- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

A Deferred Sales Trust (DST) is a specific estate planning and tax management approach. It’s a strategy that allows valued asset sale through a trust, such as real estate or business, with deferred capital gains tax payment. Usually, an individual or entity transmits the assets into a trust, and this trust will arrange specific IRS (Internal Revenue Service) conditions.

The trust then markets the asset on behalf of the proprietor and reinvests the profits. The capital gain tax on the sale deferrals entitles the owner to potentially acquire tax savings, diversify acquisitions, and obtain income from the trust. Deferred Sales Trust makes such a convincing option for those pursuing to protect their economic future.

Read also: How Long do you have to File Probate after Death in California?

Table of Contents

How Does a Deferred Sales Trust Work?

While establishing a Deferred Sales Trust (DST), there is a strategic method to supervise the sale of valued assets while deferring capital gains tax. The process initiates with the asset owner forming a team of technical experts, including tax consultants, lawyers, and financial professionals.

At the core of the DST arrangement is the structure of the trust itself, ensuring that it is carefully prepared to meet the specific conditions fixed forth by the IRS to authorize tax-deferral benefits. IRS typically stands for the “Internal Revenue Service.” It is liable for aiding and enforcing the Internal Revenue laws, which include accumulating taxes and handling tax-affiliated matters.

The dealer then recognizes the asset they plan to sell and places it into the Deferred Sales Trust(DST). A suitable third-party trustee supervises the trust, organizes its assets, ensures IRS compliance, and makes investment decisions. The trustee’s role is pivotal in the DST process as they negotiate the asset’s sale on behalf of the trust.

The Deferred Sales Trust manages the earnings from the deal and distributes them for various investment opportunities. The owner receives compensation through a promissory letter or periodic allowance expenses from the trust, designating the sale profits.

The mechanics of deferring capital gains tax within a Deferred Sales Trust involve a crucial distinction: the owner doesn’t immediately incur the capital gains tax liability upon the asset’s sale. Instead, the owner defers this tax burden until they acquire allotments from the trust.

These allotments might include structured expenses like installment deals, assistance, or promissory notices. This deferral strategy can optimize tax planning because the owner might be in a lower tax bracket when they receive distributions or have other tax-efficient options.

Emphasizing the importance of specific IRS regulations and guidelines for DSTs, the trust must be accurately established and maintained within the confines of tax laws by working closely with experts experienced in DSTs.

Benefits of a Deferred Sales Trust

Utilizing a Deferred Sales Trust (DST) offers several significant advantages:

- Tax Deferral: The foremost benefit of a DST is the capability to defer capital gains tax on the sale of appreciated assets. Instead of paying a lump sum of taxes at the time of sale, the seller can spread the tax penalty over time, potentially resulting in significant tax savings.

- Diversification: Individuals can diversify their investments by placing the sale proceeds into a DST. This will qualify more of a comprehensive scope of investment opportunities and can potentially reduce the risk. Also, it will improve the general portfolio implementation.

Check this out: How Does Owner Finance Work In Texas? 101 Guide

Providing a Consistent Income Stream:

A DST can also provide a reliable and consistent income stream, which is especially valuable for retirees or those seeking ongoing financial stability:

- Structured Payments: Sellers can receive periodic payments from the trust, such as annuities or installment payments. This creates a dependable income source that may supplement retirement income or cover other financial needs.

- Steady Cash Flow: Structuring DSTs to generate a regular cash flow offers financial security and peace of mind. This ensures income continuity post the primary asset sale.

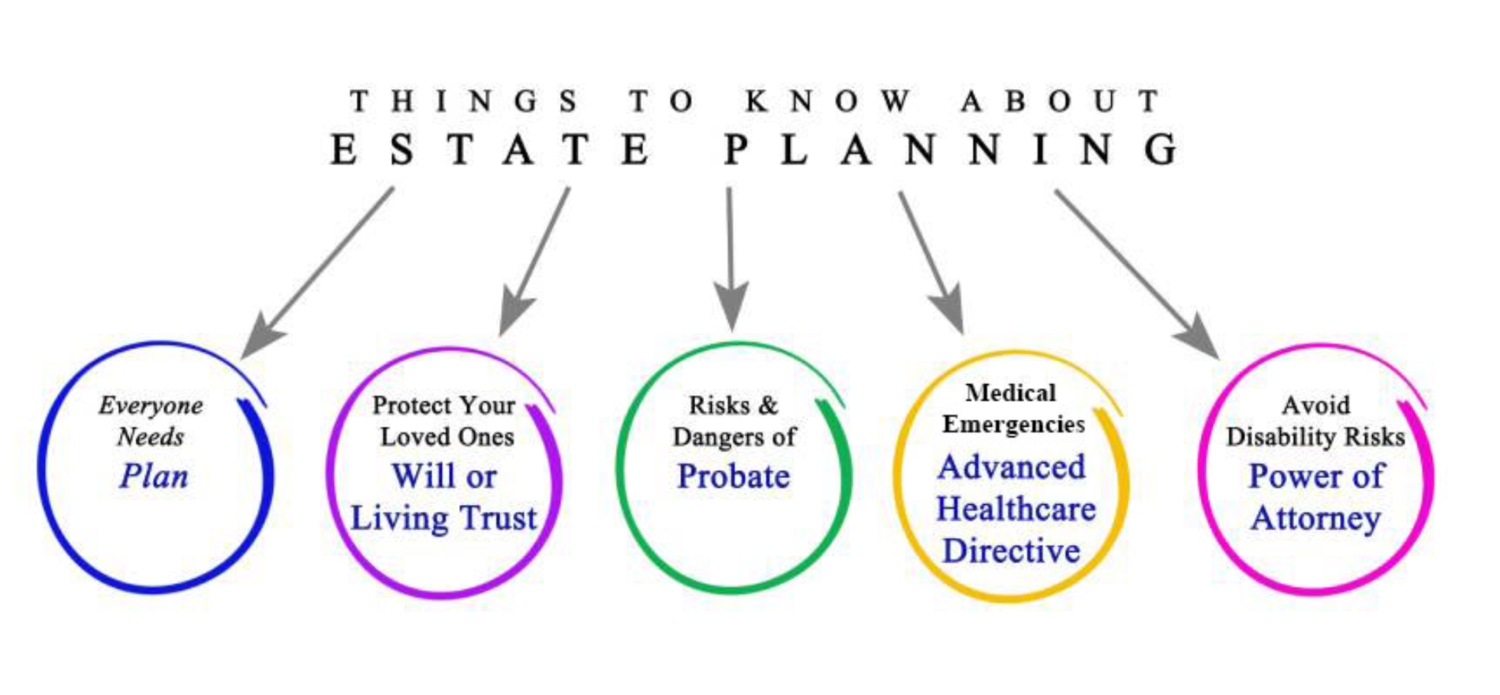

Facilitating Estate Planning and Wealth Transfer:

In addition to tax and income advantages, DSTs can be an influential tool for estate planning and wealth transfer:

- Estate Tax Mitigation: Structuring assets within a DST minimizes estate taxes, actively preserving wealth for future generations.

- Control Over Distribution: DSTs allow the grantor (the seller) to specify how and when distributions occur. This enables them to plan for the orderly transfer of wealth to heirs or beneficiaries.

- Asset Protection: Assets in a DST may have some protection from creditors or legal claims, safeguarding the family’s financial legacy.