- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Referral programs are very effective in creating a dedicated and loyal customer base. Besides the benefits, referral programs can help increase a brand’s promotional strategies. Hence, a new way to gain more website visitors and increase downloads by maximum.

A successful referral program can allow customers to earn benefits and try new brands. Hence, these programs are a win-win for both parties. We have listed the best referral programs to profit from in the easiest ways.

Table of Contents

What are referral programs?

Using word-of-mouth marketing (WOMM) to encourage open dialogue and product suggestions. The objective is to get people to talk about a company, brand, product, or service. We are social beings; thus, WOMM works because we enjoy sharing our experiences with our friends, family, and coworkers. A strong referral marketing program is one strategy to encourage WOMM.

In referral marketing, as a bonus, the brand rewards customers for sharing the business with friends, followers, or anyone. It is a strategy to grow the customer base, which is exceptionally helpful for new brands.

Best referral programs to make money

Payoneer

You can receive and send money using the online-only Payoneer service. So it’s something similar to PayPal but with less bureaucracy. Additionally, it’s the preferred payment option for most affiliate marketers, especially those using remote workstations or leading a digital nomad lifestyle.

Additionally, they run a referral scheme. You participate in their “refer a friend” program and are given a monetary bonus. Due to the intense competition in the financial services sector, Payoneer is always grateful for new business referrals. Their recommendations to other customers can earn you up to $25.

Google Workspace

Google Workspace is a program that includes collaboration tools, documenting space, etc.

To “spread the word on its business-related software,” as Cnet puts it, Google introduced the referral program for what was then known as “Google Apps for Work” and is now known as “Google Workspace” since 2014. Back then, the program offered $15 per purchase.

The number of Google Workspace paid subscribers has increased from under 2 million to over 6 million since the program’s debut. The Google Workspace referral program is unquestionably a success, despite no statistics on the program’s effect on sales.

Swagbucks

The loyalty rewards program Swagbucks has been in existence for a long time. It offers numerous opportunities to earn rewards and is completely free to use. You can gain points by completing quick tasks, including surveys, viewing films, testing new products, playing games, and purchasing online.

Once you’ve accumulated a specific number of points, you can use PayPal to exchange them for gift cards or cash. You can get a $25 gift card by earning about 2,500 Swagbucks points. You will receive 300 points for referring new members to Swagbucks using your referral link, plus 10% of their lifetime Swagbucks earnings.

After logging in, go to the ‘referrals’ option under your account details. To earn extra Swagbucks points that can be exchanged for money, copy your link and start sharing it with others.

See Also: 12 Best Loyalty Card Apps for Android & iOS

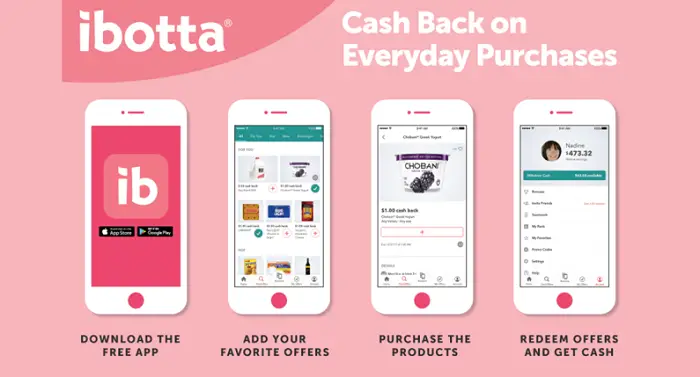

Ibotta

With Ibotta, you can get cash back on groceries and more. This software is available for free download and enables you to earn rebates by buying items like groceries, household goods, and more that you would typically buy.

Using the app, you can select any retailer you want to shop at and browse all the deals they offer. Locate a cashback offer for a product you must purchase and choose it. Then proceed to the store and make your usual purchases.

Ibotta currently offers cashback rewards for both traditional and online purchases. You receive $10 from the Ibotta program for each person you convince to download the app, which is a fantastic perk.

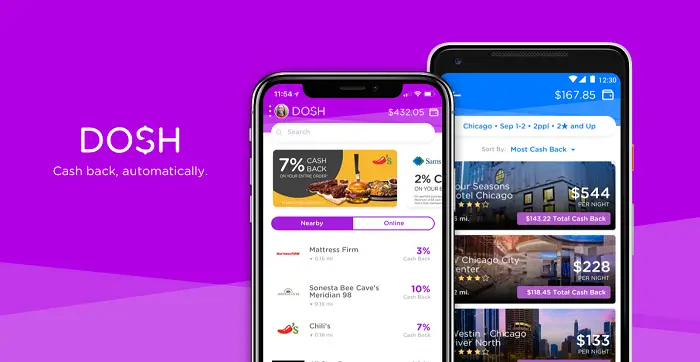

Dosh

Dosh is an app that functions similarly to Ibotta and is another fantastic alternative among many that pay for referrals. The fact that it offers cashback automatically is a fantastic feature that sets it apart from its rivals.

For each card you add to the referrals category, you will receive one dollar plus five dollars for each person you recommend to the platform. The only drawback is that you must first have 25 USD to withdraw. Visit the official website to learn more.

Questrade

Popular bargain brokerage Questrade is known for its incredibly low costs and commission-free ETF trading. For each person you recommend, you receive $70, and your friend receives $50 in free trades. You must deposit $1,000 or more into your investment account for the bonus to take effect.

When you sign up, use the discount code SAVVY50 to receive $50 in free trades.

You can start inviting your relatives, friends, or followers on social media once you’ve funded your Questrade account. Hence, this is one of the best referral programs to make money from.

Squish Candy

The referral scheme at Squish Candy is fantastic for many reasons. It’s a fantastic, affordable marketing tool to start. A 15% discount won’t significantly affect their profit margins because their products are reasonably cheap.

One of their buckets, for instance, costs $20.99. It only costs Squish around $3 if a consumer uses their 15% discount reward for this purchase. For a new client who might return, make numerous more purchases, and recommend more of their customers, that’s a little price to pay.

Since Squish Candy is a unique kind of candy, acquiring the trust of its customers is a critical component of its marketing plan. It could be overwhelming for new clients to know where to begin, given the abundance of distinctive flavors.

Coinbase

One of the more well-known cryptocurrency exchanges is Coinbase. They have been carrying something for their clientele since 2012, long before the Bitcoin craze gained traction. Thus, they essentially offer a simple platform to buy and sell cryptocurrencies.

The Coinbase referral program is a reasonably simple concept. You create a profile with them. You then use your “refer a friend” link to tell your friends about it.

Within 180 days of your referral purchasing or selling $100 worth of Bitcoin, you will receive a $10 bonus to your accounts, which can then be used to purchase additional Bitcoin, Ethereum, Tether, Stellar Lumens, etc.

See also: What is Twitch Affiliate? Everything You Need to Know

ShareASale

One of the best referral programs to make money from is ShareASale. There, you can promote thousands of affiliate programs. They manage a referral promotion scheme with the aid of their software.

When the affiliate earns at least $20 in affiliate commissions, you are eligible for the $30 referral bonus. For referred merchants, you can earn $150 if they generate $100 in ShareASale fees or stay active for six months.

Earn $30 for each affiliate who signs up through your suggestion and makes at least $20 in revenue when you refer friends to ShareASale.

FAQs on best referral programs to get money from

Which Referral Programs Pay the Highest Bonus?

Questrade, Wise, and Payoneer referral programs provide bonuses from $50 to $70 for referring one person. These are some of the best referral programs to make money from.

Are Referral Programs Beneficial?

Statistically, businesses using referral programs experienced an 86% increase in revenue growth for two years. A Wharton Business School study found that companies' referral programs were generally $0.45 more profitable per day than other consumers. Moreover, referral programs are advantageous to both customers and the company, as one receives rewards and the other gains profit.

What is the Difference Between a Referral Program & Affiliate Program?

Many businesses choose to establish affiliate marketing programs in addition to client referral programs. Both approaches emphasize growing clientele, boosting sales, and enhancing brand recognition. The program members and the incentives are the key distinctions between a referral program and an affiliate marketing program.

Are Referral Programs Really Significant?

It has long been shown that incentives raise the likelihood of recommendations. Referral incentives or awards give customers a genuine reason to tell others about your brand, whether through a discount, a free month of service, or any other value. Therefore, your business may develop a more dependable, more scalable consumer referral program rather than relying on passive word of mouth.

Conclusion

Referral programs can be extremely beneficial, especially for brands that deal with e-commerce and retailing. For example, a new online clothing store could increase its customer base by offering referral rewards. Not only does it help bring in customers, but it also helps in marketing the brand.

Moreover, referral programs are a win-win for both customers and the company. As reports suggest, referral schemes increase the brand’s publicity and reward the customers. And these examples are just great with their referral schemes.

Hence, to sum things up, these were the best referral programs to make money from anywhere and at any time.