- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Financial education for children can give them a bright future. As they grow from toddlers to youngsters, kids learn everything during their developmental stage. For instance, they learn history and math and how to speak a language at school.

But have we ever explained the importance of counting coins and learning how to manage money for the future? The answer is no; parents simply fulfill all of their children’s requests. Financial independence can be attained by teaching financial literacy to children. That seems more like you are teaching your children to be responsible with their money and laying the groundwork for their future success.

This article will focus on financial education for children

and how to raise financially savvy children.

See also: How Much Money Do Foster Parents Make?

Table of Contents

Each coin counts

Financial education for children is the best way to teach them the value of money. The best instance to illustrate this idea is when kids receive pocket money. Teach them to save their money and use it to purchase themselves treats or whatever else they want.  Although it’s not much, they discover that even a little bit of money may be valuable. To make youngsters financially savvy, you must teach them financial literacy.

Although it’s not much, they discover that even a little bit of money may be valuable. To make youngsters financially savvy, you must teach them financial literacy.

Money conversation

It is a crucial step in financial education for children. Many parents fail to teach their children financial responsibility. Discuss the value of money briefly while you are sitting next to them. At any age, a child can understand the value of money.  To start the lesson, you might show children how to count money and explain that each coin has a distinct value. In a similar vein, you must teach them the fundamentals if you want to motivate them. You’ll be shocked to hear that they’ll even try to count and understand the prices at the grocery store or any clothing store.

To start the lesson, you might show children how to count money and explain that each coin has a distinct value. In a similar vein, you must teach them the fundamentals if you want to motivate them. You’ll be shocked to hear that they’ll even try to count and understand the prices at the grocery store or any clothing store.

Everything comes with a cost

Just because you gave them everything they asked for does not mean that it has no value. People should recognize the value of talking about their children and finances. As an example, they should value money if they raise their hands to have it conveniently purchased for them.

You should make them understand that if they do nothing, nothing will come to them easily. It has a price; you could even promise to obtain the toy if you help out around the house, but that sounds like a give-and-take arrangement, and it’s good that they get the whole point. This is an important aspect of financial education for children.

See also: How Much Money Do Daycare Owners Make? Starting a Daycare

Comparing prices

Let’s imagine that you are purchasing some goods. Teach them how to shop and inform them that purchasing a product should be based on its possible future usage rather than for the sake of purchasing it.  As a result, you should educate him or her on superior quality. While comparing prices, children will gain knowledge of the worth of each price and the value of the products.

As a result, you should educate him or her on superior quality. While comparing prices, children will gain knowledge of the worth of each price and the value of the products.

Allowance

Giving children an allowance is more of a beginning step in educating them about financial responsibility. Give them money following the domestic chores they complete; for instance, if they clean the house, give them $1; likewise, if they fold laundry, etc., give them $1. Encourage kids to perform tasks in exchange for an allowance of money.  Their skills will be developed in this way. If they are younger, ask them to assist with simple chores; if they are in their early teens, ask them to perform yardwork, wash dishes, etc. You can give them tasks based on their age.

Their skills will be developed in this way. If they are younger, ask them to assist with simple chores; if they are in their early teens, ask them to perform yardwork, wash dishes, etc. You can give them tasks based on their age.

Spending decisions

It’s time to teach your kids how to spend money now that they’ve saved some by helping out with chores. At this point, you should let the child make their purchases with their own money without interfering with their choices. They shouldn’t spend their own money on anything that is just a little bit out of their price range.  The entire process is intended to teach kids the value of money, not to waste them. As a result, you might advise them to choose another product or wait to purchase that one until they have saved enough money to do so.

The entire process is intended to teach kids the value of money, not to waste them. As a result, you might advise them to choose another product or wait to purchase that one until they have saved enough money to do so.

Delayed gratification

It’s crucial to have patience in life. Explain to them the concept of delayed gratification and how they must wait to obtain their goals.  Please encourage them to avoid making purchases they cannot afford to keep the child’s future debt-free. Each coin has a higher value, and preserving it will allow them to achieve their goal of obtaining the desired product.

Please encourage them to avoid making purchases they cannot afford to keep the child’s future debt-free. Each coin has a higher value, and preserving it will allow them to achieve their goal of obtaining the desired product.

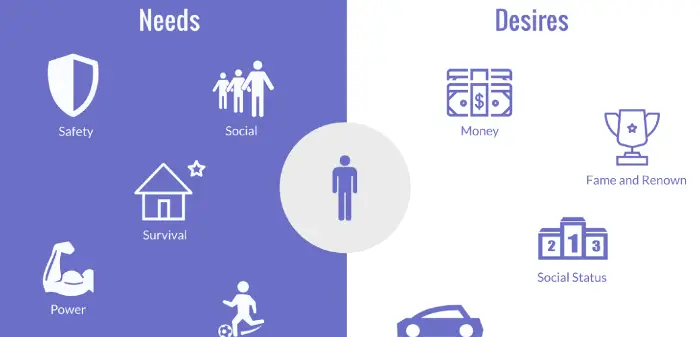

Need vs. desire

We must teach children the value of saving money in addition to the necessities and wants in their lives. They will be better able to choose necessity over want in the future thanks to this.

For instance, if your kid asks you to buy a box of Legos or some other toys, give him or her the option of picking from one of the many toys they already own or some snacks; most of the time, they’ll pick the latter.

They will learn the worth of the item and its price in this way. Children need more than just financial education; they also need to know what is crucial for their survival.

Opening a bank account

You can even start a separate account for them if they are in their early teens, which will enable them to better plan their future. They may even switch from a savings account to a regular one when they get older and use it for current expenses.  They will be able to limit their expenses this way and stop wasting money on things they don’t need.

They will be able to limit their expenses this way and stop wasting money on things they don’t need.

FAQs

What is the best way for children to learn about money?

Having money conversations with the children. Many parents fail to teach their children financial responsibility. Discuss the value of money briefly while you are sitting next to them. At any age, a child can understand the value of money. To start the lesson, you might show children how to count money and explain that each coin has a distinct value. In a similar vein, you must teach them the fundamentals if you want to motivate them. You'll be shocked to hear that they'll even try to count and understand the prices at the grocery store or any clothing store.

Why give allowance important for kids?

Giving children an allowance is more of a beginning step in educating them about fiscal responsibility. Give them money following the domestic chores they complete; for instance, if they clean the house, give them $1; likewise, if they fold laundry, etc., give them $1. Encourage kids to perform tasks in exchange for an allowance of money. Their skills will be developed in this way. If they are younger, ask them to assist with simple chores; if they are in their early teens, ask them to perform yardwork, wash dishes, etc. You can give them tasks based on their age.

Why should parents allow children to take spending decisions?

You should let the child make their purchases with their own money without interfering with their choices. They shouldn't spend their own money on anything that is just a little bit out of their price range. The entire process is intended to teach kids the value of money, not to save them. As a result, you might advise them to choose another product or wait to purchase that one until they have saved enough money to do so.

How do I motivate my child to save money?

Giving them an allowance or a reward for saving money might help you inspire them. Their future will be brighter if we teach them the value of every penny.

Conclusion

Many people might think it’s absurd to teach kids about money. However, a lot of individuals are aware that it serves as the cornerstone for your child’s prosperous future. As they grow older, they must grasp the value of money.

See Also: 14 Best Free Money Hacks To Try In 2024