budget planner be used?

You can store upcoming bills and receipts in its pockets, and you can also keep some emergency cash in them.

Is a budget planner worth it?

We highly suggest investing in a reasonable budget planner book to systematically track your finances and get encouraged to pay off your debt on time.

How will a budget planner help save money?

Budget planner books help you save money by tracking where every cent is spent.

Which is the best planner for beginners?

We recommend Clever Fox Budget Planner, Erin Condren Petite Budget Planner, and GoGirl Budget Book.

Conclusion

There is no single budget planner book suitable for everyone’s needs. But there is a need for budgeting for everyone. We have covered the best budget planner books in the markets and their features so that you get various options to choose from.