- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

The best alternative app, like Grain, is discussed in the article. Accessing and establishing credit can be complicated, and establishing credit in conventional ways can take time. Fortunately, new businesses are developing chances for you to raise your credit score.

Grain is one application that helps you to create credit and receive money. The top app like Grain are:

This article will cover the characteristics of credit facilities by another app like Grain. With the help of Grain’s virtual credit card, you may establish credit based on your debit card purchases. Thus, Further in the article, we will see the best app like Grain.

See Also: 5 Top Stores That Offer Bad Credit Furniture Financing

Table of Contents

Let’s talk about other Grain-like apps

Here is the best app like Grain:

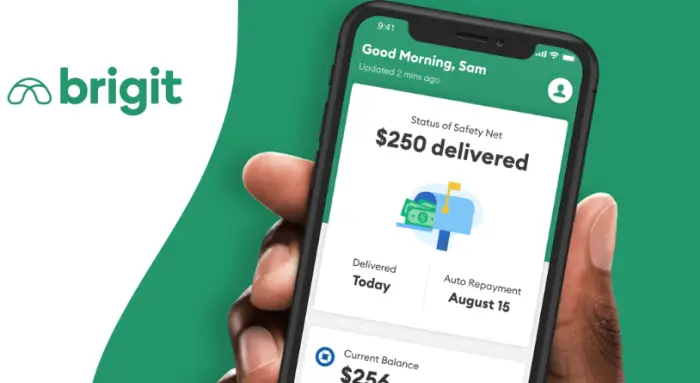

Brigit Card

An app called Brigit provides financial advances up to $250. The website says it takes two minutes to join and has three million users.

A credit check is optional, with complete protection of your credit. There are no interest fees in Brigit.

There are free and premium versions of this program. The free option offers alarms, tools for creating budgets, financial analysis, and more.

According to the company, the average user of Brigit boosts their credit score by 60 points by maintaining strong payment history.

Cash App

Cash App is a popular application that makes transferring and receiving money simple. You should know that Cash App allows users to obtain loans through the platform.

You can use your Cash Card to purchase after taking out the loan. Your Cash App balance may be assessable by the Cash Card, a debit card. Your loan payments are recorded to the credit reporting agencies. Cash App can assist you in raising your score if you routinely make your payments on time.

Chime

Chime is an online finance company that provides its consumers with fundamental money management services. It offers several advantages, like the Chime Credit Builder Secured Visa Credit Card.

To take advantage of this credit-building opportunity, you must be a Chime client with a Chime Spending Account, which serves as a checking account.

After your Chime Spending Account sets up, you may transfer money between the two to establish a spending limit for your Chime Credit Builder Secured Visa Credit Card. Your credit limit will be the transferred amount. Every time you transact with Chime, your available credit will decrease.

ZayZoon

For on-demand access to pay, ZayZoon interfaces with payroll partners. Thanks to partnerships with hundreds of large payroll platforms, employees have power over their paychecks.

ZayZoon will pay you immediately after you specify how much your salary you want to receive early. On your subsequent pay run, it recovers the fund, and the money you are accessible to will automatically deduct from your subsequent paycheck.

Japer Card

The Jasper Card is a good choice if you want to access a credit card but need excellent credit. People with poor credit or little credit history are eligible for the card.

To begin using the card, there is no security deposit required.

The three main credit bureaus get Jasper Card reports. The individual will receive cash back on 1% of her purchases. If you can get six friends to apply for the card, you’ll even have the chance to earn up to 6% cashback.

Line App

The working professionals who use the Line app. Depending on your circumstance, you may use Line to obtain $10 to $1,000 in lines of credit to pay for emergencies.

Working with Line will enable you to create a more effective financial strategy. The Line keeps an eye out for any overdrafts on your checking account.

Point card

The Point Card is a debit card with incentives and advantages similar to credit cards. The Point Card does not pose the danger of overspending like credit cards.

Applying for the Point Card doesn’t include a credit check. Currently, the Point Card Neon gives 3x points for food delivery, 5x points on select subscriptions, and 1x points on all other purchases.

Self-Card

The Self-Secured Visa Credit Card is a choice if you’re committed to establishing credit. An Individual must have a Self-Credit Builder account of three months to qualify for this protected card.

You must make monthly payments on a credit-building loan; you won’t have access to the loan’s principal upfront. Self will save up this money and place it in an account. You may use part of your locked funds as your credit limit on the Self-Secured Visa Credit Card.

Vola

Vola provides up to $300 in cash advances. Getting started with this software takes a few minutes.

Vola analyses your checking account cash flow as a cash advance app to assist you in avoiding overdraft penalties.

You can get a cash advance to prevent paying a hefty fee if Vola detects any possible overdraft problems. Based on the activities in your checking account, Vola provides expenditure insights.

Kikoff

By adding a $750 credit line to their credit reports, Kikoff assists clients in improving their credit. The additional funds assist you in establishing good credit by lowering your credit use.

Your payment history makes up most of your credit score, and the account contributes to increasing your credit age if you keep it open.

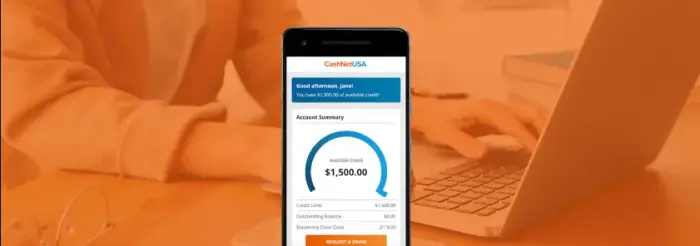

CashNetUSA

You want a lender with a solid reputation if you need money for an emergency. Enova International, one of the top financial technology providers, is the parent company of CashNetUSA. Over the past 16 years, it has assisted more than 4,000,000 people to regain control of their money.

The business has created an app to make managing credit lines simpler for everyone, even those with less-than-perfect credit ratings.

You must first apply. Your credit availability displays on the dashboard if authorized. The money will subsequently be available for withdrawal to your account that day. After 1 p.m., draw requests are handled the following business day.

Thus these were the best alternative app like Grain.

FAQ’s

Does the credit limit increased by Grain?

Grain will provide you with a credit offer with a security deposit required after evaluating your cash flow. Paying bills on time can increase the credit limit without any security deposits.

Do you receive money from Kikoff?

Kikoff gives all candidates a $500 revolving line of credit. There is no credit check, and the maximum loan amount is $500.

What products does Kikoff sell?

Sadly, you can only use the account to purchase anything from Kikoff's store, which exclusively sells self-help e-books. Kikoff's customer service could improve by solely reporting our activity to Experian and Equifax.

How long does it take for money to arrive through the app Grain?

According to Grain, the money may appear in your bank account immediately if you use your credit line within one business day.

Is Cash App available without a bank account?

No, a bank account is not required to open a Cash App account or deposit funds to your Cash App balance.

See Also: 7 Best Credit Cards for College Students in 2024

Conclusion

Thus, these are the best app like Grain in use today. People trust these apps and have been using these for transactions.