- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Real estate is a great field to research if you are considering switching occupations. In this article, you will read about the best-paying jobs in real estate investment trusts. Real estate prices are rising indefinitely as demand for new homes increases nationally and worldwide.

Best Paying Jobs in REITs:

- Property Development

- A Real Estate lawyer

- Real Estate Investment Trusts Analyst

- Investors in Real Estate Investment Trusts

- Site Acquisition Specialist

- Asset Manager

- Real Estate Property Appraisers

- Relations Consultant

- Real Estate Agent

Real estate investing is a booming industry, and there are several prospects for investors since new REITs are constantly emerging. In this post, we’ll examine the highest-paying positions in REITs.

Table of Contents

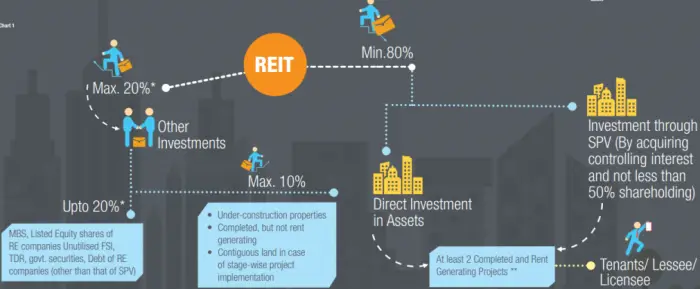

9 Real Estate Investment Trusts: What is it?

Before we talk about best-paying jobs in real estate investment trusts, let us know about real estate trusts. Investing in, financing, or maintaining commercial real estate that generates income is done with the help of real estate investment trusts (REITs).

To allow numerous investors globally to invest in brand-new real estate initiatives, REITs were designed to resemble mutual funds.

A governmental or private organization makes investments in income-producing real estate. REITs can own any real estate, including hotels, shopping centers, and business parks. As well as residential properties, including properties like The Vermont Apartments Los Angeles, CA 90010 flats, single rooms, and dorms for students.

REITs have been expanding quickly, creating many jobs in the industry.

Best Paying Jobs in REITs

Here are the best-paying jobs in real estate investment trusts:

Property Development

Finding real estate properties and organizing their development and utilization fall within the purview of property development professionals. They must be well-versed in various topics, including managing projects, economic trends, etc.

This makes it one of the best-paying jobs in real estate investment trusts, with compensation in the six figures, depending on the REITs.

This makes it one of the best-paying jobs in real estate investment trusts, with compensation in the six figures, depending on the REITs.

A Real Estate lawyer

Lenders, landlords, and equity investors are all responsible for evaluating crucial real estate transaction documentation. In addition, he communicates with the leading manager on policies and procedures and represents the business in legal meetings.

They are responsible for ensuring that everyone is informed of the rules and responsibilities of the business. If the business has trouble acquiring or administering a site due to legal issues, it can also intervene on the company’s behalf.

They are responsible for ensuring that everyone is informed of the rules and responsibilities of the business. If the business has trouble acquiring or administering a site due to legal issues, it can also intervene on the company’s behalf.

Real Estate Investment Trusts Analyst

Analysts for real estate investment trusts support the financial division. A REIT analyst will research, analyze the data, and create a plan for potential new or existing real estate prospects.

The acquisition team frequently consults the analysts’ data before making a new investment choice. Therefore, their work is crucial. They will produce reports on the market and its potential for the operations team.

The acquisition team frequently consults the analysts’ data before making a new investment choice. Therefore, their work is crucial. They will produce reports on the market and its potential for the operations team.

Investors in Real Estate Investment Trusts

The task assigned to real estate investment trusts is to acquire real estate assets, increase their value, and resell them for a profit.

Understanding the best times and locations to buy and sell real estate is crucial. In light of this, you should undertake market research daily.

A REIT investor will motivate new purchases and the sales of houses or buildings. They may occasionally cultivate connections with old and new investors to keep investors interested in their initiatives.

A REIT investor will motivate new purchases and the sales of houses or buildings. They may occasionally cultivate connections with old and new investors to keep investors interested in their initiatives.

Site Acquisition Specialist

Finding real estate transactions is the responsibility of a purchasing specialist, who then brings them to the portfolio manager and asset manager for assessment.

An expert in site acquisition works with the overall acquisition of the site and all of the finer details involved in building it. A site specialist will offer operational support for leasing, entitlements, and construction codes.

An expert in site acquisition works with the overall acquisition of the site and all of the finer details involved in building it. A site specialist will offer operational support for leasing, entitlements, and construction codes.

Asset Manager

Asset managers manage a specific subset of assets. At any given moment, asset managers are in charge of managing hundreds of properties. They strategize about ways to boost REIT performance while primarily managing their portfolio.

The asset management department manages the REITs’ asset portfolio and controls its financial and operational activities. When present, the vice president or senior vice president directs the asset managers.

Real Estate Property Appraisers

An appraiser specializing in real estate has the skills necessary to assess and calculate the value of a property.

A home or business property might be involved, and market circumstances and other economic factors influence the value of a piece of property.

Insurance firms rely on property appraisers to calculate insurance coverage and premium level.

Insurance firms rely on property appraisers to calculate insurance coverage and premium level.

Relations Consultant

Most individuals desire a position as a relations consultant since these REIT professions pay well. For individuals with passion, it is regarded as the ideal employment option.

Talking to innovators and seeking prospective projects to embark on are their duties. They build up teams for meetings and seminars, make investment reports, and work on connecting with stockholders.

Talking to innovators and seeking prospective projects to embark on are their duties. They build up teams for meetings and seminars, make investment reports, and work on connecting with stockholders.

Real Estate Agent

Real estate agents are one of the professions in real estate that is still expanding. Helping clients buy or sell real estate is a part of their duties.

Residential real estate agents act as a go-between and mediator between buyers and sellers. Residential real estate is a specialty of specific agents, while commercial real estate is a specialty of others. Homes, condos, beach houses, and many more types of property are included in this list.

Residential real estate agents act as a go-between and mediator between buyers and sellers. Residential real estate is a specialty of specific agents, while commercial real estate is a specialty of others. Homes, condos, beach houses, and many more types of property are included in this list.

Thus these were the best-paying jobs in real estate investment trusts.

FAQs

Does working for Real Estate Investment Trusts make sense?

Real estate and finance require a solid dedication to work in REITs. By doing this, you can get a sizable return on your investment. This is a great career route for you if you have a passion for finance and real estate. Your CV will benefit from the multicultural experience you receive.

Which position in the REIT industry is best?

A career in any of the jobs mentioned above descriptions is a great choice. But in real estate investment trusts, a real estate agent's or broker's position has frequently been seen as the highest paying position. The salary and variety of opportunities the work provides are the reasons. Therefore, if you become an expert seller, you can close more transactions than you think!

How to Find Employment in a REIT?

You need to collect the necessary information and abilities for the career role you want. Additionally, your career graph will automatically improve if you already have appropriate experience. A bachelor's degree in finance, management, or a similar discipline from a reputable university is required. Taking more classes might help you develop your talents. Understanding the business and how REITs operate is the most crucial step in landing a job there. You can get started by learning from books or internet resources.

What advantages do REIT employees receive?

The principal advantages of working for a REIT are: several high-paying job categories a global industry in growth Travel and adaptability Excellent benefits and investment possibilities good career development

Conclusion

This post is where we hope you find your vocation. To assist you in launching your career, we have listed the Real Estate Investment Trusts positions with the highest salaries.

The real estate sector is enormous and has shown recent solid growth. Consequently, it is an appropriate field to pursue as a profession. You might need to work for a Real Estate Investment Trust to establish the groundwork for a successful career.

With enough experience, you may go farther in your job. You stay ahead and be sure to study and follow business news constantly. You may obtain any of the best-paying jobs in real estate investment trusts with consistent hard work.