- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

There is no getting away from it anymore. When you invite visitors over, your outdated furniture becomes a spectacle. Or perhaps you’ve got a child in desperate need of a pair of orthodontic appliances? It requires action on our part.

Where is the alleged source of this funding? Is it acceptable to take your bank card out of your purse or withdraw funds from your deposit account for circumstances like this?

Sinking funds are helpful in this situation. They may mean sticking to your monthly spending plan and going overboard. Find out which sinking fund categories to include in your budgeting.

Table of Contents

How do Sinking Funds work?

Your sinking fund accounts are a mini-savings plan that enables you to pay in advance for the purchases you want or require. One of the essential financial skills you have to master to thrive with your finances is preparing ahead as you do!

Here’s an example of a sinking fund: Easter baskets plus chocolates for the kids. Although you are aware that your usual monthly spending is already somewhat limited, you could use that money instead of using a bank card. Alternately, you might start saving $10 monthly for it commencing in January.

It sounds feasible to keep aside $10 per month, so you have Easter sinking money. Lemons made it breezy!

Alternatively, people utilize sinking fund categories to support apart from a significant expense (such as a house, vehicle, vacations, etc.) or an unforeseen expenditure that individuals know will probably occur but don’t know when (such as HVAC reinstallation, new vehicle tires, etc.)

Why are Sinking Funds used by Individuals?

The primary reason individuals utilize sinking money, which is a good reason, is that it prevents you from using your bank card to make a transaction (and possibly pile up a lot of high-interest loans)! You are aware that eventually, as well as in just a few years, your vehicle will require new tires. Simply because you didn’t budget your expenditures doesn’t warrant going into debt. That is absurd! Don’t be a fool!

Additionally, money from various sinking funds gives you anything to anticipate! Although it can require many years to save, once a month, the goal becomes closer and closer when you deposit $50 into your bank account. That sensation of progress toward your objectives and goals is unbeatable!

70 Sinking Fund Categories that aid in Professional Budgeting:

Read out all the 70 sinking fund examples and attributes if you’d like to create the most significant budget feasible. You’ve got this whole accounting stuff down, but how can you save more cash?

After creating a budget, financial planning is the next logical step. This might involve saving for items you want and covering your emergency fund, which is a need. The critical learning in budgeting and saving may be seen in the term “want” or desire highlighted earlier.

- A stimulus package for the things you require presently is what budgeting involves (current month).

- Saving is the act of laying money away for future needs or wants.

Sinking funds ideas are among the best strategies to save earnings. They have been essential for most of the family’s financial success.

Let’s go over a checklist of examples of sinking funds to learn how to create the most effective spending plan to maintain a debt-free lifestyle:

Home-related sinking fund categories

One of our most significant investments is our house. Although it’s well known that consumers detest paying for time-consuming tasks like cleaning services, doing them will help avoid more serious (and costly) problems in the future. So do yourself a favor and stop scrambling to find money to mend things, and instead save a little bit every month.

The items listed below are all ones you would want to think about including in your fixed sum:

- Home renovations.

- Annual home upkeep includes drain cleaning, HVAC repair, pool disinfecting, and propane refueling.

- House remodeling.

- New gadgets and furniture.

- Updated landscape.

- Garden maintenance and seasonal planting, etc.

- Housing insurance.

- Real estate taxes.

- Pest prevention.

- Annual subscriptions to Disney+, Netflix, Costco, etc.

- Emergency investment: this can be classified as either a family or a home expense.

Vehicle-related sinking fund categories

An automobile will likely be the following most expensive possession we possess. Automobile issues are never acceptable, and frequently, they may be prevented by just doing routine auto maintenance. Although regular inspections on your vehicle keeps you and your family safe, one is aware that it is not a relaxing way to spend money. However, safety must always come first.

The car-related charges listed below could all be deducted from your sinking fund.

- Savings on new cars.

- Unexpected auto repairs.

- Fresh tyres.

- Scheduled auto maintenance.

- Detailing a car.

- Testing for DEQ.

- Registering a vehicle.

- Auto insurance.

- Parking pass.

- Bus/train ticket.

Family-related sinking fund categories:

This financial intermediary is for “fun.” These are just the enjoyable activities that add flavor to our lives and are significant sources of delight. Birthday celebrations, ice cream dates, zoo visits, and a brand-new swimming pool for the lawn! You will stop feeling guilty about using it when you have funds set aside mainly for these “fun things.”

You know that you have everything else covered; this amount is only intended for entertainment.

- Vacation.

- Pool, jungle gym, patio furniture, and other backyard amenities.

- Entertainment includes events, excursions, video games, etc.

- Aquariums, zoos, and other attractions offer annual and monthly passes.

- Birthday celebrations for family members – gifts, decorative items, cake, leisure, etc.

- Pet essentials.

Medical-related sinking fund categories:

Nobody enjoys a medical emergency, much less one that costs $4,678 because of an ambulance ride. Even though not all costs will be so expensive, they quickly pile up when you have a four-member family, and each member needs their prescription or treatment.

- Out-of-pocket protection.

- Annual premiums and deductibles.

- Prescription medication.

- Co-pays.

- Medical supplies.

- Orthodontics, eyeglasses, and contacts, among other medical specialties.

- Insurance won’t pay for chiropractic treatment, prolonged physical therapy, and other services.

Children-related sinking fund categories:

Parents wish to always give in to their children. Parents want everything for their children. However, mothers and fathers frequently have to say “no” or simply “not now” to children. But despite their best efforts, people cannot answer “yes” to their kids’ request to play soccer this season due to a lack of funds. You can make it easier to say

YES, if you have a kiddie fund!

- Training & camps for sports, hobbies, etc.

- School or college expenses.

- Scholastic attire and materials.

- Birthday celebration and gifts for friends.

- Activities at school, such as clubs and sports.

- Classes in music and other co-curriculum.

- Proms, commencements, and other school celebrations.

- The cost of a new baby includes furniture, supplies, clothing, etc.

A fantastic teaching opportunity is to explain to your children how you are using sinking funds to save money. Educating kids on the need for tolerance, patience, and trying to save income is essential. Keep in mind that children learn more from your actions than those from what you say. So demonstrate your cost saving to them and invite them to join you in your efforts!

Self-related sinking fund categories:

Everyone occasionally needs to treat oneself, and having a sinking fund for oneself makes it easier! Like the family sinking fund, you never have to feel terrible about making purchases for yourself. Mothers frequently say that you shouldn’t purchase new gym shoes for yourself as old ones will last a little longer, and the little sister wants a new dress, which is true. Mama ruins your enjoyment. Spend the money on what brings you joy because you have earned it yourself!

- New clothing.

- Club memberships.

- Box subscriptions.

- Courses.

- Self-care includes visiting a spa, getting counseling, getting new nails, etc.

- Hobby equipment.

- Dinner date with your sweetheart.

Holiday-related sinking fund categories:

American vacations are occasions for celebrations of all kinds; is President’s Day any different? Most likely not, but that’s alright since you can continue to save dollars for your big family Fourth of July garden BBQ Fiesta! In addition, you’ve always desired to get your husband that three-foot-tall, gigantic chocolate bunny during Easter. And you can see today, thanks to the assistance of your Easter Capital Asset.

As a specialist tip, you don’t have to save money for each of them constantly. Start preparing for the next festival as soon as the previous one is over to help expand the expense.

- Party on New Year’s night.

- Valentine’s Day date, confection, or gift.

- Dress, basket, and sweets for Easter.

- BBQs on Memorial Day and Labor Day weekends.

- Halloween candies and outfits.

- Dinner on Thanksgiving.

- Fireworks, drinks, and other arrangements for special occasions.

- Christmas.

Travel-related sinking fund categories:

Savings and spending for Christmas are comparable to this category. Don’t overlook an expense because there are many other aspects to consider. Again, don’t separate your savings for each item in this case. Think about grouping them (such as lodging and travel expenses, meals and amusement, and fun/extras). There is a fantastic printable travel organizer to get you organized. Yes, there is a webpage on budget travel tips and one with a planner for ideas, a plan, and information for the household.

- Air travel, train fares, or gas costs.

- Travel protection.

- Insurance for a rental automobile.

- Shuttle charges.

- Snacks and lunches.

- Airbnb or even a hotel.

- Resort fees and often hotel parking charges.

- Passport costs.

- Cost of TSA pre-check.

- Tickets for events or attractions.

- Renting kayaks, camping equipment, etc.

- Souvenirs.

- Hotel personnel, tourist guides, etc. can expect tips in cash.

Types of sinking funds

Long-term sinking funds:

- Mortgage down payment (it is a lump sum amount, so it will take time to achieve).

- A new automobile fund.

- Vacation savings.

- Child fund.

These are revolving sinking funds that are ongoing because each month, money is added, and, often, some are taken out after you make your payments. These term deposits are never both full or empty.

Short-term sinking funds:

- Afternoon at a spa.

- Dinner on a date for Valentine’s Day.

- Cycling group.

- Capsule clothing.

Sinking funds may be revolving or one-time payments. A holiday-related sinking fund, for instance, is a one-and-done (although you may repeat it yearly). Once you’ve purchased your costumes and candies for Halloween, you’ve finished, and you can no longer save cash for it.

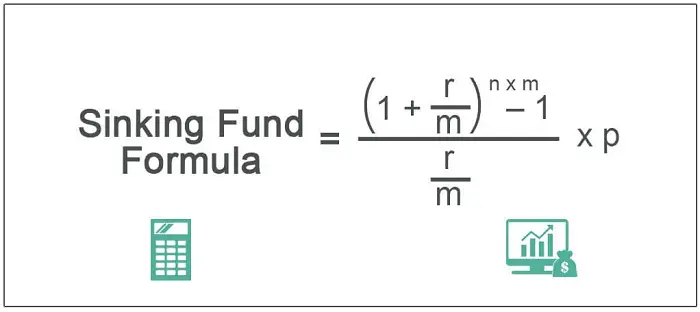

The formula for Sinking Funds

Although no one enjoys math, in this situation, it’s fun because it will help you achieve your objectives. Here is the sinking fund equation for investing for a specific goal (non-revolving event).

How much you should save monthly = The amount of money you need and the number of months until around the event.

Let’s take the example of investing in a new patio set for your back garden:

$450 divided by 4 months equals $112.50 every month till spring (unquestionably around $115 to aid with sales tax).

The fundamental sinking funds that each household needs are

Every family must have a minimum of all the following six sinking funds:

Fund for home repairs

Things constantly fail. Kitchen appliances, more attic insulation, new dining room table, etc.

Auto repair budget

Repairs, tire replacement, registration, and DEQ testing (if you own a vehicle).

Sinking money for healthcare

Treatments, co-pays, deductibles, and additional costs like braces and eyeglasses, etc.

Vacation Budget

Weekend beach getaways, a day spent exploring a new city, palm trees, or sandy beaches.

Emergency savings

This sinking fund serves as the most important one.

Fund for Christmas

Each year, Christmas comes around, so why not plan early and reduce the stress? Create a brand-new holiday cash envelope on January 1st, and add $20 to it every week. It’s that simple.

FAQs

How Are your Sinking Funds set up?

Select the categories for your sinking funds and indeed the sum you hope to save from each.

Choose the number of months you wish to save.

With the number of months, share the required amount.

Deposit that sum to the individual categories sinking fund.

What Amount Should you have set Aside for your Sinking Fund?

Aim for having between three and six months' worth of living expenses set aside in your emergency savings. Generally, a sinking fund would consist of a smaller and much more flexible sum.

How is the Sinking Fund Schedule Determined?

A = P.A (n,i) ; A is Savings amount, P is Periodic Payment, n is the Payment Period.

How many Separate types Should your Budgeting have?

Make four divisions with your income: necessities, desires, savings, plus debt payback.

What ought to be the Budget's top Priority?

When it pertains to budgetary priorities, retirement falls first. You can then concentrate on accumulating emergency and anticipated maintenance reserves.

Conclusion

These groups were far from an all-inclusive list of what you should be ready for. Depending on your demands, sinking fund categories would seem slightly different for each person.

You might want to think about including sinking fund segments in your plan. You might find that it’s what has been missing from your plan all along.

Whenever these expenses do arise, I hope this list will help you find a way to handle them without experiencing too much worry. Which categories for sinking funds are you trying to use in your budget?Trading can also be an asset for your future too.