- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Financial management delves towards understanding and handling the finances of a company you’re working with to make it successful and cooperative concerning the specified regulations available. The lucrative image of procuring an occupation in finance has attracted several people. It has also motivated people to apply for several online certification courses in finance. There have been several short-term certification courses where you can study finance online in the comfort of your home. Along with this, you gain recognized certificates that can help kick-start your career.

Top Short-term Certification Courses in Finance:

- Financial Modelling

- Certified Financial Planner

- International Financial Reporting Standards

- Chartered Wealth Management

- Chartered Alternative Investment Analyst

- Chartered Financial Analyst

- Financial Risk Manager

- Certified Investment Management Analyst

- Certified Fund Specialist

- Certified Treasury Professional

Short-term courses are present to build a person’s knowledge of a specific subject quickly. These courses hold an equal value to degrees that require long and full-time classes. This article is about the different short-term certification courses in finance that anyone interested can access on the Internet.

Table of Contents

Top 10 Short-term Certification Courses in Finance

Financial Modelling

Financial modeling is a certification for many people who have an interest in joining the finance field. It represents the process of creating a summary of all the expenses a company incurs in a spreadsheet. The spreadsheets are used to figure out the impact of a future event or decision. Such workers analyze the performance of the business and build data based on it to provide future predictions.

People taking up this certification have a reasonable chance of finding employment in new companies and businesses based in financial services, health coverage, and startup markets. This short-term certification course in finance can also explore fields like investment banking, financial analysis, project finance, and credit ratings. This certification does not have specific eligibility requirements. Therefore, students and other working professionals can apply to study financial modeling directly.

People taking up this certification have a reasonable chance of finding employment in new companies and businesses based in financial services, health coverage, and startup markets. This short-term certification course in finance can also explore fields like investment banking, financial analysis, project finance, and credit ratings. This certification does not have specific eligibility requirements. Therefore, students and other working professionals can apply to study financial modeling directly.

See Also: Best Business Bank Accounts for Entrepreneurs [2023]

Certified Financial Planner

Certified Financial Planner is one of the well-recognized short-term certification courses in finance. This course is based on creating and maintaining a sufficient financial plan for a company. The focus is on understanding the company’s financial goals and determining its current financial situation. CFPs work to provide advice on retirement planning, choosing investments, tackling debts, and saving. Their view is primarily fixed for future related financial planning.

Holding a certificate in financial planning helps people hold a competitive edge in being trusted workers in the eyes of their employers and clients. It is one of the best finance courses available. The essential eligibility requirement to apply for CFP is for students to have a high school degree. However, even people with education in Chartered Accountancy, Chartered Financial Analyst, Ph.D. in Finance, etc., can register for this certification.

Holding a certificate in financial planning helps people hold a competitive edge in being trusted workers in the eyes of their employers and clients. It is one of the best finance courses available. The essential eligibility requirement to apply for CFP is for students to have a high school degree. However, even people with education in Chartered Accountancy, Chartered Financial Analyst, Ph.D. in Finance, etc., can register for this certification.

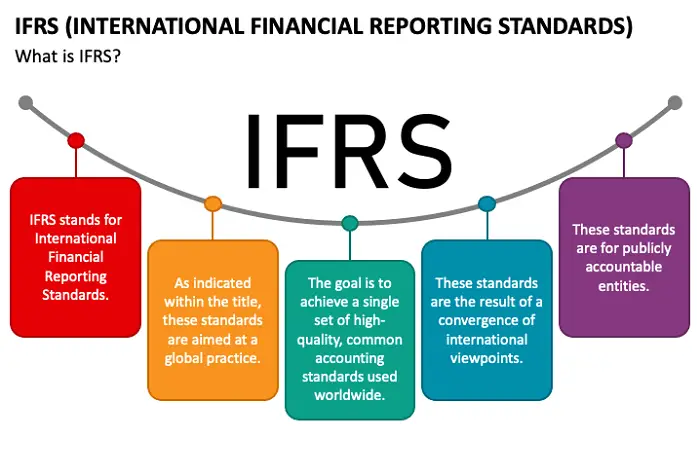

International Financial Reporting Standards

International Financial Reporting Standards precisely consist of a group of accounting standards that have been created for the financial transactions of several companies and businesses. They work on regulating how one should report these transactions in financial statements in a relevant manner, have clarity, are understood to be reliable, and are comparable worldwide. The International Accounting Standards Board is responsible for issuing the International Financial Reporting Standards certification.

This short-term certification course in finance is taken up by more than 100 countries and focuses on the importance of allowing companies to become transparent. This business finance online course can enable investors and related people to make informed economic resolutions. The course requires an essential eligibility requirement of having a bachelor’s degree in finance or related fields. It also requires applicants to have a professional experience of 3 years in the field of accounting.

This short-term certification course in finance is taken up by more than 100 countries and focuses on the importance of allowing companies to become transparent. This business finance online course can enable investors and related people to make informed economic resolutions. The course requires an essential eligibility requirement of having a bachelor’s degree in finance or related fields. It also requires applicants to have a professional experience of 3 years in the field of accounting.

Chartered Wealth Management

This is a short-term certification course in finance with the skills and knowledge to implement primary financial functions successfully. The focus is on developing the management of relationships and core financial skills. It is a globally recognized profession by investors and employers and helps open various employment opportunities.

This certification is a benchmark of competency in finance and is a leading accreditation in wealth management and private banking. It involves several other topics like investment strategy, behavioral finance, intergenerational wealth transfer, life cycle management, relationship management, and global taxation. This business finance online course requires at least three years of experience in wealth management and a recognized master’s degree in a specific field of finance.

This certification is a benchmark of competency in finance and is a leading accreditation in wealth management and private banking. It involves several other topics like investment strategy, behavioral finance, intergenerational wealth transfer, life cycle management, relationship management, and global taxation. This business finance online course requires at least three years of experience in wealth management and a recognized master’s degree in a specific field of finance.

Chartered Alternative Investment Analyst

Chartered Alternative Investment Analyst is a short-term certification course in finance that advises and supervises alternative investments like hedge funds, venture capital, private equity, pension funds, sovereign wealth funds, and real estate investments. The certification also covers topics like ethics, tangible assets, asset allocation, risk management, and structured products. The certification is known to be a benchmark in alternative investment worldwide.

People who take up this finance course online take at least one year to complete it. Chartered Alternative Investment Analyst is not a versatile course in finance like the Master of Business Administration certificate; therefore, the scope is less in other fields. The certification requires eligibility in the form of a bachelor’s degree in finance or related fields and at least four years of professional experience in the same.

People who take up this finance course online take at least one year to complete it. Chartered Alternative Investment Analyst is not a versatile course in finance like the Master of Business Administration certificate; therefore, the scope is less in other fields. The certification requires eligibility in the form of a bachelor’s degree in finance or related fields and at least four years of professional experience in the same.

Chartered Financial Analyst

Chartered Financial Analyst is a short-term certification course in finance that finance professionals highly demand. CFA professionals work in areas involved in risk management, investment management, asset management, etc. It mainly consists of working in portfolio management, investment analysis, financial reporting and analysis, equity, alternative investments, wealth planning, fixed income, ethical standards, etc.

This course has international recognition and is a very challenging financial certification course that is available. It is primarily theoretical, with an excessive concentration given to portfolio management. This online certification course in finance has a meager pass rate and, therefore, is a challenging goal to accomplish. The eligibility requirements of this business finance online course include needing a background in finance, accounting, or economics and a professional experience of at least 4 years.

This course has international recognition and is a very challenging financial certification course that is available. It is primarily theoretical, with an excessive concentration given to portfolio management. This online certification course in finance has a meager pass rate and, therefore, is a challenging goal to accomplish. The eligibility requirements of this business finance online course include needing a background in finance, accounting, or economics and a professional experience of at least 4 years.

Financial Risk Manager

Financial Risk Manager is one of the best short-term certification courses in finance for people has a keen interest in working as risk officers, risk analysts, and other positions in risk management. It is a cost-effective and time-efficient finance course online. Such professionals have expertise in estimating business risks and are likelier to work in major banking establishments, insurance companies, accounting firms, asset management firms, and regulatory agencies.

Financial Risk Managers determine the risk factor by scrutinizing the present financial markets to predict possible changes in the future. They also have to develop strategies to impede the effects of these possible risks. This online finance course requires a minimum professional experience of at least two years. People can complete this certification in less than a year. It is known to be a specialized certification that is recognized in over 90 countries.

Financial Risk Managers determine the risk factor by scrutinizing the present financial markets to predict possible changes in the future. They also have to develop strategies to impede the effects of these possible risks. This online finance course requires a minimum professional experience of at least two years. People can complete this certification in less than a year. It is known to be a specialized certification that is recognized in over 90 countries.

See Also: Top 10 Best Laptops For Finance To Buy

Certified Investment Management Analyst

Certified Investment Management Analyst is a short-term certification course in finance that the Investments and Wealth Institute set up. People with this certification find employment in areas involving investment consultation. They also work in financial consulting firms and extensively interconnect with high-net-worth clients and large business organizations.

CIMAs are not just skilled in finance but also in business strategy involving evaluation and supervision of risks. This online certification course in finance centers around asset allocation, ethics, risk measurement, investment policy, and performance measurement. The people applying for this certification need to have an experience of at least three years in the field of investment consulting.

CIMAs are not just skilled in finance but also in business strategy involving evaluation and supervision of risks. This online certification course in finance centers around asset allocation, ethics, risk measurement, investment policy, and performance measurement. The people applying for this certification need to have an experience of at least three years in the field of investment consulting.

Certified Fund Specialist

It is a short-term certification course in finance that received its certification from the Institute of Business and Finance. Individuals in this field have a certification in mutual funds and find employment as accountants, bankers, financial advisors, etc. They can advise their clients about the mutual fund that suits their needs best and manage client portfolios. Certified Fund Specialists also provide advice on when, where, and how to invest. They can understand the market movements and financial instruments and, therefore, can be relied on to make proper investment decisions.

People with this certification have the added knowledge in exchange-traded funds, real estate investment trusts, closed-end funds, risk management, asset allocation, portfolio construction, advanced fund analysis, etc. This business finance online course requires aspirants to have a minimum qualification in a bachelor’s degree in finance or related fields and a professional experience in the same field. Interested aspirants can complete the CFS course in a period of fifteen weeks.

People with this certification have the added knowledge in exchange-traded funds, real estate investment trusts, closed-end funds, risk management, asset allocation, portfolio construction, advanced fund analysis, etc. This business finance online course requires aspirants to have a minimum qualification in a bachelor’s degree in finance or related fields and a professional experience in the same field. Interested aspirants can complete the CFS course in a period of fifteen weeks.

Certified Treasury Professional

The Certified Treasury Professional course helps to develop the competence one needs to implement essential corporate liquidity, risk management, and capital functions. They help supervise and operate corporate treasuries and oversee the credits and liabilities that occur in a business, as well as the debits and assets incurred by the company.

There is less tax planning and working on a long-term financial strategy for a company involved. More focus is provided on managing cash holdings, assessing the value of corporate assets, collecting debts, paying outstanding debts, documenting a company’s financial position, comprehending financial forecasts, etc. This certification is one of the best short-term certification finance courses. The eligibility requirements are possession of a degree in accountancy, finance, or banking. It is also mandatory to have at least two years of professional experience in the finance field.

Benefits Of Taking A Short Course In Finance

For all non-financial professionals who want to advance their careers or are just searching for ways to change them, finance courses are one of the most excellent academic possibilities to think about.

One of the best countries in the world to study financial management and how finance managers go about their daily work is the UK.

Discover the benefits of earning a finance certification as you continue reading to learn why you should enroll in finance courses in the UK.

Get Many Employment Opportunities

A short course in finance from the UK can open up employment opportunities for you that only some other courses can. A financial management training certificate can demonstrate your capacity to transition into a new career more efficiently and your drive to develop yourself voluntarily, regardless of the work experience you have had.

With this certificate’s help, you will discover employment in various industries, including investment banking, financial management, and financial planning, as well as commercial and retail banks, brokerage firms, and insurance organizations.

Prepare Yourself For Any Business Opportunity

Your ability to quickly adapt to various professional training programs will help you become more career-focused and open up various job opportunities that involve training in particular fields. You can get a solid basis for future training to achieve a specialization in finance by enrolling in one of the UK’s certificate programs in the subject.

Connect with the academic community of finance

Any educational gaps that may have developed throughout your time in college or university can get filled up by investing time in understanding finance while working a side job.

Relearning finance is a terrific approach to staying current with changes in the global corporate environment and improving job performance.

Improve Your Work Satisfaction

By broadening your financial knowledge and improving your financial abilities, you may be more innovative at work and better understand the nuances of your current position.

Give yourself enough time to become financially literate. You’ll feel more prepared for work daily and more assured that you can continue contributing as a valuable team member.

Use The Learning Results

The UK offers practical finance courses that can assist you in putting what you have learned during the course curriculum to use in your workplace or to manage a small business. Successfully managing your finances and understanding any company’s financial health will instantly improve, resulting in both short- and long-term success.

A Solid Foundation in Financial Principles

Those who believe they have forgotten the fundamentals they acquired as students may find applying for a finance course in the UK beneficial. Connect to our website right away!

Short-term Courses After Completing Different Education Levels

Check out the short-term finance courses after achieving different qualifications:

Short-term financial courses after the 12th grade

The following finance courses are available to class 12 graduates:

- Chartered Alternative Investment Analyst (CAIA)

- Certified International Investment Analyst (CIIA)

- Financial Modelling

- Chartered Wealth Manager (CWM)

- Certified Investment Management Analyst (CIMA)

- Certified Financial Planner (CFP)

- Financial Modeling and Valuation Analyst(FMVA)

Short-term financial courses after the 12th grade

The following finance courses are available to class 12 graduates:

- National Institute of Securities Market (NiSM) Certifications and NSE’s Certification in Financial Markets (NCFM)

- Chartered Alternative Investment Analyst (CAIA)

- Financial Modeling and Valuation Analyst (FMVA)

- Certified International Investment Analyst (CIIA)

- Financial Modelling

- Chartered Wealth Manager (CWM)

- Certified Financial Planner (CFP)

- Financial Modeling and Valuation Analyst(FMVA)

- Certified Investment Management Analyst (CIMA)

After an MBA, short-term finance courses

Following an MBA, there are several popular options if you want to take some short-term courses in finance:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- NCFM Certifications

- FLIP Certifications

- Financial Risk Manager (FRM)

- Chartered Alternative Investment Analyst

- Certificate in Quantitative Finance

- Company Secretary (CS)

Frequently Asked Questions

Is it worth having a certification in courses involved in finance?

These certifications are considered highly valuable for established businesses and individuals. Companies benefit from employing people with such credentials because of their increased productivity which can positively impact the business in the long run.

Is there a certification course in finance that you can rapidly obtain?

Finance-related certification courses are not accessible and require tremendous dedication and hard work from interested aspirants.

Which certification in finance is known to be the most difficult to receive?

The Chartered Financial Analyst certification is not only a gold standard in finance and investment but is also known to be one of the most challenging certificates to acquire.

What is the expected salary of someone certified as a Certified Financial Analyst?

Based on a study conducted in 2019, CFA holders reported $126,000 as their base salaries.

How can someone become a Financial Analyst after graduating high school?

It is vital to earn a bachelor's degree in finance and gain experience with it before applying for a certification course in finance. It is important to update your proficiency, apply for internships and attend networking events to establish a presence as a financial analyst.

Conclusion

These short-term certificate courses in finance are accessible and are given high importance worldwide. People from anywhere in the world can study these finance courses online at their own pace. Ultimately, the personal benefits they will reap with most of these best finance course certifications will be colossal. The professional assistance they can provide to their clients can help people make better financial decisions for a long time.

See also: Financing a Boat: How Many Years Can You Finance a Boat?