- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Are you struggling to manage your finances and wondering how to budget successfully? This article will discuss how to budget for dummies and help you take control of your money and achieve your financial goals.

In this article, we will delve deep into what budgeting is and why it is essential, numerous ways to budget your money, the best apps for budgeting, and how to stick to the budget. By mastering the art of budgeting, you can gain control over your finances and reduce financial stress.

To put it in simple words, a budget is a plan for your hard-earned money. Let’s simplify things for you and start with a Budgeting 101 article that will walk you through how to budget.

Table of Contents

How to Budget: What is Budgeting?

A budget is a roadmap for understanding where you spend money more responsibly. You plan on how much and where to spend your hard-earned money efficiently. You typically make a financial summary of expected income and expenses for a defined period, say one month.

Every month there will be an inflow and outflow of money. You list down all the sources of income like salary, interest, etc., and your monthly expenses like rent, bills, childcare, debts, entertainment, etc. It will be exciting to learn about the areas of expenditure and may surprise you as well.

With this itemized financial summary, that is, budgeting, you will be able to identify where the outflow of money is, control your finances and work towards your financial goals.

Why is Budgeting important?

After comprehending the concept of budgeting, let us know why it is needed. Only one-third of all households are expected to stick to the budget, and if you join the bandwagon, your decision will pay off.

You will not have to live paycheck to paycheck and struggle with finances but make a better living.

Budgeting will lower your financial burden and make things simpler for you. It is not rocket science or difficult to live with but it can help you to have a comfortable lifestyle. Apprehend the reasons and benefits of budgeting.

- Puts you in control of your finances.

- Prioritize spending

- Track every penny spent and save the rest.

- Identifies overspending.

- Find ways to save more money for retirement, rainy days, or investment.

- Help you pay off debt.

- In line with your financial goals (list down your goals too)

Budgeting is not as boring as it sounds. It is just a psychological barrier that needs to be overcome. It is just a work of 1-2 hours towards your financial goals where you are financially and emotionally invested, whose fruits will be reaped in the future.

How to Budget your Money?

An obvious question by now is, How to Start Budgeting? Let us get into the nitty-gritty of it in this Budgeting 101 article.

Even before the beginning of making a budget, be completely honest with yourself and realistic while doing the exercise as it is easy to manipulate numbers to work in favor of you. Still, it will not help to achieve the result.

Create a budget that works for you, and there is no one-size-fits-all. How to budget your money depends on your financial goals and lifestyle.

Not everyone has the same earning and spending power, so creating a budget will be different. Let us go step by step on how to budget:

Calculate your Monthly Income

List down all your sources of income in your Excel spreadsheet or budgeting tool (I will talk about it later in the article).

It is very important as your total income and expenses will be subtracted. Do not leave any source of income- for example – rental income, investment income, or income from a side hustle.

For many people, their takeaway home salary is their only income source. However, if you are an entrepreneur or have an additional source of income from a side hustle, it will be included in the budget.

Try to take help from your financial statements and estimate accurate information about your earnings. Use an average of the last three months’ income if you have an unstable income.

Example:

- Salary from the job: $3500

- Blogging: $500

- Teaching: $300

Calculate your Monthly Expenses (Fixed)

Now list down all your monthly expenses. Categorize it into fixed and variable expenses.

Fixed expense means the same monthly expenses (monthly bills and living expenses), and you must pay like mortgage/ rent, debt/ loans, gas, electricity, water bills, grocery, car payments, tuition fees, etc.

If you are unsure of your monthly fixed expenses, check your past 1-3 months’ accounts and take an average for each expense. Accurate information about your expenses is essential to get a lucid picture to make a budget efficiently.

Example:

- Gas, Electric, and Water Bill: $120

- Rent: $1500

- Grocery: $250

- Loan Repayment: Personal and Subjective

- Any other mandatory monthly expense

Be inclusive in listing down your expenses to make a budget precise and keep an account of all your expenses.

Set financial goals

Before budgeting and including your variable expenses, let us stop and know your financial goals. Apart from budgeting day-to-day spending, it is important to prioritize and give importance to your financial goals.

How to budget your financial goals?

Write down all your financial goals and aim for a financially stable life. Ask yourself, how do you want to be financially successful? Do you want to be debt free? How do you want to spend your retirement days? Determine the current situation and envision your future.

Understand where you are right now to reach where you want to be. Determine your short-term goals (1 year or less) and include them in your monthly budget.

Example:

- Be debt free

- Set up an emergency fund

- Create a retirement fund

- Additional savings for house or car

After writing down your financial goals, consider them as your expense and include them in your monthly budget. This will help you save and work towards your financial goal.

In continuation of the previous step of expenses,

- Gas, Electric, and Water Bill:$120

- Rent: $1500

- Grocery: $250

- Loan Repayment: $Personal and Subjective

- Any other mandatory monthly expense

- Emergency Fund: $200

- House Savings: $200

- Debt Repayment: $150

Variable Expenses

Expenses differ from month to month and are not essential. Let’s say entertainment, vacation, dining out, clothes, etc. These are costs that can be adjusted to your need and affordability.

These are not necessary expenses. Their turn comes after fixed expenses and financial goals, as we must prioritize the important ones for financial health.

Example:

- Gas, Electric, and Water Bill:$120

- Rent: $1500

- Grocery: $250

- Loan Repayment: $Personal and Subjective

- Any other mandatory monthly expense

- Emergency Fund: $200

- House Savings: $200

- Debt Repayment: $150

- Entertainment: $50

- Dinner and outings $75

- Others $200

How do you start budgeting after collecting data about your monthly income and expenses?

See also: 9 Best YNAB Alternatives

Subtract Expenses from Income

Now, is the most important step after totaling monthly income and expenses – subtracting expenses from income.

If the number is positive, your income is more than the expenses. The surplus can be used in savings or as you wish to use.

If the number breaks even, it infers no extra money is left. It would be better to revisit the budget and adjust the variable expenses to have some money in hand during an unexpected crisis.

If the number is negative, it infers that your expenses are more than your income. You must cut expenses mainly variable – entertainment, outings, or others.

Budgeting for dummies, it is your first step to a secure financial future. With a step-by-step guide on budgeting your money, you will now need to monitor, adjust and revise the budget when necessary.

Monitor, Adjust and Revise

It will take a few months to get accustomed to budgeting, but it becomes your favorite once you get the hang of it.

Review your budget and adjust it wherever needed. Check regularly and monitor how it will keep track of your money.

Budgeting is a great tool to put your money to use and achieve financial success systematically. There are many tools to help you to make a budget hassle-free.

Different Budgeting methods

There are various budgeting methods available. After knowing the basics on how to budget and create one as well, the fact is no one size fits all. Hence, choose a budgeting method that suits you.

Budget Your Money 101 (Budgeting for Dummies)

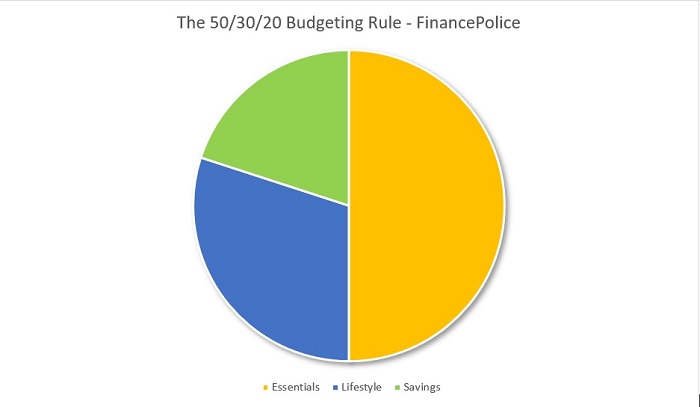

50/20/30 Rule

Wonder why no money remains after making a budget. Well, here is a method that can help you.

Living expenses account for 50% of your budget, including rent, gas/ water/ electric bills, loan repayment, insurance/phone/internet payment, groceries, etc.

Your financial goals account for 20% of your budget, which includes investments, retirement funds, emergency funds, debt-free, and savings.

And finally, your variable expenses, which are not essential, account for 30% of your budget, which includes outings, dinner, entertainment, gifts, personal care, and others.

An easy way how to start budgeting if not yet begun.

Zero-Based Budget

It is a frugal way of living. It involves income – outflow =$0. This means that every single penny will be used productively.

After allocating every penny into different categories, you will be left with $0. This style may not suit all, but it is an option for spendthrifts or massive debt repayment at the earliest.

Envelope Method

This method is suitable for those who are overspending. In this method, for each category, you will have a cash envelope(like utilities, groceries, bills, rent, and others) as per the budget.

After spending the cash from your envelope, you cannot spend additional money from your pocket or credit card.

Best Budgeting Apps

These days, technology makes things simpler and easier for all. This Budgeting 101 article will help you with the best budgeting apps to help you gain power over your spending and track down every penny spent. Presenting the best money management and budgeting apps for you.

Mint

Mint is one of the oldest market leaders in budgeting management, owned by Intuit, and is free at no cost.

It comes with a wide range of features and easily answers the question of how to budget’ by automatically updating the transactions linked to your debit or credit cards. So, you can start by categorizing transactions, tracking bills, splitting ATM transactions into purchases made from the cash withdrawn, and setting budgets that will alert you if you go overboard.

PocketGuard

A simplified budgeting app that keeps you away from overspending. PocketGaurd is free, links all your financial accounts, and helps track all your spending compared to the budget for the month.

After accounting for your bills, spending and financial goals will tell you how much money is available in your pocket for the day, week, or month.

YNAB

You Need A Budget is for all die-hard budgeting fans. YNAB is based on the envelope-based method, allocating the exact income to the expense categories.

Not a single dollar goes unaccounted for, and forces you to keep track of every penny spent. It offers a 34-day trial and then requires a financial investment of $83.99 per year or $6.99 per month.

See also: Personal Capital vs. YNAB: Which One Is Better?

Wally

It is not among the best apps to navigate, but it is popular among millennials. Wally is best for budgeting as it helps to track your income and expense and provides a snapshot of your remaining budget to avoid overspending.

It also offers an extra feature supporting all foreign currencies, which can also help users outside the USA. Wally is available for free for iPhone and Android users.

Mvelopes

Again an app with envelope-based budgeting- a style of budgeting where you put cash in envelopes for different expense categories, and when each envelope is empty, that category is spent for the month.

Mvelopes follows this cash/envelope style in a digital budgeting world of debit and credit cards. The app works in real-time and will tell you whether you can buy a coffee or need to wait to reset the budget for next month.

Albert

An all-rounder app that takes care of budgeting savings and debt payments. It is available for free. Albert tracks down all your bills, expenses, and income and automatically creates a budget leaving a particular portion in savings.

It tracks all your financial accounts and provides recommendations to improve financial health.

Simple

An all-in-one banking and budgeting app. Simple is a budgeting app and an entire bank with inbuilt budgeting features. You can budget and bank from the same app under one roof.

This will help you easily track your income and expense and make a budget for you. It also has a feature to motivate your savings. This app has no fees.

Personal Capital

Personal Capital is best known for evaluating investment accounts. The tools help users to improve their investment strategy. Its services combine a hybrid robot advisor with human financial advisors.

A part of Personal Capital’s investment tools, along with handy budgeting features, is free to use. This app might not have as extensive budgeting tools as others on the list, but it works fine.

The app emphasizes the investment side – automated analysis of the asset class, 401(k) fees, and a retirement planner.

Several budget templates are available online if you want to keep it simple. Also, you can use Excel spreadsheets to start with.

See also: 11 Cheap Bachelorette Party Ideas to Try.

How to stick to the Budget?

It is one thing to make a budget and another to stick by it. A little self-motivation and willingness are needed to sit down at the end of each month to review your expenses and compare them to how they look on the budget.

Analyze whether you spend much more or less than expected. Taking time out and reviewing your overall performance will keep you on the path to financial success.

Money management apps will help you track alerts, graphs, and more by linking your bank accounts.

Another way to keep yourself motivated is to list your expenses or spending in a book or phone to help you track and think of every penny spent.

FAQs

How should a beginner start budgeting?

A beginner could start budgeting, starting with calculating monthly income and fixed monthly expenditure, setting financial goals, calculating variable expenditure, and finally, monitoring, adjusting, and revising.

What is the 50/20/30 budget rule?

According to the 50/20/30 budget rule, 50% of your budget includes your living expenses, including your rent, bills, loan repayment, insurance, groceries, etc.; 20% of your budget includes financial goals, that is, your investments, emergency, and retirement funds, debt and savings and lastly, 30% of your budget includes your variable expenditures, which includes your wants like your extra spendings and outings.

What are the benefits of budgeting?

Budgeting lowers your financial burden and makes things simpler for you. It puts you in control of your finances, helps identify overspending, tracking every penny spent, pay off your debts, and also save money.

Final Note

If you haven’t thought about ‘how to start budgeting’ or ‘how to budget,’ start now. Plan your money responsibly and keep your spending under control. Stop using debit or credit cards everywhere, as you cannot keep a check on your spending. Use cash to avoid overspending.

I highly recommend budgeting for a more secure and stable financial future. Don’t let money control you, but you control your money.

So, with all the tricks of budgeting for dummies from the above and the learning ins and outs of Budgeting, let us summarize it to have a guide handy.

- Calculate your monthly income.

- Calculate your monthly expense -Fixed and Variable

- Decide your financial goals

- Decide which budgeting style suits you

- Review, Adjust and Implement

- Try to use cash instead of swiping the card

- Keep track of your daily spending by app or write it down (help you stay updated with your expenses).