- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Are you looking for a high-yield savings account? Well, look no further! In this article, we will review Yotta Savings and help you decide whether it’s worth using or not. Plus, we’ll explore how Yotta makes money to provide this opportunity.

Is Yotta legit? Yes. Yotta is FDIC-insured(Federal Deposit Insurance Corporation) for $250,000 due to its collaboration with Evolve Bank & Trust, a Memphis-based bank formed in 1925. Any information you enter into the Yotta app is encrypted with 256-bit AES.

Dive deeper into the features and benefits of Yotta Savings. Uncover tips and considerations to help you decide if Yotta Savings is the right choice for your financial goals.

See Also: Swagbucks Review 2024: Is it Good or Scam? (New Tricks)

Table of Contents

What Is Yotta Savings? Is Yotta legit?

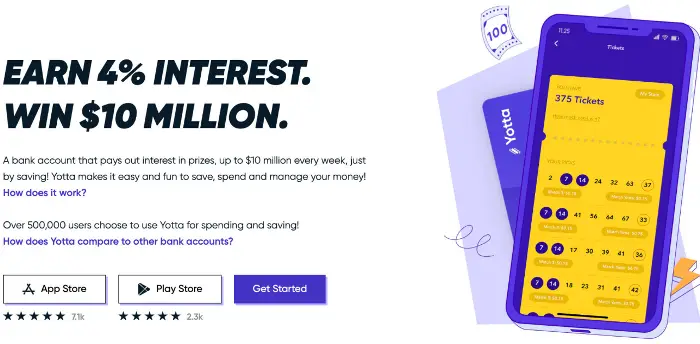

Yotta Savings is a mobile application that offers digital savings account with a unique twist: users can enter daily sweepstakes to win cash prizes ranging from $0.10 to $10 million.

The app uses the interest earned on users’ savings to fund the tips awarded through a weekly lottery-style drawing. Users’ chances of winning increase as they accumulate more entries, which they do by saving more money.

Yotta Savings is a genuine business supported by reliable partners and investors. Due to the company’s FDIC insurance, deposits made by clients are covered by up to $250,000 in total. Yotta implements security mechanisms similar to those banks use to protect users’ financial and personal information.

While Yotta Savings offers a unique and potentially lucrative savings opportunity, it is essential to keep in mind that these odds of winning the top prize are extremely low. Users should rely on something other than the app as their sole savings strategy. However, for those looking for a fun and potentially rewarding way to save money, Yotta Savings can be a great option.

See Also: Rebaid Review: Everything You Should Know

Exactly How Does Yotta Work?

Yotta is a digital savings platform that allows users to save and win prizes in a gamified way. Users create an account and deposit money into their Yotta savings account, earning little interest.

Yotta holds a random number drawing every week, with users’ savings account balances serving as entries. Winners receive cash prizes, ranging from a few cents to millions of dollars, depending on the size of the weekly prize pool and the number of winners.

Yotta generates revenue by investing users’ deposits in government bonds and other low-risk investments, earning a higher interest rate than it pays out in prizes. Yotta can offer users savings and prize-winning opportunities without charging fees or requiring minimum balances. Additionally, Yotta offers additional ways for users to earn free entries, such as referring friends or completing in-app offers.

To ensure that users’ savings are secure, Yotta uses FDIC-insured partner banks to hold users’ funds. The platform also uses security features to safeguard user data and stop fraud, including encryption and multi-factor authentication.

See Also: Grifin App Review: Everything You Need To Know

Pros and Cons of Yotta Savings:

Here are the pros and cons of Yotta Savings:

Pros:

- Chance to win cash prizes: Yotta Savings’ lottery system allows users to win significant cash prizes. This can be a great motivator to save money, especially for those struggling to keep.

- No fees or minimum balance: Yotta Savings assess no payments, and no minimum balance is needed to start or maintain an account.

- High-interest rates: Yotta Savings offers an Annual Percentage Yield (APY) of 0.20%, much higher than savings accounts’ average APY.

- FDIC-insured: The FDIC insures Yotta’s Savings deposits up to $250,000 per depositor.

Cons:

- Lottery-based system: The chance to win cash prizes through a lottery system may not appeal to everyone, and some users may prefer more traditional savings methods.

- Limited withdrawals: Yotta Savings limits users to withdrawing funds once a day, which could be an issue for those who need to access their money more frequently.

- Scarce banking services: It is primarily a savings app and doesn’t offer a full range of banking services like checking accounts, debit cards, or bill payments.

- Limited availability: Since Yotta Savings is exclusively offered in the US, people who reside abroad cannot access it.

Yotta Savings Income vs. Conventional Savings Account Income

Comparing a savings account against another is one of the finest ways to determine how well it can perform. Here, we begin each bank account with a $1000 balance and track its development throughout one, three, and ten years.

The average rate for savings accounts’ APY of 0.33% (as of February 15, 2024) is used to compute the growth of the traditional bank account. The Yotta account’s growth rate is determined using its 2.70% (as of January 30, 2024) APY. Be aware that your real APY may differ from this Yotta statistical estimate.

Here is the Yotta Savings Review in comparison to Conventional Savings:

Conventional Savings

0.33% (as of February 15, 2024)

Yotta Savings

2.70% (as of January 30, 2024)

Starting balance

$1000

$1000

After one year

$1003.3

$1027

After three years

$1009.9

$1081

After six years

$1019.8

$1162

After ten years

$1033

$1270

If you made regular deposits into either account, you might earn more than shown in this table. Also, Yotta Savings cash rewards could help you increase your finances even further.

Your savings reviews and complaints

Here are some Yotta Savings reviews and complaints:

Yotta savings review:

- Many users appreciate the chance to win cash prizes while saving money.

- The application is easy to navigate and utilize.

- The interest rate is competitive with traditional savings accounts, and customer service is responsive and helpful.

Complaints:

- Several users claim that the awards need to be more significant to make a noticeable impact on their financial situation.

- The app occasionally experiences technical issues and glitches.

- A few users have needed help withdrawing their funds.

Yotta Savings has received positive reviews for its unique savings model and user-friendly app. However, some users have experienced issues and may be concerned about their savings’ safety.

FAQs

What are the odds of winning with Yotta?

The odds of winning with Yotta vary depending on the size of the prize and the number of users who have entered the weekly sweepstakes. Yotta offers several different prize tiers, with payouts ranging from $0.10 to $10 million.

How can I boost my odds of winning?

Since Yotta is a game of chance, there is no guaranteed way to increase your chances of winning a prize. You can use strategies to improve your odds of winning: referring your friends, entering regularly, taking advantage of bonus tickets, and pooling your keys.

What happens if multiple people win the Yotta jackpot?

If more than one person wins the Yotta jackpot, the winnings will be split equally. For example, if two people win the $10 million jackpot, each winner will receive $5 million.

Will taxes be due on my winnings?

Absolutely yes, you must pay taxes on any rewards if you win a prize on Yotta. In the United States, all lottery and gambling winnings are taxable income, and Yotta is no exception.

How often does Yotta pay interest?

Yotta pays interest every week, every Monday. The interest rate offered by Yotta is variable and is currently set at 0.2% APY (Annual Percentage Yield) as of this response.

Conclusion

Yotta Savings is a unique savings app that offers a fun and engaging way to save money while allowing users to win prizes through weekly and monthly lottery drawings. However, whether or not you should use Yotta Savings depends on your financial situation and savings goals.

If you enjoy playing the lottery and are looking for a fun way to save money, Yotta Savings could be a good option. However, if you are looking for a traditional savings account with a guaranteed interest rate, there may be better choices than Yotta Savings.

Whether or not to use Yotta Savings depends on your financial goals and preferences. Researching and evaluating your options is usually a brilliant idea before making a choice.

Thus this was all about Yotta savings review.

See Also: Outlet Finance Review 2024 – A Complete Guide to the Brand