- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

The loss of a loved one can be heartbreaking and highly emotional. Addressing legal matters after a loss can add stress, but tackling them promptly remains essential. This article will tell you all the information you need to know to file Probate after death in California.

You will have to file Probate after death in California within 30 days if nominated as the executor of the will. Since the whole process will have you in a waiting game, it is best to start the process as soon as possible to avoid any potential issues in the future.

This article will help you understand all the information you need about filing Probate after death in California. Continue reading to find out how.

Read also: How to Change Registered Agent in California?

Table of Contents

What is a Probate?

Probate is a legal procedure that must occur after an individual’s death to resolve their financial and legal affairs and transfer their assets to descendants or beneficiaries.

It will ensure the settlement of all outstanding debts and taxes.

This procedure is overseen by a court, often known as the probate court, with the primary objective of ensuring the efficient and equitable distribution of the deceased person’s assets.

Read also: 7 Best Real Estate Side Hustles

File Probate After Death In California– What Does The Process Include?

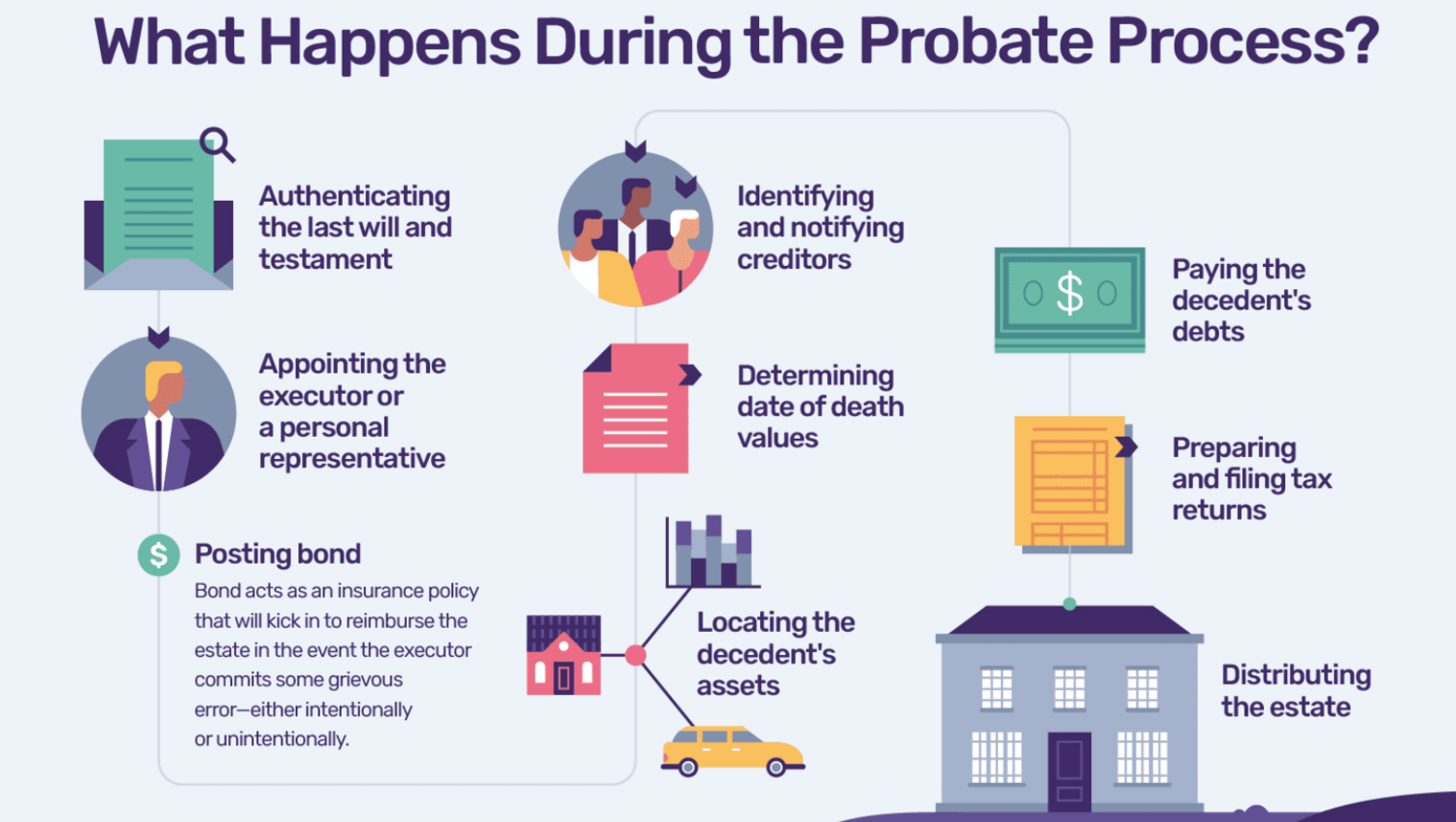

Validation of the Will

If the deceased has one, the first stage in the probate procedure is to validate the will’s credibility. After verifying the correct completion of the document and in the absence of any objections to its legality, the court acknowledges the directions outlined in the will.

An Executor Will Be Appointed

Suppose you are designated as the executor of the will. In that case, you will take the responsibility of executing the terms stipulated within the choice and overseeing the progression of the probate process.

If no will or executor is specified, the court assigns an administrator to carry out these responsibilities.

Compiling Of An Asset Inventory

As the executor or the assigned executor of the will, you will have to compile an inventory of the deceased’s assets.

This may include real estate, bank accounts, investments, personal belongings, etc. Making this inventory is essential for determining the value of the estate.

Settling Of Debt

Before distributing assets to beneficiaries, fulfilling the estate’s obligations and liabilities is critical. This involves proactively informing lenders, promptly paying any outstanding bills, etc.

Ensuring accurate calculation and payment of taxes and addressing any claims made against the estate. This crucial process guarantees that you fulfill financial obligations before the distribution of assets.

See also: Navigating Deferred Sales Trust and Wealth Benefits

What Can The Beneficiaries Or Heirs Do During The Process?

They will receive notification regarding the probate proceedings. Additionally, they have the right to raise objections and intervene if they suspect any mishandling of the process or perceive any unjust actions.

The Assets Are Fairly Distributed

Once settling debts are concluded, the deceased’s remaining assets will be transferred to the beneficiaries designated in the will.

Records Will Be Maintained

As an executor, the responsibility extends to meticulously documenting every detail, encompassing the estate’s valuation, income, and more.

These meticulous records will culminate in a final accounting, a pivotal document submitted to the court for evaluation and endorsement. This step plays a significant role in finalizing the probate process.

Check this out: For How Long Can You Finance a Used Car?

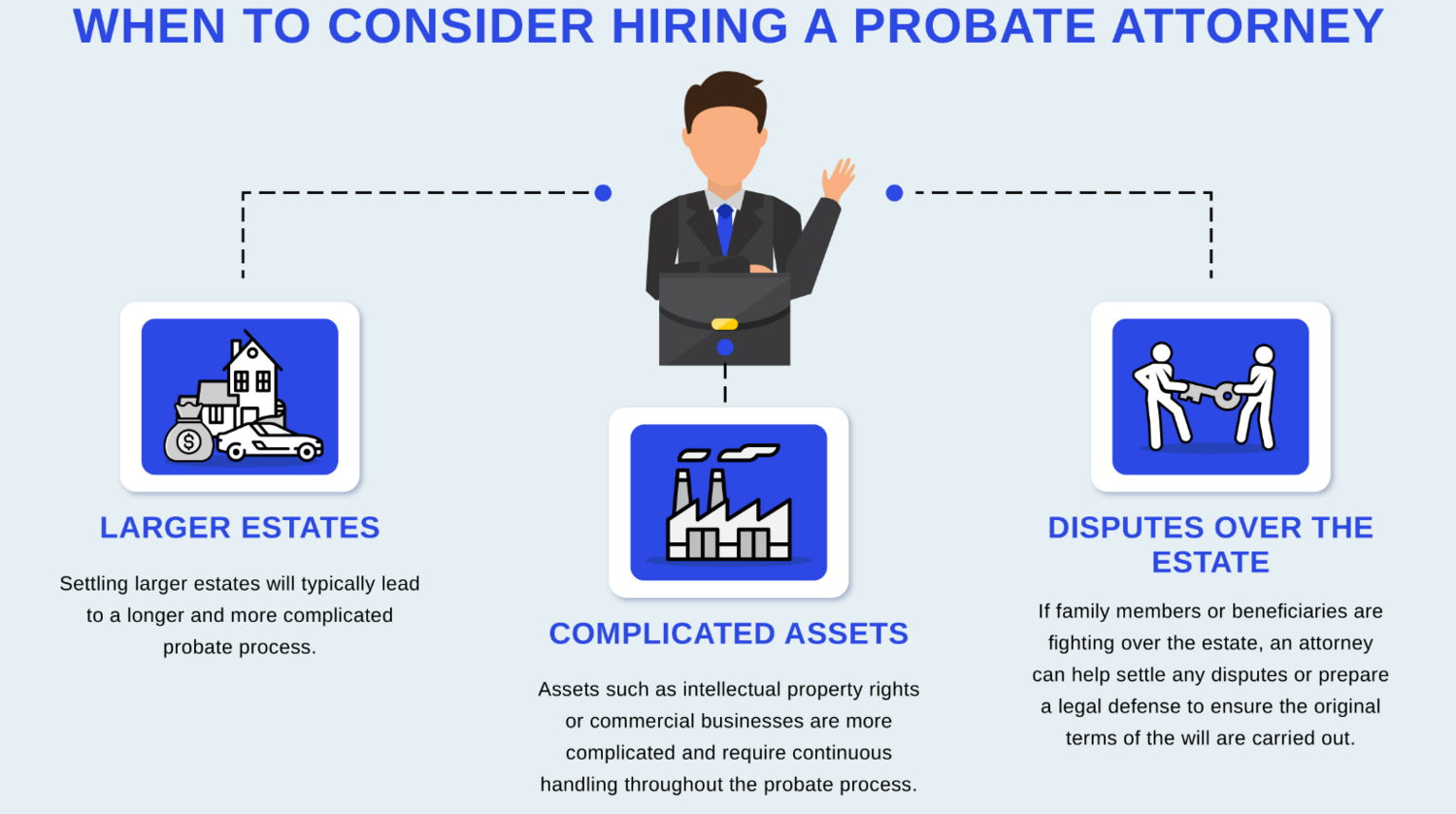

Will You Need An Attorney To Help You With Probate Process?

Although unnecessary, it will ultimately depend on factors like the estate’s complexity and your expertise in legal processes. However, handling Probate without legal aid may be possible for simple estates with minimal assets and cooperative beneficiaries.

A professional attorney can help you review the legal procedures and prepare documents appropriately. They will also provide specific guidance that will save you time, prevent errors, and relieve stress during an already stressful time.

Here is a list of things an attorney will help you with through this long process:

- If you have a busy schedule or little time, a lawyer can handle the legal aspects on your behalf.

- If you are unfamiliar with legal procedures, getting a lawyer to help you with everything is best.

- If there is a chance of a disagreement between beneficiaries, creditors, or other parties, having a lawyer on your side can help you handle issues and find fair solutions.

- Help you make informed and knowledgeable decisions.

- A lawyer can assist you in properly preparing and filing the documents to avoid delays and mistakes.

- While engaging a lawyer incurs legal expenses, their experience could save money. This will guarantee an efficient probate procedure and swiftly resolve possible legal difficulties in the long term.

How Long Does It Take to File for Probate?

The question: How long do you have to file Probate after death? Is common. The Californian Probate Code specifies various time frames and deadlines. If an executor is specified in the will, they must apply for Probate before 30 days of the deceased person’s death.

You will have until 30 days to file a probate, and it is advisable to do it as early as possible. To avoid last-minute rushing when you get close to the deadline, it will only add to the stress you are experiencing.

Once appointed as the executor by the court, the process generally takes around 12 to 18 months to complete.

Also, Financing a Boat: How Many Years Can You Finance a Boat?

Why Is Filing For A Probate Important?

Here are a few reasons why filing a probate is essential:

- It helps to avoid conflicts and assures asset distribution fairness.

- Creditors may assert claims towards the estate for any remaining obligations.

- The court ensures that beneficiaries and heirs receive their rightful shares by the will or the prevailing legal regulations.

- The process of Probate helps maintain the integrity of property ownership.

- Probate offers a platform for discussing these problems and looking for lawful and orderly solutions.

FAQs

What happens if you don't file Probate after death in California?

As long as debts remain outstanding, the probate court has the authority to restrict access to the deceased's property, thereby preventing beneficiaries and descendants from accessing it.

In California, how long can an estate remain open after death?

If the will designates you as the individual responsible for the execution, you will have one year after the person's passing in California to initiate probate proceedings and oversee the estate's settlement.

Who pays for Probate in California?

In California, as an executor, a probate should not cost you anything. If you wish to take care of the Probate, you must pay court fees and other charges out of your pocket until you become the appointed administrator.

How can you avoid Probate in California?

A living trust is one technique for preventing Probate in California. A living trust is a legal instrument that permits you to give another person ownership of your possessions. This implies that your possessions will not be subject to Probate after you die.

Conclusion

In this article, we have covered probate, its process, the importance of filing a probate, and how much time you have to file a probate in California. We have also covered if and why you need an attorney to help with the process.

See also: 9 Best Paying Jobs in Real Estate Investment Trusts.