- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Do you want to know how the Grifin app works and if it is legit? Yes. Grifin is overseen by the Financial Industry Regulatory Authority (FINRA), and the SIPC will protect your securities and money up to $500,000.

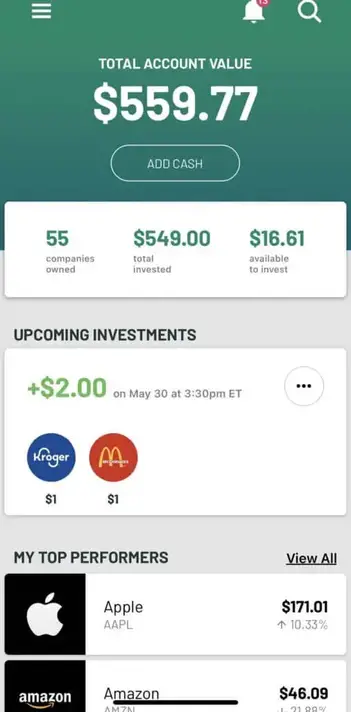

The Grifin app is a powerful financial management tool that helps users take control of their investments. Grifin connects to your credit card and invests small amounts of money in stocks of businesses you frequent. It’s free to use, with no commission fees, and offers a diverse portfolio of assets.

Give Grifin some patience as it experiences growing pains but has received positive reviews. In the following article, we’ll explore the pros and cons of the app, its cost and fees, investments, necessary information, and how you can get support from Grifin.

See Also: Mainvest Review: Everything You Need To Know

Table of Contents

Grifin App Review: How Grifin Operates?

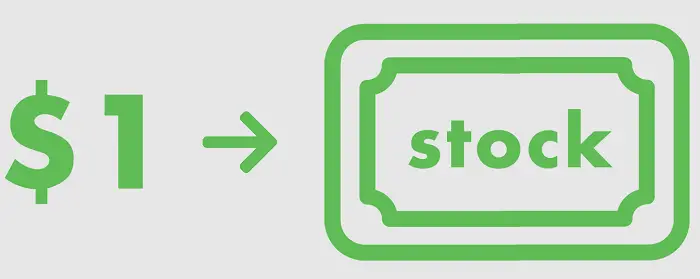

Griffin connects two different financial accounts to function. It first connects to a credit card. Griffin keeps track of each credit card transaction and allows a dollar’s investments in the company’s shares.

For instance, if you go to McDonald’s for lunch, Grifin will notice the cost and instruct you to put $1 into McDonald’s stock.

Griffin can still deposit one dollar into your cash account if you purchase something from a business it doesn’t endorse or doesn’t have publicly traded shares. You can then manually invest that money in one of your other businesses.

Griffin operates through transferring fractional shares to your account because the stocks you purchase have a share price of more than $1.

Griffin operates through transferring fractional shares to your account because the stocks you purchase have a share price of more than $1.

In other words, Grifin buys one share of stock in McDonald’s, allowing the fraction worth $1 to your account using accounting. You will receive 1/100th of a share if McDonald’s stock is $100 per share.

You would receive 1/100th of the dividend paid by McDonald’s when it pays dividends. One-hundredth of the stock’s current price will pay you when you sell.

Griffin secretly distributed portions of that same share to different customers.

This requires Grifin to distribute the shares in a firm among a sufficient number of users for the investors’ stocks so it can function without subjecting Grifin to many investments in its customers’ stocks.

Griffin only permits investing in particular stocks to make sure this happens. The organization allows customers to invest in more than 200 stocks but still needs a list.

Griffin connects to a second checking account, which withdraws funds to make investments. Only the credit card is under Grifin’s watchful eye in this account.

Griffin only permits users to link one credit card as of right now. The business points out that processing credit card transactions result in expenses. It must keep costs down to keep its product free, so it only accepts one card.

Where Can I Invest With Grifin?

Grifin enables you to buy stocks while you go shopping. For instance, when you buy something at Starbucks using a linked card, it will remove $1 from your bank account and deposit it in the Starbucks stock on your part.

Additionally, Grifin deposits your $1 buy from a retailer you cannot invest in into a cash fund so that you can spend it on a different stock you own.

Visit Grifin

Griffin Investments

The Griffin Investments team is responsible for a diverse portfolio of generational assets and is in charge of strategically seeking, acquiring and managing these assets.

Media

The acquisition of properties that strategically improve Griffin Media’s core activities.

Griffin Investments is a family-owned private investment firm actively looking for strategic media opportunities and additionally constructs a portfolio of diversified assets, which supports its long-term growth.

Real Estate For Businesses

Putting money into restricted partnerships, funds, and direct commercial real estate ownership in specified markets.

Gas And Oil

Acquire minerals from both generating and non-producing sources in all the major basins.

Private Equity Limited owns strategic investments in private equity funds, partnerships, and direct investments.

Recent Transactions

Check below the recent transactions of Grifin:

- Cross, Lavinder, Quinn & Park Family Dentistry uses Griffin as its sole investment banker.

- Park Sutton Advisors, LLC uses Griffin as its sole investment banker.

- Griffin advises Northmark Bank in its sale to Cambridge Bancorp as its sole financial advisor.

Grifin App Review: Works Best For Whom?

Grifin is the most incredible option for shareholders who don’t want to stress about their investment decisions. Every moment you make a sale, you’ll buy shares in businesses you love and frequent.

But this new App will must some patience from you. Despite a few software bugs, most customers appreciate the UI once they get beyond the onboarding process. Grifin app review of customers is good so far.

Costs And Fees

It costs nothing to download or use Grifin. There are no commission fees or transaction costs. There can be a few extra charges, like:

- Transfer of securities outgoing fee of $50

- $5 per account for tax certification (W-8) fees

- $3 for check withdrawals

- Fee for ACH withdrawal: $0.25

How Do I Register?

- Visit the App Store of Apple first.

- Look up and get the Grifin App.

- Click to begin your journey after you open the App.

- Type in your contact details, including your phone number and email address.

- Integrate a credit or debit card with your bank account.

Download: Grifin on iOS

Eligibility

For you to use the Griffin App, you must full fill in the following requirements:

- US resident or citizen

- Must be over 18

- Devices that are iOS-compatible, like an iPhone, iPad, or iPod touch

- A financial institution other than Capital One

Necessary Information

You’ll need to put in the following information to register with Grifin:

- First and last Names

- Your email address

- Telephone

- The Social Security number

- Details about a bank account

- Debit or credit card information

Research Resources

Grifin is an alternative investment where you buy stock in a company to show your support for it.

The platform doesn’t provide research tools to provide insights into the company’s stock information or previous performance because it is designed to let you invest where you shop. The Grifin app review looks excellent.

Cons And Benefits

Pros

The Grifin app offers the enlisted advantages:

- Interest is earned on a cash fund. Your $1 can be used to buy more stocks if you buy something at a business that you cannot invest in, or it can go into a money fund that pays Interest.

- Partially held shares. Grifin permits fractional shares; thus, if the company pays dividends, you can purchase portions of the company’s stock and receive a fractional payout.

- Guardrails. Users can set a monthly investment cap and turn off companies they don’t wish to invest in.

Cons

Before downloading the App, take into account the following restrictions:

- Stock restrictions. Before investing in a corporation, you must first unlock it through a purchase. That implies that regardless of how much you wish to invest in Tesla, you first must buy Tesla stock to be able to trade it.

- Bugs in the App. The lengthy loading and processing times are frequent complaints from users. We were unable to proceed past the signup process’s account verification stage.

- Limited assistance. Only certain financial assets and cards are supported by Grifin, along with iOS devices. For instance, you cannot access this service if Capital One is your bank.

Grifin, Is It Real?

Yes. Grifin was established in 2017 and had its corporate office in Tampa, Florida. Drive Wealth, a broker-dealer with SEC registration and membership in SIPC, the Financial Industry Regulatory Authority, and the Securities Investor Protection Corporation, serves as its brokerage partner (FINRA).

This implies that FINRA controls Grifin, and the SIPC will protect your securities and money up to $500,000.

It didn’t have any complaints and is not BBB-accredited, based on the Consumer Financial Protection Bureau (CFPB) (BBB).

Grifin App Review And Complaints

Grifin remains a new company with few testimonials. Although it has an A grade with the BBB, there aren’t any comments on its BBB page.

The Grifin application has received 444 reviews and 4.2 stars as of August 2022. Users who are familiar with Grifin’s operations and its policies and guidelines praise the innovativeness of this new investment idea.

Some investors are dissatisfied with the company’s sluggish customer service and transaction times. Grifin said that because of its enormous social media success, it is mak. Customers are giving Grifin app reviews the best.

How Can I Get Support From Grifin?

The following is how to contact Grifin:

- Email. On the company’s website, ask a founder team member a question.

- Online conversation. Click the messaging icon on the application or website’s Help Centre to communicate with a natural person.

- Twitter. Who can tweet support for Grifin at @grifinapp.ing every effort to serve all new users?

FAQs

How does Grifin work?

Grifin connects to your credit card and invests small amounts of money in stocks of businesses.

How does Grifin investment work?

If you make a purchase at a company that you can't invest in, Griffin can still deposit one dollar into your cash account if you purchase something from a business it doesn't endorse or doesn't have publicly traded shares. You can then manually invest that money in one of your other businesses

Who owns Grifin app?

Grifin is an investment application developed and co-founded by Aaron Froug and Bo Starr. The company also has a third co-founder by the name of Robin Froug.

How do I contact Grifin customer service?

You can use the Grifin Platform and contact them at [email protected] . You can also use twitter and tweet support Grifin at @grifinapp.ing You can access the company's email to get support.

How do I withdraw money from Griffin?

Open the Grifin app. Click on the Menu icon in the top left corner of your Home page. Click on 'Banks'. Under 'Transfer Cash', select “Transfer to your Bank.”

Conclusion

A new funding app called Grifin is revolutionizing how we build our portfolios. Grifin invests in businesses you patronize rather than buying a stock since you believe it will increase in value.

However, this company has specific bugs that it is still ironing out. Grifin app review is good.

Consider using a different broker if you prefer a platform that allows you to trade in any security or stock without requiring a prior purchase.