- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Would you like to buy a new home but would like to know how you will get the finances? You don’t need to because we are here to help you with our guide on how owner finance works in Texas.

In this article, we will be glancing upon the below topics to aid our readers with how owner finance works:

- How Owner Finance Works

- Why It Is Needed

- Is It Good For Sellers

- Pros And Cons

With all these things, we will also look at owner finance’s benefits to sellers and buyers.

Table of Contents

How Does Owner Finance Work In Texas?

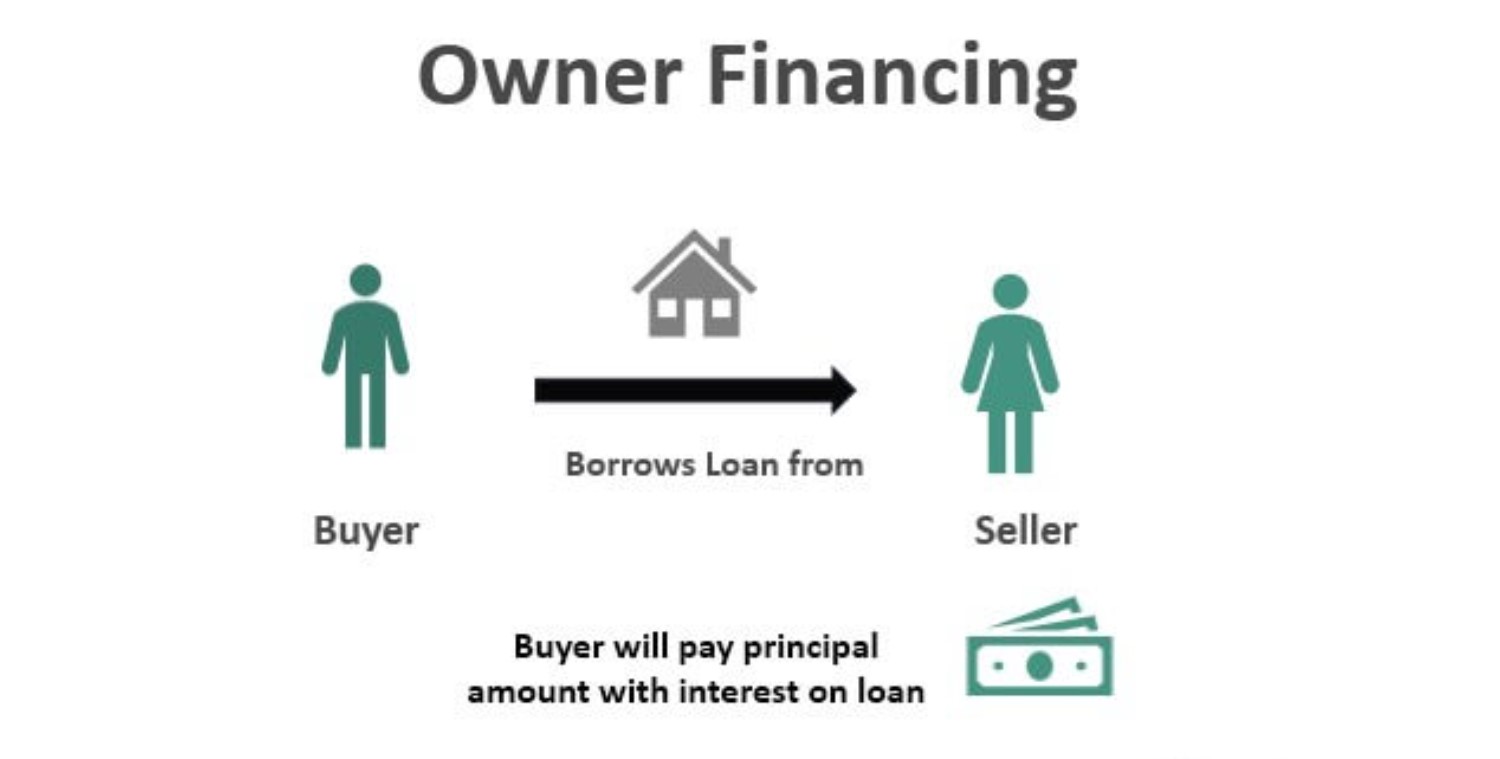

Let’s begin our guide on how owner finance works in Texas by first discussing what owner financing is. You can take an idea from the term itself that this is related to the owner offering finances.

Yes, that is right. In owner financing, house owners who wish to sell their houses provide financial support to the buyers. That eliminates the need for banks and other financial or credit unions that offer home loans.

In owner-financing homes, some points make it different from traditional home loans. Firstly it is between a seller and buyer, and the seller becomes a financial entity providing a loan to the buyer. In this, the seller owns the debt and gets all the rights and advantages of being a bank.

Secondly, unlike banks and other credit unions cases, the term for a loan is much shorter in owner finance. It is generally for 4 to 10 years, as the seller will decide the monthly payable amount.

Moreover, the entire process gets completed quickly and without hassle because buyers and sellers deal directly.

A seller doesn’t offer customers money in owner-financing homes like a mortgage agreement. However, sellers extend credit to their buyers that can cover the purchase amount of the house. In various ways, they require a down payment for the home.

And in some cases, they agree without a down payment and divide the entire amount into installments. The buyer needs to pay that fixed amount for the set period.

See also: Navigating Deferred Sales Trust and Wealth Benefits

Mortgage Agreement

In owner financing, instead of the mortgage agreement, the buyers sign a promissory note to the seller that includes terms. It contains the repayment schedule, interest rates, and in case of default, immediate occupation of the home by the seller.

In some cases, the seller of the house keeps the title to himself until the buyer pays the full payment.

See Also: The Power of CRM Analytics: Gaining Insights and Making Data-Driven Decisions

Why is it Needed?

The next topic of discussion in our guide on how owner finance works in Texas is to see why it is needed.

Well, there are many reasons why the need for owner finance emerged, making it inevitable. Some of them are as follows,

- First, it eliminates the third party providing loans or financial assistance. This makes the entire process easy, quick, and without any hassle.

- Banks and other financial institutions have a lengthy and sophisticated loan approval procedure. And until their approval, both buyers and sellers have to wait.

- However, both parties don’t need to wait when they are omitted, and sellers can close quickly.

- Also, buyers sometimes need to pay higher interest rates for home loans from banks. But with owner finance, they can bargain for interest rates and tenure for the loan.

- In addition, buyers can save on bank fees and appraisal costs. And they will get more flexibility, too.

- In many cases, buyers often don’t get home loans for poor credit scores or other reasons. In that case, seller financing is the best alternative for them and the best solution to buy a house.

Is Owner Financing It Good For Sellers?

We discussed how owner financing works for buyers and what they will get. However, now it’s time to talk about the advantages it offers to the sellers. And if any, what are the drawbacks of owner financing for sellers?

Pros

- In owner financing, sellers don’t need to make costly repairs and can sell their homes as it is. Unlike traditional lending, sellers first need to make necessary repairs.

- Providing owner financing helps close quickly and can earn more profit. Because they are the prime entity providing financial aid, they can set interest rates accordingly.

- If there is a default case, sellers will have the down payment amount like rent. So even in that condition, they will have money in their homes.

- Lastly, the deal closes quickly in owner financing, making it easy for sellers to close.

Cons

- In the case of default, sellers must go through a foreclosure process involving further legal procedures.

- When sellers get the home after the default case, they may need to pay more on repair costs depending on how the buyer treats the house.

- In addition, they might need more than just signing a promissory note and have to manage the Dodd-Frank Act.

How to Get Owner Financing?

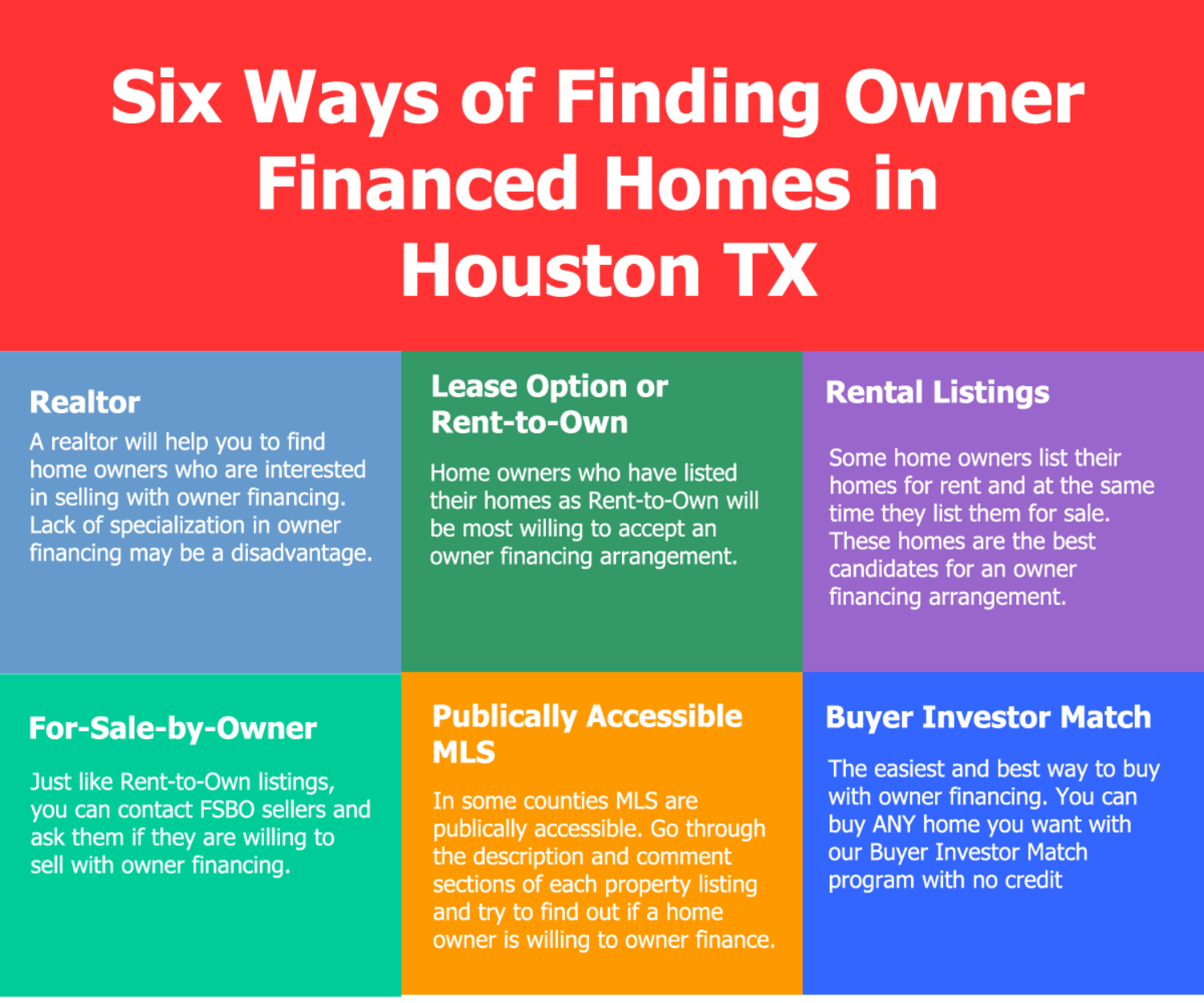

As a last step in our guide on how owner finance works in Texas, we will see where you can get owner financing. There are many options that you can choose from below:

Real–Estate Listings

Real estate brokers and agents know better what property is available for owner financing. They can help you find such properties and will provide you with the contact details of the sellers.

Real–estate websites

If you are new in your locality, search for real estate websites and see if they have owner-financing properties.

FSBO Listings

Another good option to find owner-financing property in your area is to search FSBO listings. You can search for the property you want and then contact the seller.

See also: How Long do you have to File Probate After Death in California?

FAQs

How can I apply for a home loan?

Applying for home loans depends on where you request a loan, whether it’s a bank or any other credit institution. However, you must prepare and submit the required documents in all cases. To get the home loan, you also need to describe your assets and your income. In addition to this, more processes depend as well the approval period differs.

Conclusion

Therefore, we can see that people are finding new ways to finance their purchases today. Whether a car or a home, sellers now provide their customers and clients with new financing methods.

That is why it is necessary to know how owner finance works in Texas so you can buy a new home. Real estate prices have soared lately, whether you want one room or an entire villa.

Even rents have increased in many folds, worrying both sellers and buyers. Moreover, the lengthy procedures of loan approvals and credit scores have made the process longer.

That is why sellers have taken one step forward and taken up the roles played by banks and credit institutions. Now, they are providing their buyers with finance options, eliminating the need for a bank between two parties.

However, this method of financing has its perks and drawbacks; it is essential to consider all aspects before making a decision.