- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Have you ever thought of earning some money instead of surfing the internet all day long? If you want to do so, PTC sites, i.e., Paid to Click sites, are the easiest and easiest way to earn extra cash. But do you know any best-paying PTC sites?

Some of the best PTC sites are

- Neobux

- Clixsense

- InboxDollars

- InboxPounds

- PrizeRebel

- Offer Nation

- Scarlet-Clicks

- Paidverts

- Heedyou

- Makeculous

Different other PTC sites are outlined in the article. The PTC sites will help you to maximize your earnings and will help you to grow. So, if you want to start earning money from the comfort of your home, keep reading the article and discover the best PTC sites to use.

Table of Contents

17+ Top Paying PTC Sites

Now, let’s take a look at some of the PTC sites that we have to increase our earnings via this:

Neobux

NEOBUX is the chief PTC site as it is one of the most trustable and reliable sites. There are many ways to earn from this site, and you earn nearly $50-200 per month.

Furthermore, you can earn by clicking on ads daily, participating in surveys, and playing games. You can earn up to $0.02 per ad you view and up to $0.01 per referral click.

Neobux pays daily over 100K$ to their members who visit their websites. Payment can be made through Skrill, NETELLER, Payza, and Trustwave.

- Well Managed

- Instant payments

- Free Worldwide Service

- Wide Range of Earning Features

- Affiliate System (Increasing DR limits)

- Complaints about the Rented Referral System

- Strict Forum Rules

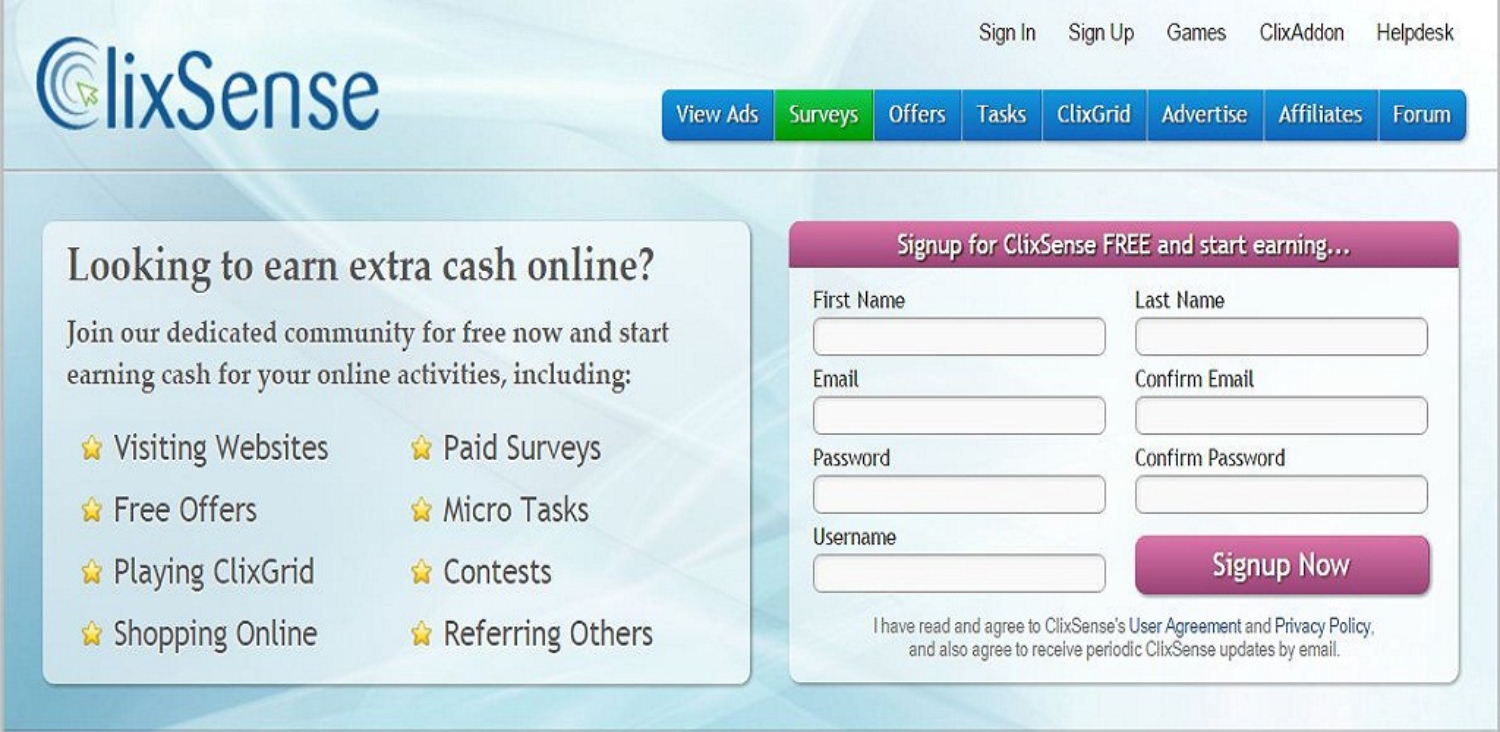

Clixsense

ClixSense is a global online community that offers multiple earning options. Join now and earn with paid online surveys, cash offers, completing simple tasks from home, and the referrals you make.

Earn extra income by participating in free paid surveys influencing the next generation of products, services, and much more.

Get high pay for attempting new products and services, downloading relevant apps, signing up for their websites, watching related videos, and many more.

In addition, you can make money by accomplishing simple tasks from the comfort of your home. Earn bonuses and participate in our weekly contest through this PTC site.

Keep sharing and promoting ShareSense with your friends, and watch your earnings grow quickly. You will end up earning up to 30% of what your referrals make!

- Free to join

- Agreeable site

- Multiple Methods To Earn Money

- Earn Up to $26 per day

- No instant payments.

- High Payment Threshold

InboxDollars

This is one of the most trustworthy PTC sites for international members. If you are from the US & UK, you can participate in more Surveys and offers. There are pretty many ways to earn extra income from InboxDollars.

Hundreds of people earn more than $100+ per month from this website by just viewing ads 5-10 minutes a day.

We have full-InboxDollars here, which could be helpful to you to earn a good extra income from this website.

Only people who live in the US & UK can join InboxDollars. ClixSense & Neobux should be your top-notch choice if you belong to another country.

- Earn cash, Not points

- Trusted & Mega-Popular

- Multiple Methods To Earn Money

- Super Large Community

- Easy Navigation

- $3 Processing Fee for $30

- No PayPal Support

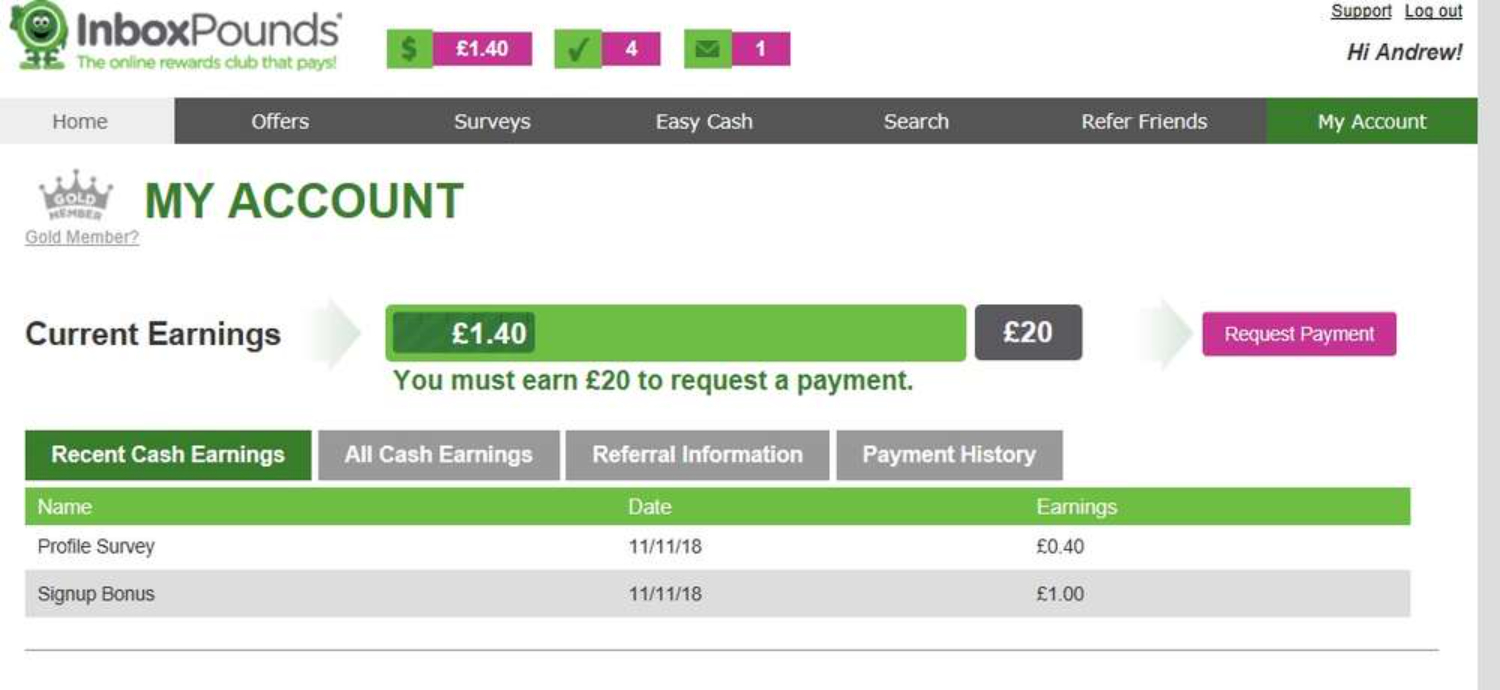

InboxPounds

InboxPounds is now a leading platform in the UK & Europe. It is also a top-notch PTC website, with its sister website, InboxDollars, being recognized by millions of users worldwide.

You can start by signing up on the platform and completing various tasks InboxPounds offers. The high-rewarding tasks are mostly taking surveys, watching videos online, and playing games that are usually interesting, and this is better than just clicking ads.

Like its sister website, InboxPounds also offers various payment methods to avail of your rewards. So, register now and start making money online.

Like its sister website, InboxPounds also offers various payment methods to avail of your rewards. So, register now and start making money online.

- Earn cash, Not points

- Trusted & Mega-Popular

- Multiple Methods To Earn Money

- Super Large Community

- Easy Navigation

- $3 Processing Fee for $30

- No PayPal Support

See Also: How To Make Money On OnlyFans?

PrizeRebel

Prizerebel is absolutely the best PTC site to earn coins to make money. On this website, you earn coins and stand a chance to get $1 for every 100 coins.

You can earn through Paid Surveys, Offerwalls, Video Walls, and other simple tasks. In addition to that, you also get paid by winning Raffles, Contests and lucky Numbers.

You can earn up to 20% referral points for life. Payment method- Paypal, Bitcoin, and Gift Cards.

- Minimum $2 Payout

- Quality Surveys

- Multiple Ways To Earn Money

- Super Large Community

- Easy Navigation

- Screening out Surveys

- No Consistent Offers

Offer Nation

Offer Nation is a paid survey website that offers multiple streams to earn dollars through clicks. Like other websites, Offer Nation pays $0.001 to $0.01 per click. The referral commission options are also available to increase your income. The minimum payout is $1 on Offer Nation, and you can get it through PayPal, Bitcoin, & Skrill.

However, you should remember that, like other popular websites, Offer Nation allows only one user per IP address policy. So don’t try to refer yourself using a different email address.

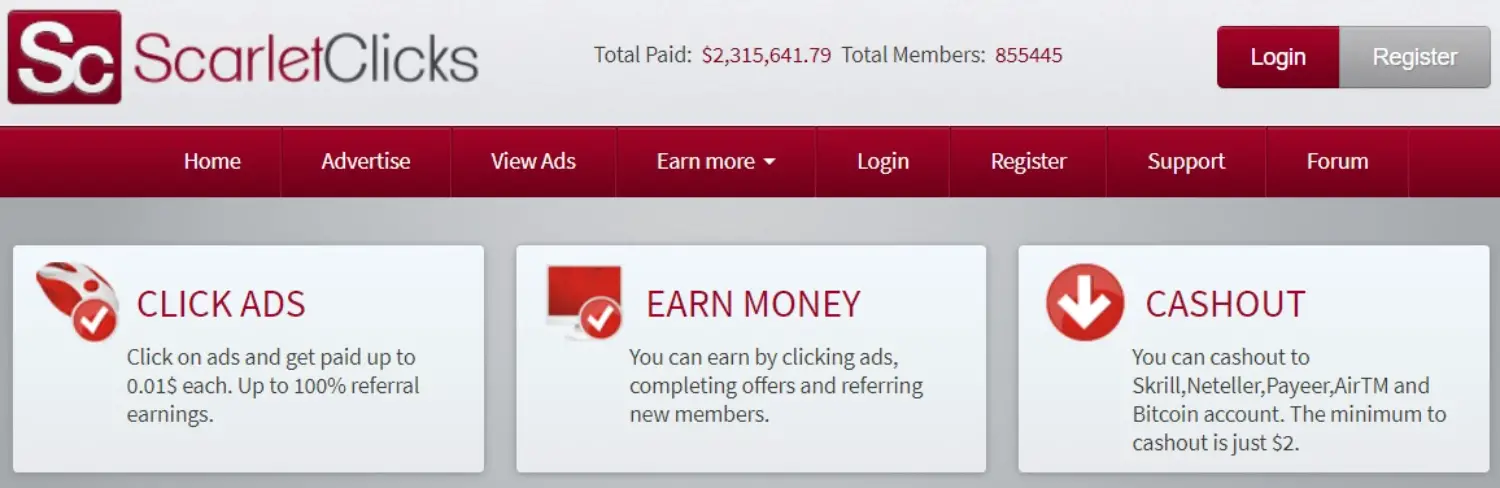

Scarlet-Clicks

Like Ayuwage, you can earn a lot of money by viewing ads, fulfilling offers, and referring other members to this website. Scarlet-Clicks lets you click on ads and pays you almost $0.01 per ad. Cool, isn’t it?

They also assure you about 100% referral earnings. You see approx 30 ads per day having a minimum payout of just $2. You can cash out to your PayPal or Bitcoin account.

Also Read –

26+1 Super Easy Ways to Get Paid to Watch Videos (Free Money)

16+1 Proven Ways to Get Paid to Play Games Online

Paidverts

This is one of the leading and high-paying PTC sites. The concept of Paidvert is quite divergent from other PTC SITES. When you join Paidverts, you have a task to click 16 Bonus Ads Points (BAP) regularly until you click 100 BAP Ads.

You will only be awarded the paid ads after you click 100 BAP ads. The more BAPS you collect, the more you earn.

Apart from that, you can also earn by referring your friends. Paidverts pay through different payment methods: Paypal, Bitcoin, Perfect Money, etc.

Heedyou

Heedyou works in such a way that their members go through the displayed websites to earn extra cash in their spare time.

You can earn up to $0.10 per click of the ad with a minimum payout of $1. You can do instant Payments via PayPal and Payza. Some of these websites give out high payouts during Black Friday & Thanksgiving. You can also check out these Black Friday hosting deals for comfort.

Makeculous

Makeculous is one of the best PTC sites for earning money during leisure time. Earn extra income by performing simple tasks like surveys, watching videos, tasks, offers, and playing games.

You will earn a 10% referral commission and a minimum payout of $10. The payment method could be Bitcoin, PayPal, etc.

Also, read – 20 Best Online Jobs for Moms (Stay-at-Home Jobs)

Ojoo

Ojoo is one of the fantastic PTC sites and has been working for the past 3 years. Earn up to $0.04 per ad that you click.

Also, you can earn up to $0.015 per referral click and get up to a 9.2 bonus for every. You can make payments through PayPal, Payza, etc.

Difbux

Like other PTC sites, members get the privilege of earning cash just by viewing the ads that they see on the website. You get all the perks by just becoming a member of Difbux.

You need to visit the websites daily as we guarantee that the ads you see are frequent.

The other benefits include detailed statistics, and you can also upgrade opportunities. Apart from that, you get instant payments by just viewing ads.

Buxinside

As a member, you can earn by viewing the ads you see on Buxinside. The best part is you can cash out instantly at only $2.

The edge of this website over other PTC sites is that you can earn money effortlessly and get instant payments via PayPal, Payza, and Bitcoin.

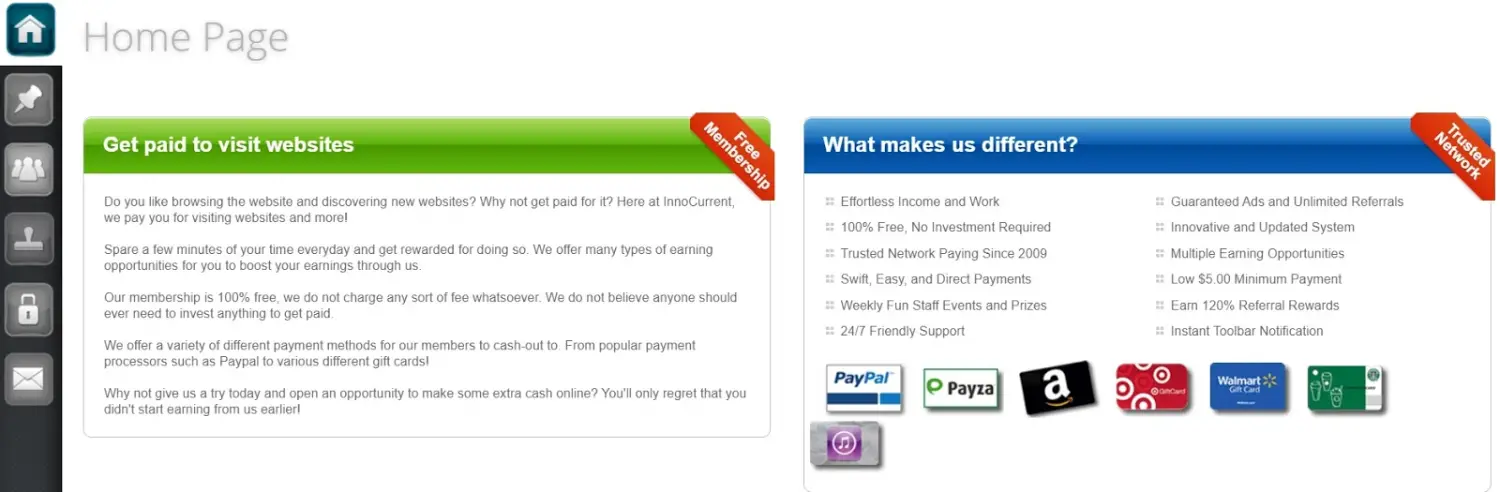

Innocurrent

Innocurrent gives you a golden opportunity to earn $0.03 per ad you click. You can also earn a referral commission of up to 120%.

You can see the ads frequently, nearly 40 ads daily. Moreover, you get a minimum payout of $5; the payment method could be through PayPal, Payz, etc.

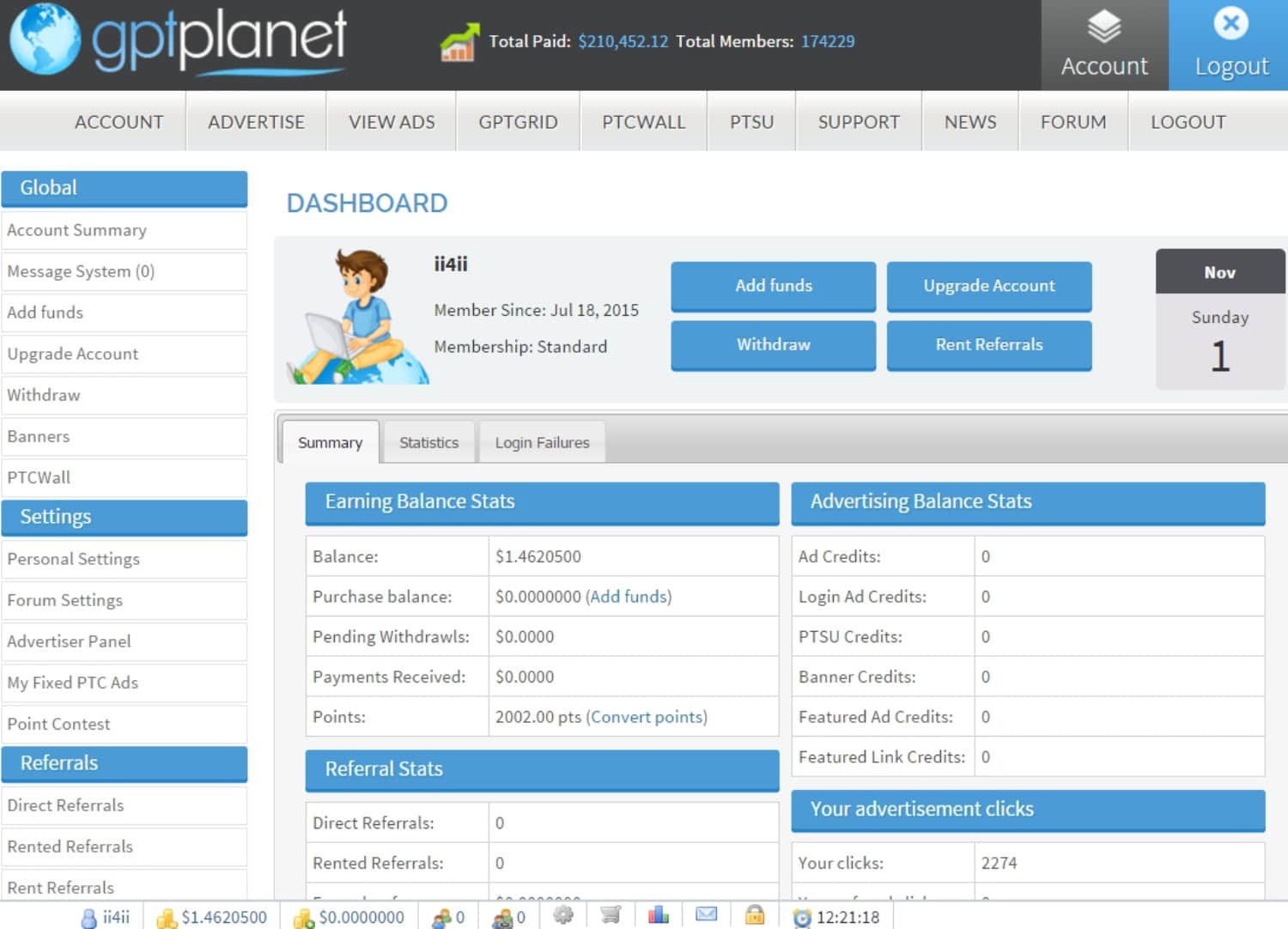

GptPlanet

Gptpanet, launched in 201, is a PTC website where a free member can earn up to $0.001 – $0.0002 for viewing advertisements.

It has almost six to seven upgrade plans, and you can earn quite a lot of money as an upgraded person. Direct referrals will also fetch you a lot of money.

Also, Read – How To Make 1000 Dollars Fast (23 Ways to Earn $$$)

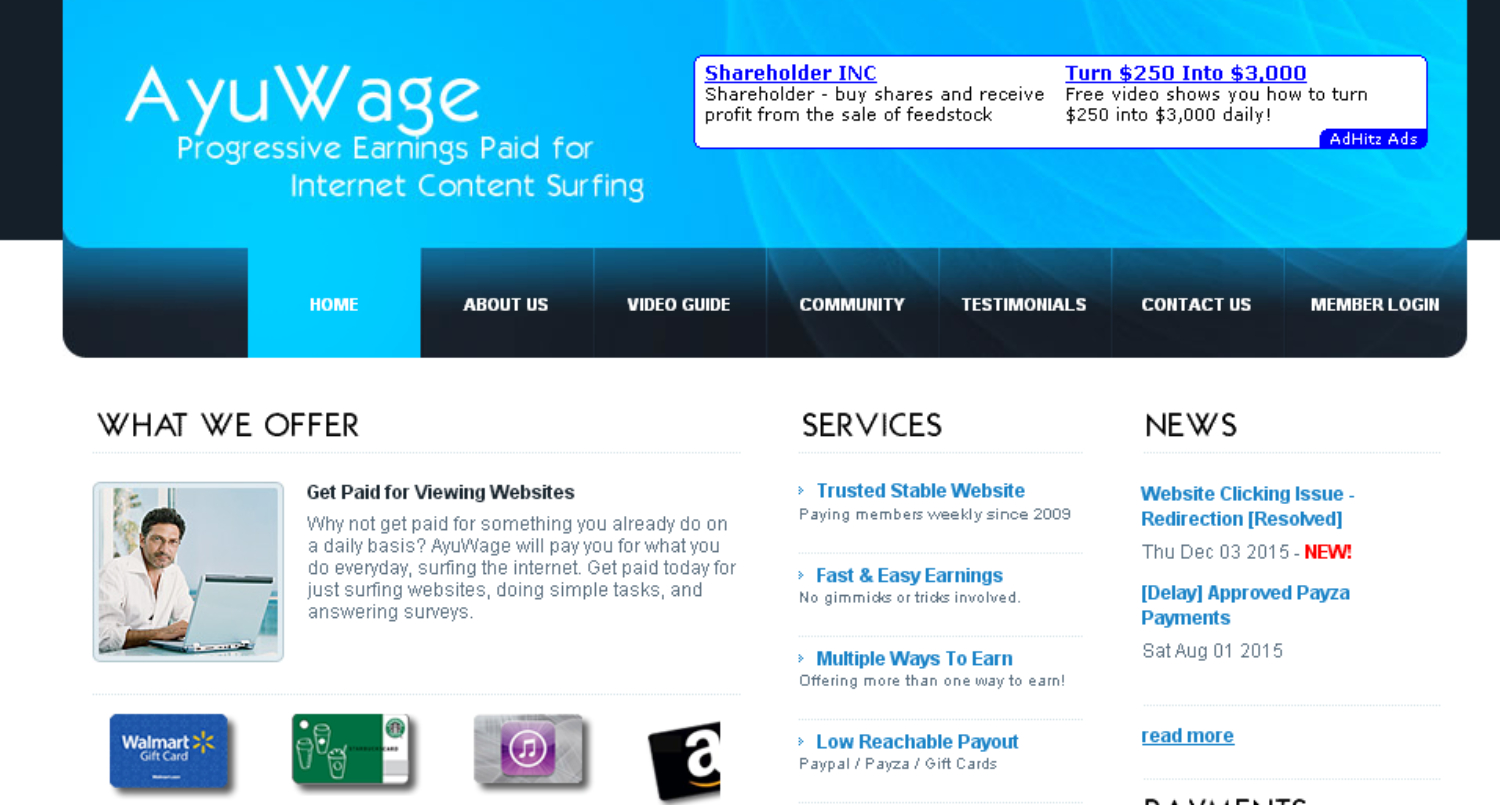

Ayuwage

Enough of doing things that you frequently do without getting paid! Why not start earning money for doing things you do every day?

Ayuwage is here to give you what you deserve. They pay their members to surf the internet, view their websites, do simple tasks, and answer surveys.

I must admit that they are one of those legit websites you will find online that have paid their members on time for more than 3 years now with a minimum payout of $2.

AyuWage pays personally to your desired payment method within a few business days. So, what are you waiting for? Try them out immediately and give them the liberty to pay you, just as they have paid for many others. You earn up to $0.01 per ad.

Also, if you want to earn more money from survey sites, try Learnbonds. Learnbonds explains how much you can earn from surveys with easy guides and thorough information.

Donkeymails

Like other PTC sites, Get Paid for Clicking on ads through Donkeymails. Also, you can manually surf with Cash and Credit prizes, and you can make money up to $25.

Now, not just that, you can earn extra cash by playing games. Amusing. There are different ways of earning cash using Donkeymails, and one is to earn cash by reading daily emails.

Moreover, you earn extra income for more than $250 signups to earn more Daily New offers! Get Paid To upgrade $0.50 per 1,000 Credits!

Payouts will be made once in 2 weeks, and there are 5 Referral levels of commission beneath you. Payment methods- $1 minimum Bitcoin payout, Perfect Money, $1.06 Paypal, and $0.50 Solidtrustpay.

Suggestions to Earn More Money on PTC sites

Here are some PTC site methods and strategies you can use to increase your earnings from online ad-clicking jobs.

Register with the most PTC websites possible.

First, prospective paid-to-click customers should sign up for at least ten highly lucrative PTC sites.  You will have additional opportunities to investigate and learn about the PTC industry by joining more ad-clicking sites and providing more ads to click.

You will have additional opportunities to investigate and learn about the PTC industry by joining more ad-clicking sites and providing more ads to click.

Schedule time for work and promotion

Creating accounts on PTC websites is unnecessary, and you must invest a few minutes in clicking for money and learning how to advertise to grow your downline.

Daily time should be between 15 and 20 minutes. Additionally, avoid using your smartphone to navigate PTC websites; instead, use a computer and the Chrome or Firefox browser for optimal efficiency and time savings.

Create your tactics

It will be preferable if you can construct your road to success using the advice of professionals. One person’s exact plan might not be suitable for another.

Use the PTC app to save time clicking advertising

It will take more time to earn money by watching ads one at a time. Utilizing the free PTC app is a better solution. You may manage your PTC sites and click ads with this program without opening numerous tabs.

Create your downline

Your downline-creation strategy is the most crucial aspect. Increasing your earnings on pay-per-click sites is the hardest and greatest strategy.

If you frequent Q&A websites, you can also recommend users to Yahoo Answers or Quora.

Quality over quantity

Having 10,000 inactive references is useless, regardless of how many users have them. To make money, you need a thriving downline.

To keep the referrals active, you can train and motivate them.

To keep the referrals active, you can train and motivate them.

Purchase premium membership upgrades

PTC customers can typically upgrade their account to a premium membership by paying a small amount to the paid-to-click website.

When a user upgrades his account, he will be paid twice for clicks he makes and clicks from referrals.

Pros and cons of PTC jobs

Pros

- PTC websites’ benefits include the following:

- Watching advertising for money online is the most straightforward job. Say no to laborious labor; pay-per-click jobs are all about clever work.

- Like the Ethereum faucet, you can get money by clicking adverts without investing or paying for registration.

- As you progress, receive daily payouts from the pay-per-click websites.

- Take charge and profit from referrals.

- The best online position for stay-at-home homemakers, stay-at-home working mothers, and students looking for part-time work.

- While traveling, use your smartphone to click adverts.

- Users from all countries, including the USA, UK, Philippines, India, etc., can access PTC sites.

Cons

- Ad-clicking jobs don’t work well for most people on PTC sites.

- You need a massive downline to get respectable revenue from paid-to-click sites.

- Low level of job satisfaction in comparison to freelancing work.

- The majority of PTC sites are frauds. So, stick to the sites that are given above.

- No direct deposits into banks.

FAQs

How to check if the PTC site is legit and safe?

Even though all sites are safe, it is essential to verify a scam PTC. Any suspicious activity or bad review is a clear sign of walking out. Checking out the different payment options also shows their legitimacy.

How to get started with PTC websites?

First of all, create an account with the website to get started. After the signup process, you'll be asked to view ads and get paid per ad depending on the ad and duration. Referrals also lead to a small bonus.

How does one get their payment?

Once you reach the withdrawal limit, the amount is processed using PayPal, Payza, etc. Before withdrawing money, add and verify your bank account with these payment options.

Conclusion

So these are some of the top-notch PTC sites where you can join in, be assertive of viewing numerous ads and other earning offers, and make smooth-running payments. Also, all these PTC sites have an excellent payment history with positive feedback from the members who viewed the ads.

A PTC site is a very easy and honest way to earn a bit of money. It’s free to join and there are no hidden fees. You just politely share your affiliate link and your money is deposited through PayPal or whatever you choose. It’s just advertising for wholesome companies.

Site name

New PTC site. I am currently earning 1.00 per click and I am also promoting and bringing traffic to my other online affiliate offers. You can get started for FREE here and get the same results and more as long as you are an action taker. In a nutshell, awesome article!

which ptc site are u earning 1 dollar per click can u share pls

Hi, I’m Maziar, can you help me earn money? Income by clicking

Details please

Thank you for this very comprehensive list! There are a number of sites on your list that I haven’t heard of before, I need to check them out!

I stumbled across a site the other day that’s an auto surfing site that pays you $0.02 per page you surf. But they’re not as reliable as these sites.

Thank you for this very comprehensive list! There are a number of sites on your list that I haven’t heard of before, I need to check them out

plz sir help me

Hi, Everyone, I notice some people are extending greetings for a shared list of PTC sites. Please, I can get to see any list here. Kindly shared the list with me. Plzzz

Get For Lead it the high paying PTC website that you never seen

Comments are closed.