- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Do you need help choosing M1 Finance or Robinhood for your investment needs and need help to determine which platform offers the best features and benefits? Then we’ve got you covered. In this article, we’ll dive into a detailed comparison of Robinhood vs. M1 Finance.

Both platforms offer unique features and cater to different types of investors. M1 Finance focuses on long-term investing, offering an easy-to-use interface and low fees. On the other hand, Robinhood is known for its user-friendly interface and wide range of investment options, including cryptocurrencies.

You will understand each platform’s strengths and weaknesses by exploring the similarities and differences between M1 Finance and Robinhood. Keep reading to delve deeper into the two media and help you decide which is best.

Table of Contents

M1 Finance Vs. Robinhood: Differences Explained

Let’s understand the core business models of both platforms and they are different from each other –

What is M1 Finance?

M1 Finance is the next-generation investment platform taking the world by storm. It’s a robo-advisor that offers an easy-to-use interface and low fees, making it an ideal choice for novice and experienced investors. With M1 Finance, users can invest in stocks, ETFs, and even fractional shares of popular stores like Amazon or Google.

This innovative platform offers everything from investing to borrowing to checking, all in one convenient place. With M1 Finance, you can say goodbye to juggling accounts and hello to taking control of your money.

What is Robinhood?

You’ve probably heard of Robinhood if you’re interested in investing and trading. But what exactly is it? Consumers can use Robinhood’s smartphone app to change and invest in stocks, options, ETFs, and cryptocurrency. That means you can trade stocks as much as you want without worrying about paying high fees.

Robinhood makes buying in stores, ETFs, or cryptocurrency simple with just a few clicks. And if you’re worried about costs eating into your profits – don’t be! Robinhood does not charge any commission fees.

Now, let’s get down to comparing M1 finance vs. Robinhood

Read also: Advanced ETF Trading Strategies: How experienced traders stay ahead in the UK market

Investing Options

So, when it comes to M1 Finance vs. Robinhood, how does M1 Finance differ from other investment platforms like Robinhood?

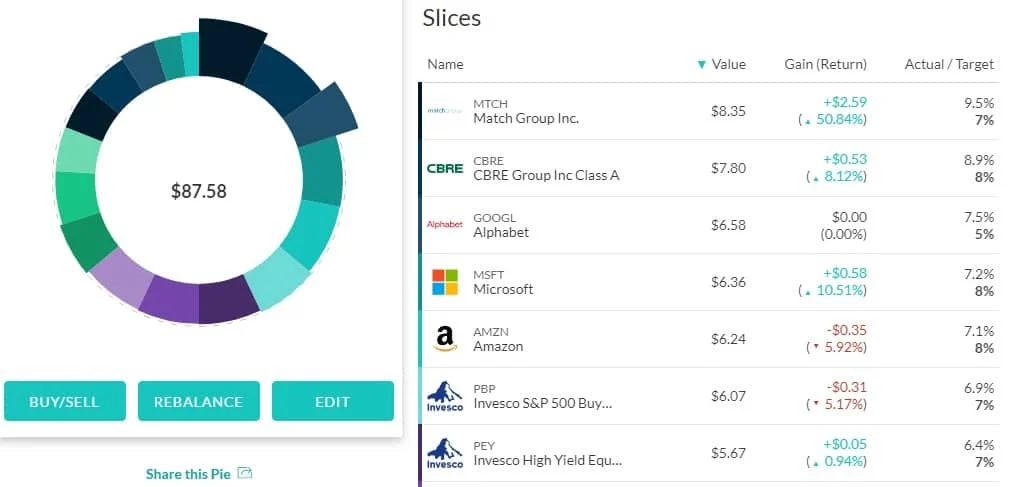

A hybrid platform called M1 Finance provides self-directed investment and robotic advising services. The platform allows users to create personalized portfolios with fractional shares, making investing in multiple stocks at once more accessible. Additionally, M1 Finance offers free trades and no account minimums.

The most incredible thing about Robinhood, which makes it perfect for people who wish to start small, is its commission-free trading. However, unlike M1 Finance, Robinhood offers no advisory services or retirement accounts, and Robinhood offers cryptocurrency trading options attractive to some investors looking for more diverse investment opportunities.

M1 Finance allows users to invest in over 6,000 stocks and ETFs using pre-built portfolios or creating custom ones from scratch. In contrast, Robinhood’s selection is limited compared to M1, and users can only trade stocks and ETFs listed on U.S. exchanges and cryptocurrencies.

While both platforms offer commission-free trading, M1 Finance focuses on long-term investing with its pie-style portfolios.

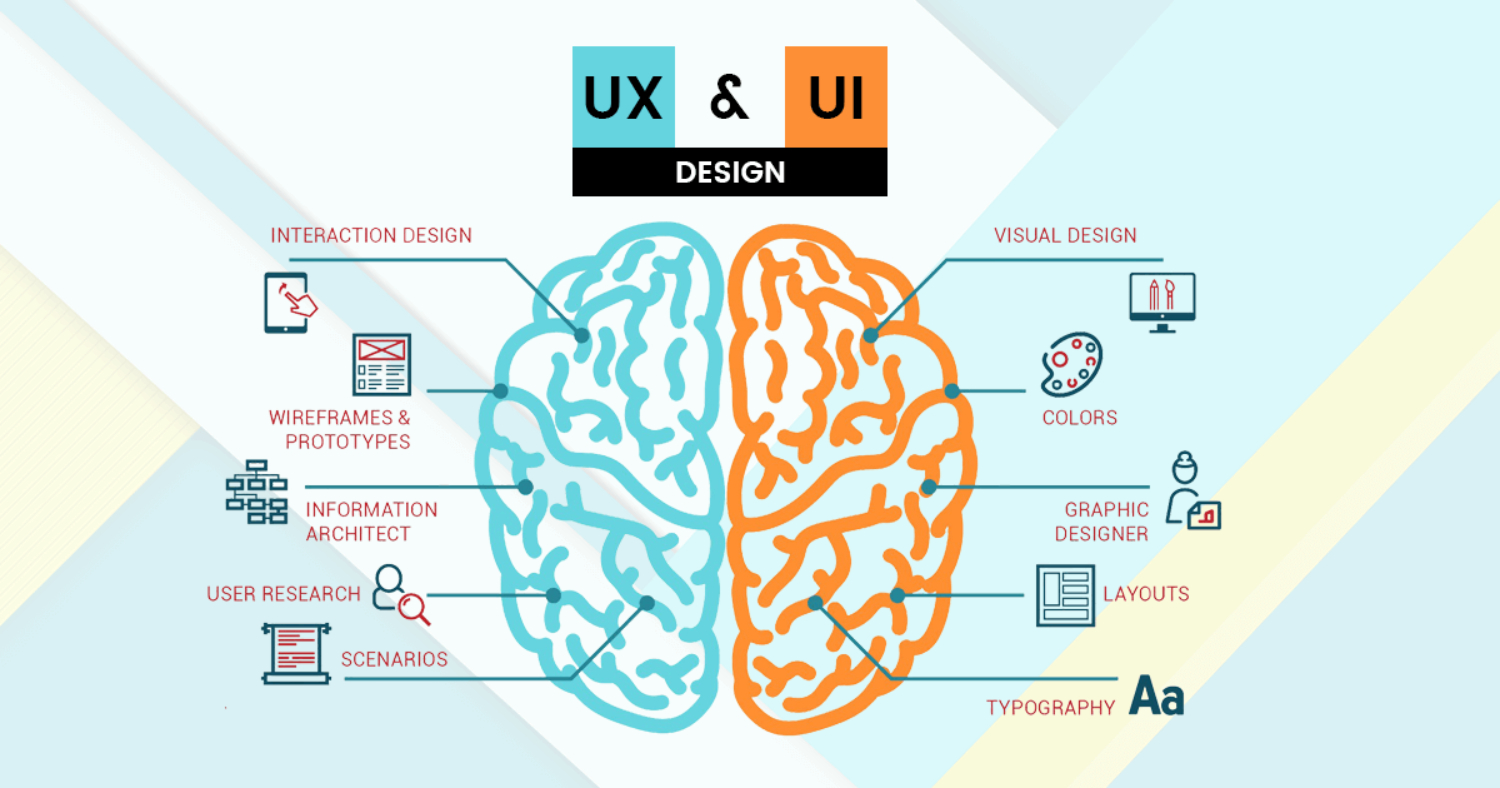

User Interface and Experience

M1 Finance has a sleek and modern interface that’s easy on the eyes—designed to be minimalistic, with only essential information displayed on your dashboard. Navigation is smooth, thanks to its intuitive design, and you can access several areas, such as your watchlist, portfolio, or settings.

Moreover, M1 Finance’s pie-based investment strategy allows users to invest in multiple stocks with just one click!

The user-friendly layout of the Robinhood app makes it simple for consumers to move around the site. The home screen displays all your investments at a glance, providing real-time updates on the performance of your portfolio. This feature lets you track your assets effectively and make quick decisions based on up-to-date information.

When comparing M1 Finance’s mobile app versus its desktop website, users may find the app is more streamlined and user-friendly while offering more advanced features such as custom portfolios and tax optimization tools. Similarly, Robinhood’s mobile app provides an intuitive interface with basic trading functionalities. But its desktop website offers extensive trading capabilities along with customizable charting tools.

Account Types

What about the account types available with M1 Finance vs. Robinhood?

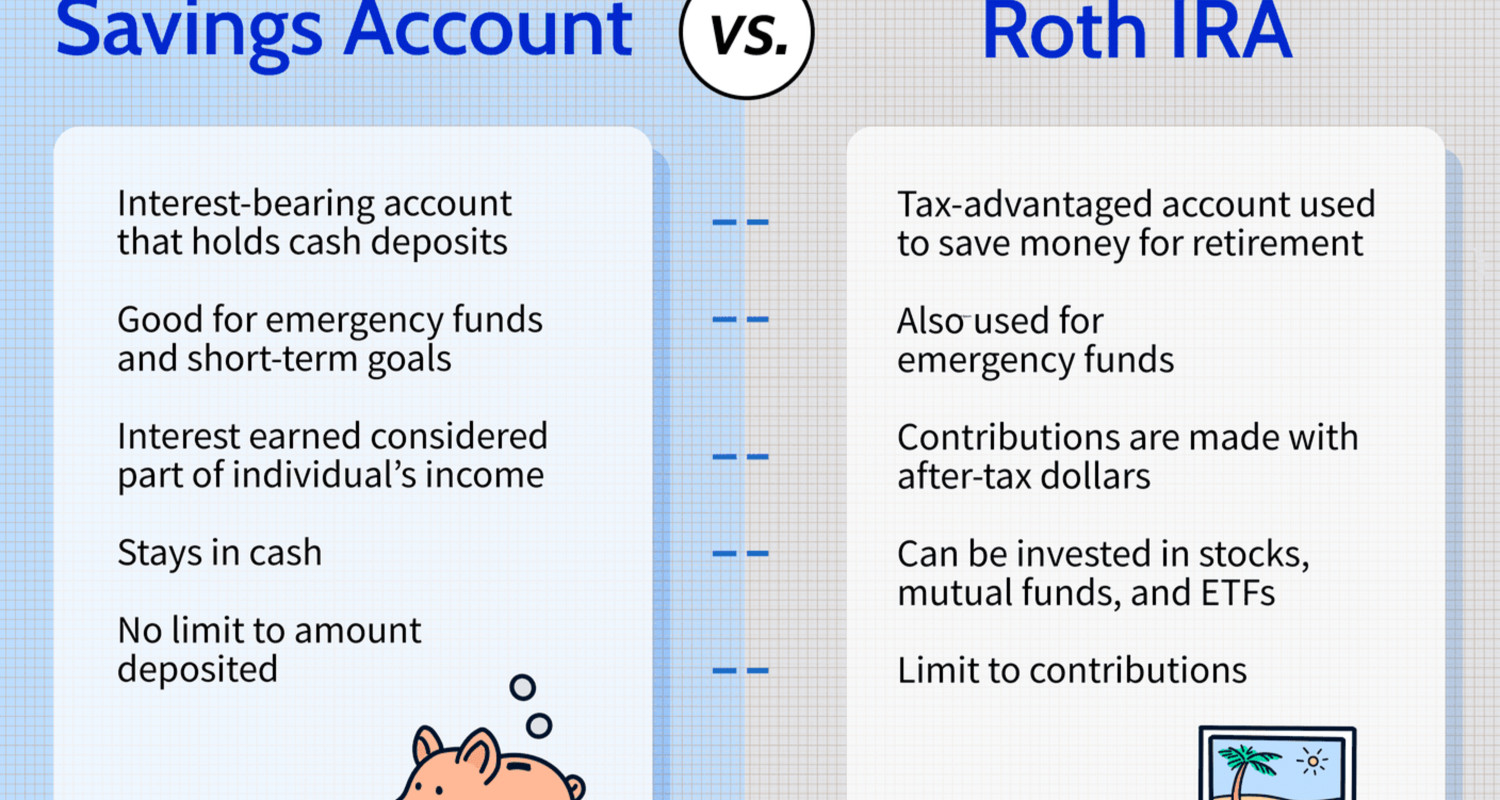

M1 Finance specializes in individual taxable accounts, IRAs, trusts, and joint accounts, making it ideal for those looking to create a diversified portfolio with multiple account types. In contrast, Robinhood only offers taxable brokerage accounts and doesn’t cater to retirement savers.

They both provide a variety of accounts to their members. Individual taxable accounts, joint taxable accounts, regular IRAs, Roth IRAs, and SEP IRAs are all available with M1 Finance. Each account has its eligibility criteria and requirements.

The traditional IRA is open to individuals under 70 ½ years old who have earned income, while the SEP IRA is available for small business owners with employees.

Individual and joint taxable accounts, conventional and Roth IRAs, and cryptocurrency trading accounts are all available with Robinhood. The requirements for each type of account also differ, and the cryptocurrency trading account requires a valid government-issued I.D. and social security number or tax identification number.

To open an M1 Finance or Robinhood account, you must be 18 years old and a U.S. resident with a valid Social Security number or Tax Identification Number (TIN). Both platforms require identity verification through personal information.

Both platforms offer a free basic account. But, M1 Finance charges $125 per year for an M1 Plus account, while Robinhood charges $5 per month for Robinhood Gold.

Customer Support

M1 Finance offers phone and email support during business hours, which can be helpful if you need immediate assistance with your account. Their website also features a sizable FAQ area where you may discover solutions to frequently asked queries or problems. On the other hand, Robinhood only offers email support and lacks a phone number for direct contact with its team.

It can make it more difficult to receive prompt assistance if the software ever gives you trouble.

Security

M1 Finance and Robinhood use two-factor authentication for logins. They also store user information in separate databases, making it more difficult for hackers to access a user’s information simultaneously.

M1 Finance uses bank-level security measures to protect user data, including 256-bit encryption for all account data, firewalls, intrusion detection systems, and regular security audits. Robinhood also takes user security seriously, with several layers of protection in place. The platform uses industry-standard SSL encryption for all sensitive information, such as account and Social Security numbers.

M1 Finance offers up to $500,000 in SIPC (Securities Investor Protection Corporation) coverage for each account type. In addition to SIPC coverage, M1 offers excess SIPC insurance from Lloyd’s of London, which provides an additional $25 million per customer for securities and cash combined.

Robinhood also offers similar insurance coverage with up to $500,000 in SIPC protection per account type. However, they do not provide any additional excess insurance as M1 does. It’s important to note that both platforms offer similar levels of insurance and protection, which covers custodial risk only.

Individuals are protected when their broker goes bankrupt or engages in fraudulent activities.

Frequently Asked Questions:

How do I choose the correct online investing platform for me?

Consider fees, investment options, user interface, customer service, and account minimums. This will help you put things in perspective and choose the platform that serves you best.

What exactly is a robo-advisor?

Simply put, a robo-advisor is an online investment platform that uses algorithms. These algorithms automatically manage users' portfolios based on their goals and risk tolerance.

Is online investing safe?

Online investing is, well, generally safe. Choose a reputable platform, take necessary security precautions, and your investments will be safe. Use strong passwords and enable two-factor authentication.

CONCLUSION

Deciding between M1 Finance vs. Robinhood depends on your investment goals and preferences. If you’re looking for a simple way to build a diversified portfolio that requires little maintenance or has various account types like trust accounts or IRAs, then M1 may be your best bet. However, Robinhood would make more sense if you’re an active trader interested in buying cryptocurrencies and stocks.