- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

College students who put new steps into adulthood have very little experience with credit cards and other types of credit cards. Their credit history is next to non-existent, so they need to apply for cards that don’t create a bad credit score. It becomes important for every student to create a good credit history.

Various banking services give special credit cards to college students, including various types like visa student credit card, master card student card, and many others, suitable for those considering Selling Credit Cards To People.

Table of Contents

Which is the Best Credit Card for College Students?

Students look at various ways to create a good credit history. A good credit card for college students has lower fees, lower APR, and various perks only for students.

Though we suggest, you do stay away from credit cards in later years. This is great as you can pay off your debts fast. However, if you’re for student benefits, we bring you the best credit cards for college students.

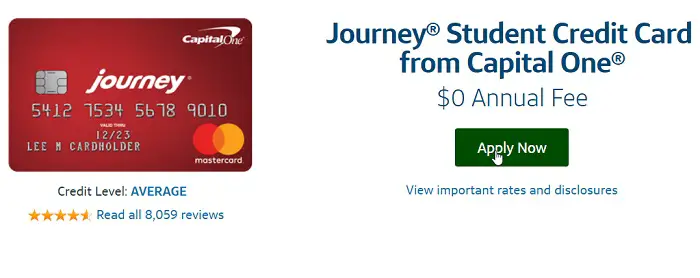

Journey Student Rewards by Capital One

Journey, ® Student Rewards of Capital One® is a low-fee credit card for college students that are best for students with adequate credit and an affinity for money-back bonuses. Its most significant benefit is the cashback plan.

You’ll receive 1% money back on everything you buy and a 0.25% money back reward every month that you give your statement in a timely. You can retrieve your bonuses as a statement credit or check at any price.

Additional perks comprise an automated credit line raise after five months of on-time repayments, minimum fees, and the perks affiliated with Capital One CreditWise specialty – a substantial credit education means.

This is one of the great credit cards for college students, with good privileges. You can save money on many excellent terms with these benefits:

- No early payment reward.

- Receive unlimited 1% cash back on all suitable purchases. When you give your statement balance timely, you’ll perceive a 0.25% cash back reward.

- Reclaim your collected money back in several amounts at any moment. You can also set your bonuses to balance to reclaim at $25, $50, $100, or $200 on any pre-determined date.No yearly fee or international transaction fee. Delayed payments cost up to $38. Money advances require $10 or 3%, which is higher.

- No introductory APR.

- Capital One CreditWise feature comprises a “what-if simulator.” You may use this to foretell your credit score and debt load developments based on potential financial actions and results.

See also: 3 Best Bank Accounts for Students in Canada

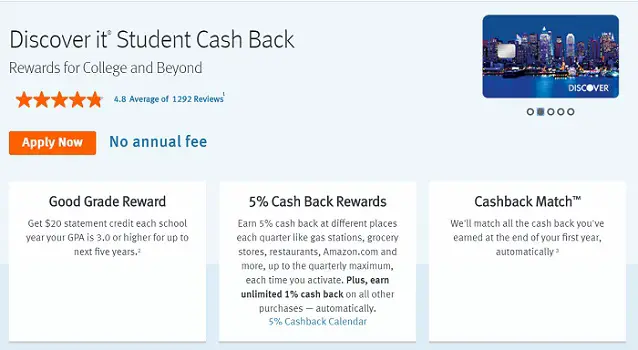

The Discover it® Student Cash Back

The Discover it® Student Cash Back Card got equal privileges to the standard Discover it® Cash Back card. In particular, it has an excellent money-back bonuses plan, unlike many credit cards for college students.

All you purchase receives 1% money back, with no expense caps or restraints. Purchases in periodically rotating expense categories (such as department store or gas station purchases) earn 5% money back, up to a $1,500 quarterly goal across all operating groups. Quarters start 1st of January, April, July, and October.

After the completion of your first year as a cardholder, Discover automatically increases all the money back you received over the past 12 months. You also get an additional $20 cash back each year if your GPA remains above 3.0 for at least five years.

Features of the Cashback Card

One demerit is that Discover It for Students is suggested for students with good-excellent credit. So, if you have weak faith or irregular credit records, you’ll face difficulty qualifying for the card.

This is among the decent credit cards for college students, with encouragement to keep your GPA above 3.0

No, conventional sign-up reward. Still, Discover automatically increases all the money back earned to double through your first year, with no limitations.

Earn 5% cash back in periodically alternating categories, max $1,500 in qualifying level spending per semester.

Also, other qualified purchases receive an unlimited 1% money back, including 5% category purchases above the periodical expense start. You can reclaim your collected cash back in any time various ways.

No annual fee. Balance changes cost 3% of the shifted amount. The money advance fee is higher at $10 or 5% of the exceptional price. Moreover, there’s no international transaction or late fee for your first late payment.

0% purchase APR for half a year and 10.99% balance shift APR for another half from the date of your initial transfer.

However, you must take them within three billing periods of your account’s opening date. Discover it for Students rewards you with a free FICO credit score each month.

Also, Discover’s Freeze lets you turn off many account peculiarities, including the capability to do new purchases and money advances.

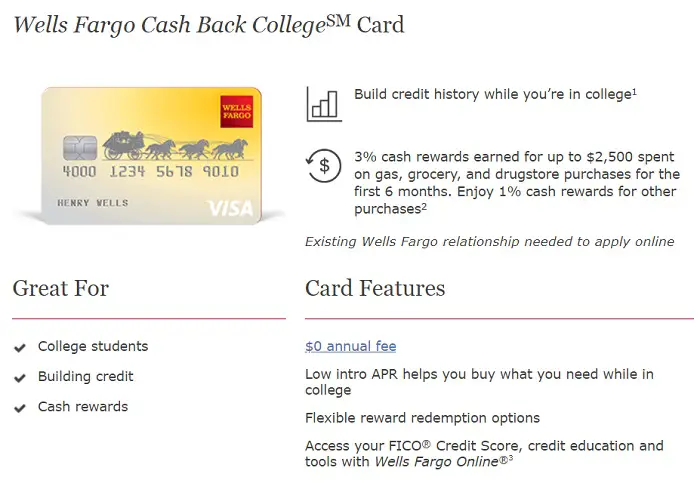

Wells Fargo Cash Back College Card

Wells Fargo Cash Back College Card is a beneficial student money-back card with, arguably, the most decent bonus plans of every card on the list.

Six months after you inaugurate your account, you’ll receive 3% cash back on gas, groceries, and drugstores, plus 1% cash back on other available purchases. Later the first period lapses, and you’ll receive unlimited 1% money back on all other available purchases.

That’s not the only opening promotion of the Cash Back College Card. A year after you start your account, you’ll experience 0% APR on all suitable shopping — the most extended 0% APR introductory promotion on this list.

A good and simple credit card for college students, with substantial benefits.

- No sign-up bonus.

- Receive 3% money back on gas, groceries, and drugstores for six months of your account’s opening. Also, receive an unlimited 1% money back on all additional eligible shopping from the first day. You can reclaim your cash back for various options.

- No annual fee. Wells Fargo’s terms and conditions report for other charges.

- The Introductory APR: 0% purchase APR for a year.

- Wells Fargo banking clients enjoy exclusive account holder perks.

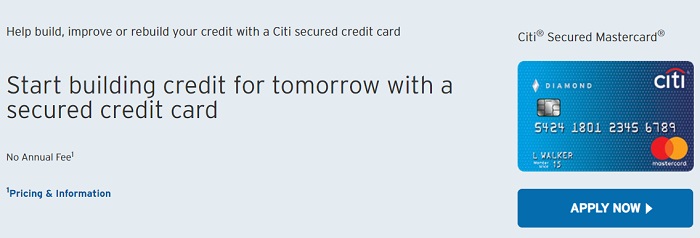

Citi Secured Mastercard

Citi® Secured Mastercard® is one more secure credit card for college students with privileges for students. You first need to deposit as small as $200 or as substantial as $2,500 to use it.

That security is similar to your credit limit and can’t be credited to your purchases. If you timely pay for 18 months, Citi may return your deposit and let you continue utilizing your card as a “normal” credit card.

Citi Secured Mastercard has moderately soft credit consent standards. This is your best student card if you have low or spotty credit. Moreover, because Citi automatically reports your payment patterns to the three significant consumer credit recording agencies,

it’s also an excellent card for organizing credit. If you timely pay, your credit score is likely to improve. The annual fee and comparatively high purchase and balance transfer APRs are notable disadvantages.

- Not the best credit cards for college students, but it one of the better ones

- No sign-up bonus.

- This card has no bonuses plan.

- There is a $25 yearly fee. International transactions cost 3%. Money advances cost a higher of $10 or 5%, and excess transfers higher of $10 or 3%. Late and rendered payments cost $35 each.

- There’s no introductory APR.

- The card has the equivalent Citi perks as the Citi.

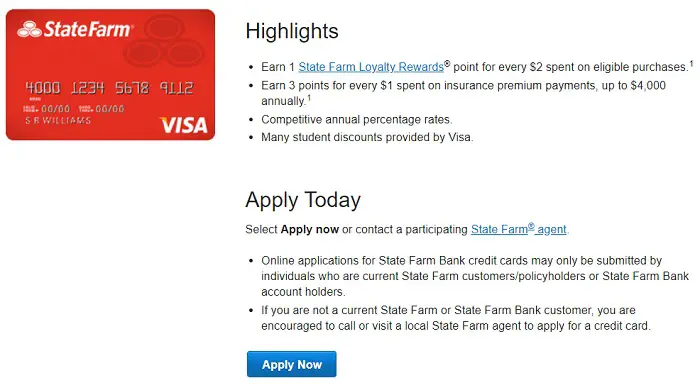

State Farm Student Visa

State Farm® Student Visa® is a bonus for credit cards for college students by State Farm, the universal insurer. If you’re seeing for a spending boost that can quickly decrease your premium charges for your auto and renters’ insurance policies, this card should be unique on your list.

However, there’s no sign-up bonus here; the bonuses plan is pretty nice for State Farm policyholders: you’ll receive 3 points on every $1 paid on insurance premiums, which adds up to $4,000 yearly. Profits on other purchases aren’t exciting — just 1 point on every $2 paid.

A substantial one among credit cards for college students with adequate plans.

- No sign-up reward.

- Earn 1 State Farm Loyalty bonus point on $2 paid on qualified net purchases. Receive 3 points on every $1 spent on insurance premium fees with State Farm, up to $4,000 yearly. Points are redeemable on gift cards, merchandise, travel, and qualified State Farm products.

- No yearly fee. International transactions cost 3% of the entire transaction amount. Cash advancements cost greater than $10 or 5%. Balance transfers cost greater than $10 or 3%.

- No introductory APR.

- The card comes with Visa-backed benefits such as complimentary loss and damage coverage for rental cars paid in full with the card.

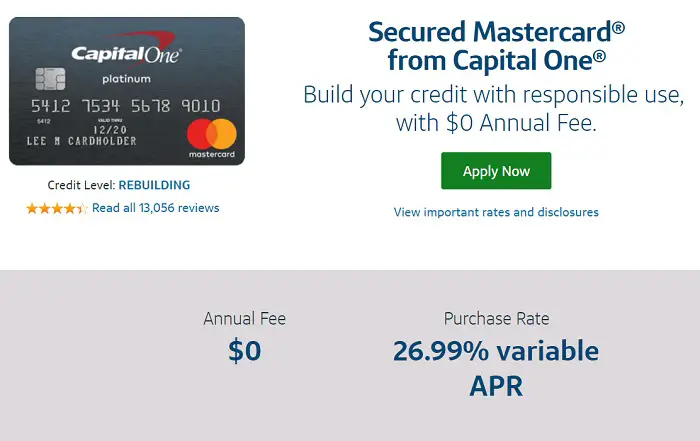

Capital One Secured Mastercard

Capital One® Secured Mastercard® is distinct from the credit cards written above – and not because membership isn’t limited to designated students. Before you start your expenses, you must make a cash deposit of $49, $99, or $200.

Depending on your creditworthiness, the deposit qualifies you for a credit line of any place from $200 to $1,000. You can consequently increase your credit limit by making an extra deposit.

However, deposits can’t be credited upon your purchases – you are still required to pay your bill each month, just as you would with a regular credit card. If you show a pattern of timely payments over many months, Capital One may increase your credit limit without demanding an extra deposit.

The greatest demerit of this card is its purchase APR, which is significantly higher than many other credit cards for college students. However, its fees are flexible, it’s open to students with weak or spotty credit, and the value-added perks of Capital One CreditWise are beneficial for students who want to track and develop their credit over time.

This credit card for college students is quite simple and easy –

- No early spend bonus.

- No rewards program.

- Also, No annual fee or international transaction fee. Cash advances cost a higher of $10 or 3%. Late fees cost up to $38 each.

- No intro APR.

- The card also has Capital One CreditWise.

See also: Savor One vs. Quicksilver – A Complete Comparison

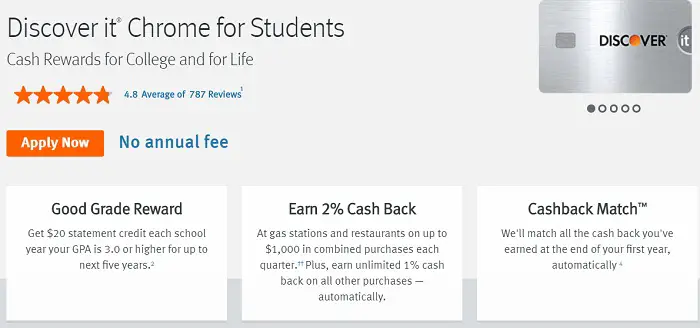

Discover It Chrome for Students

Discover it® Chrome for Students is similar to the usual Discover it Chrome card. Its money-back plan is a bit distinctive from the Discover it Cash Back cards, though: on dining and gas purchases, receive 2% money back, up to $1,000 in spending per semester.

Dining and gas expenses above this spending limit receive an endless 1%. All other purchases also receive an unlimited 1%.

Similar to Discover it for Students, Discover it Chrome for Students gives you $20 money back each year if your GPA remains above 3.0 for five years.

No sign-up bonus, though Discover does automatically increase all the money back you receive during your initial year.

You earn 2% cash back on dining and gas expenses, up to $1,000 in spending each quarter. Also, other eligible purchases receive an unlimited 1% cash back for making dining and gas purchases above the $1,000 quarterly expenses limit.

Now, you can reclaim any amount of various options. It is a great credit card for college students and encourages them to keep a GPA over 3.0.

- No annual fee or international transaction fee. Dividend transfers cost 3% of the given amount.

- The cash increase fee is higher at $10 or 5% of the advanced amount. There’s no fee on late payment for your first late payment.

- Also, 0% purchase APR for six months and 10.99% balance transfer APR for six months from the date of your first transfer. However, this must occur within three billing cycles of your account opening date.

- Enjoy a free FICO credit score and Freeze It accounts lock.

Comparison of Student Credit Cards

While choosing the best card, carefully consider a few crucial factors.

Annual Fees

Annual fees on credit cards are standard. Often, these cards offer rewards, additional advantages, and other beneficial extras. When selecting whether or not to pay an annual fee, there are several things to consider, but the most important is whether or not you will obtain enough additional benefits. The question “Will the incentives or perks of this card pay for the fee?” may be simple. But, consider if the incentives and advantages of the card will outweigh the yearly price and provide you with more excellent value than the best no-annual-fee alternative.

Another aspect to consider is an annual fee added to the credit card account, which immediately lowers available credit and is particularly important for students with little or no credit history. You will create an account with credit utilization at 33% if your card’s annual cost is $100, and you are given a $300 credit limit. We never advise credit utilization to surpass 30%—and remain below 10%—so you should be ready to pay this off to avoid damaging your credit score.

Fees and Interest Rates

Each card agreement should be carefully read before committing to anything. Don’t apply for a credit card if it seems too much trouble. Use the resources listed above for assistance in understanding what elements of the card’s usage you might need to comprehend fully.

Credit Reporting

The chance to establish solid credit is one of the main reasons why many students should think about student credit cards. But if the card issuer doesn’t disclose information about your account to significant credit reporting agencies, this won’t occur. Choose a credit card company that sends reports to Experian, Equifax, and Transunion to achieve the best outcomes. Your ability to acquire other loans and more lucrative credit card offers will improve using a student card to establish better credit.

Rewards

Credit cards for students now frequently offer good benefits, typically in the form of cashback or points. Although student card incentives are still not likely to match those of the top rewards cards available, they frequently outperform secured cards and other options for people with little to no credit history.

Deposits for security

Security deposits are rarely required for student cards, which frequently provide an unsecured alternative to conventional credit-building products like secured credit cards. The lack of a security deposit might greatly assist students who lack the funds to collateralize a credit account to establish credit or receive rewards.

Costs for Transnational Transactions and Global Acceptance

Of a trip abroad? Be sure your card is accepted worldwide and won’t charge you for every purchase you make in the country where you’re staying. Card networks significantly influence international acceptance:

International merchants frequently accept Visa and Mastercard. However, Discover is only sometimes accepted abroad.

Gaining Access to a Student Credit Card

To confirm your identity, enrollment status at the time of application, credit history (if applicable), and current income, be sure you have all the required documentation. It might consist of the following:

- Social Security number.

- Telephone Numbers (including address)

- Information about annual income

- Information on housing costs

Once the application is submitted, you can receive a response and receive your card in the mail, or you might have to wait up to a month.

You will probably be required to provide proof of your ability to make monthly payments when applying for any credit card. Anybody under 21 who uses and requests a student card should know this.

FAQs

Can a college student have a credit card?

One can start creating a credit score to build a better credit history once they become a college student and pay their monthly balance. So, having a good credit card is necessary to obtain various benefits.

Which credit card is the best for students?

Journey Student Rewards by Capital One, The Discover it® Student Cash Back, Wells Fargo Cash Back College Card, Citi Secured Mastercard, State Farm Student Visa, Capital One Secured Mastercard, and Discover It Chrome for Students are some of the best credit cards for students.

Final Thoughts

So, these were the best credit cards for college students, with the best privileges and perks, all beneficial for all students and their ease.

Credit card issuers understand that, commonly, college students have limited money than adults with full-time jobs or work-from-home jobs as freelancers.

Therefore, they tend to tightly limit how much their student clients can pay on their cards. Don’t assume your first student credit card has an exceedingly high credit limit, mainly if your only way of revenue is a stipend or work-study job. But you can try increasing your credit score by doing freelance online jobs during college.

Choose a credit card for college students carefully, keeping everything in mind. APR, transaction fees, late fees, credit limit, and most importantly, your income and source. You should also analyze all the perks you get with different student credit cards. Click Here to learn about the honey chrome extension review.

It was all for the best credit card for college students. Choose Wisely!

Yes, now change your credit card and choose the right conditions for you. Since it is not known how this situation will affect our economy. Although it is already clear what the crisis will be like. I searched everywhere and for myself, I want to find the most profitable card. I am also concerned that under the conditions of the loan it will still be necessary to pay money and whether banks will do all this on their own terms. I hope that the state will take care of this, and we will not pay too much, or we will have such an opportunity. Good luck to everyone and a good mood.

Comments are closed.