- SurveyJunkie: Make $5-$25 in your free time. Just take online surveys, participate in Focus Groups and trying new products. Join SurveyJunkie Now!

Tired of losing your loyalty cards when you really need them? Thanks to this list of the most popular loyalty card apps, you can easily keep all your loyalty cards in one place. You’ll find the best loyalty card apps for Android and IOS in this article.

Loyalty card apps allow you to earn rewards at your favorite stores without having to carry many different cards around with you. Some of these are-

- Stocard

- Key Ring

- Virtual Cards – Loyalty Cards and Coupons

- Virtual Loyalty Cards Wallet (Klaus Apps)

- Pocket Loyalty Cards Wallet

- Apple Wallet

- FLOK

Keep reading to find out more about the best loyalty card apps for Android and IOS.

Table of Contents

Best Loyalty Card Apps: Core Concept

Loyalty card apps help you store and use all your loyalty cards without carrying them all around.

You can scan and store your loyalty cards’ barcodes/ QR codes on your app. The next time you step out and need a particular loyalty card, you have to show them your code, and you’re all set!

So relax, set back, and enjoy your loyalty benefits while the app handles all your hassles.

Top 12 Best Loyalty Card Apps for Android & iOS

A loyalty program is beneficial but comes with a problem most people face. People often notice that they have left their loyalty card at home, or they lose it. It isn’t enjoyable because people lose out on their points and discounts.

To avoid this, people install a “Loyalty Card App” on their phones. You have to type the number or scan your loyalty card in the app, and your loyalty card is stored in the app. Then, you must ask the cashier to scan the barcode, and you’ll get your discount or points.

Below is a list of some of the best loyalty card apps for Android and iOS devices:

Stocard

With over 45 million Stocard users worldwide, this app is compatible with IOS and Android. It helps you easily digitize all your loyalty cards; you only have to scan them at the store.

It updates you with exclusive offers and discounts you can grab at your favorite stores.

Stocard helps you collect and maintain reward points that you can quickly redeem at the store of your choice.

Overall, it is one of the most reliable & best loyalty card apps to store loyalty cards, shop with and save a ton of money.

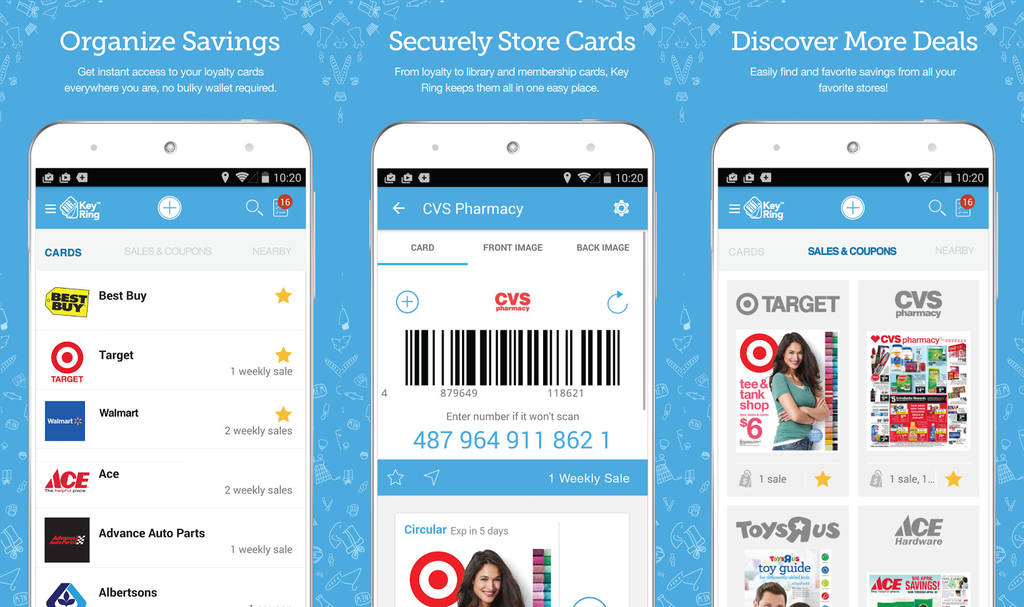

Key Ring

Key Ring is one of the most popular reward card apps, with millions of users.

This app makes the entire shopping and saving process a lot easier. It stores all your cards in one place and lets you use them whenever needed.

Key Ring finds weekly advertisements, discounts, and offers the most suitable for you and suggests them, ensuring you can take advantage of these offers at your favorite stores.

Saving money is always a shopper’s agenda, which becomes easily achievable with Key Ring.

Key Ring allows you to store your loyalty cards on your phone. So, you no longer have to carry all the loyalty cards with you when you go out to shop.

This is handy, as it means that you do not have to carry many cards in your wallet and don’t have to worry about forgetting a loyalty card and missing out on savings. It is available for IOS.

Virtual Cards – Loyalty Cards and Coupons

Virtual Card is a stress-free app that lets you sign up with a few easy steps and organize all your loyalty cards into one app, eliminating the annoyance of carrying multiple cards.

You can create shopping lists and input items you wish to buy, and the app provides you with a list of discounts and offers on the brands of your choice at the sellers near you.

It also allows you to share the latest offers and your favorite stores with your friends with the help of social media networks.

Virtual Cards also help keep tabs on the sellers and merchants by allowing you to leave reviews and read reviews before you make any purchase.

Virtual Loyalty Cards Wallet (Klaus Apps)

This app helps you keep your wallet light and organizes all those pesky plastic cards into your phone with a simple scan.

It ensures the security of your loyalty cards and requires a pin code before use.

With fast processing and great offers, this app makes shopping much cheaper and helps save a lot of money with different offers.

Your shopping experience will be completed in a snap and will be a breeze with the help of this app.

Pocket Loyalty Cards Wallet

This is one of the easiest ways to store your loyalty cards on your phone. The cards remain protected with the help of passcodes.

Pocket loyalty cards will help you show or hide your offers with a simple wipe, display your loyalty cards on the home screen, or list your favorite offers. Points can be earned and redeemed in no time.

Apple Wallet

If you are an iOS user, the Apple Wallet is one of the best options for you out there. It links all your loyalty cards, credit and debit cards, student ids, and other data onto your phone, allowing you to access it easily at any given time.

Apple Wallet is also secure and ensures that your data is not misused or stolen with several security measures put in place. It is the one-stop shop for all your payment and shopping needs, making the entire process a cakewalk.

You can also use it to store rewards cards & coupons with ease.

iOS– https://apps.apple.com/us/app/apple-wallet/id1160481993

FLOK

Flok is a mobile rewards card app that helps you find local businesses with loyalty programs. Then, each time you visit a business, you get a punch on your digital punch card and can redeem your rewards whenever you want.

You can earn more rewards by checking in when you visit a business. It also has many features when you dig it in. Also available for both Android and IOS.

Android- http://market.android.com/details?id=loyalblocks.userapp

iOS- http://itunes.apple.com/us/app/loyalblocks/id376560037?mt=8

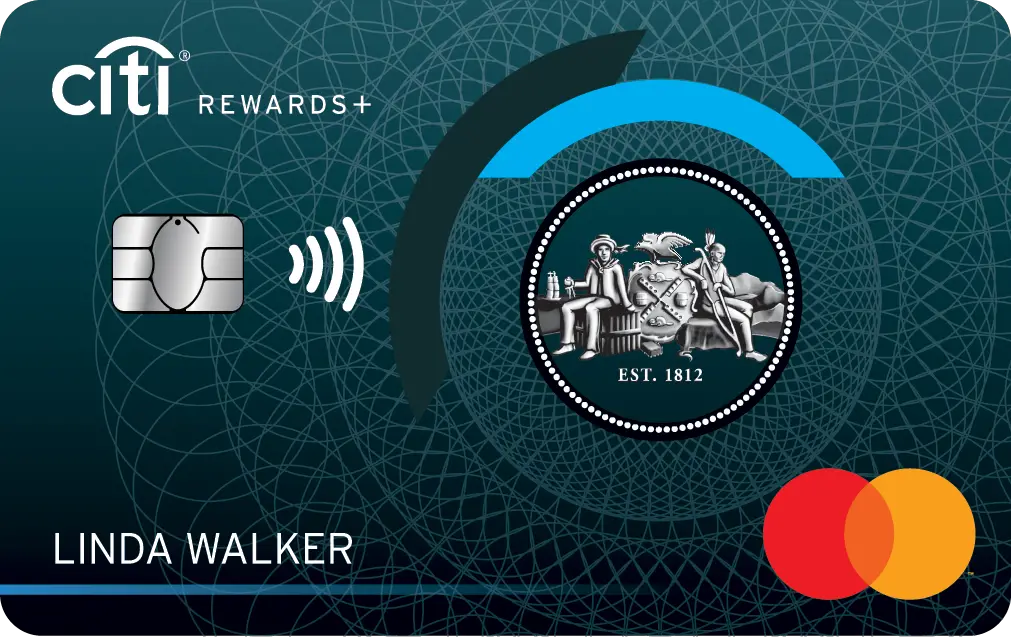

Citi Rewards

This Card is solely beneficial for Citi credit card users, but it had to be on our list because of its unique features. As every payment made with Citi Credit Card at retail outlets, online shopping sites, petrol stations, travel, and hotel bookings, customers earn rewards points.

They can transfer their points to frequent flyer programs and enjoy exciting benefits. How cool! Isn’t it?

iOS – https://itunes.apple.com/app/citi-mobile-sm/id301724680?mt=8

Android – https://play.google.com/store/apps/details?id=com.citi.citimobile

Payback

Payback is one of the largest multi-brand loyalty card apps that allows you to access almost all the brands you usually use.

It includes brands where you shop for your daily needs and, of course, your favorite ones. It is a must-have if you love shopping and can save a fortune.

Virtual Cards

Keep all of your loyalty cards on your phone with virtual cards. It provides features where you can see offers and promotions, get coupons, and create a shopping list.

It consists of features to turn notifications on/off from your favorite about discounts and rewards. Only available for both.

Five Stars

It helps the customer to earn rewards from businesses.  It is available on both Android and iPhone.

It is available on both Android and iPhone.

BELLY

Belly is a rewards app a customer can use at participating businesses.

Also, read – 7 Best Credit Cards for College Students in 2023

Digital Loyalty Cards

Clients no longer favor using plastic cards because they are old. There are 2 means for digitizing loyalty cards: to offer it through a wallet app or integrate it into the loyalty program.

Loyalty Card App’s Benefits and Drawbacks

A loyalty card app has the following advantages:

Customer Retention

A loyalty card app’s primary goal is to keep customers. Rewards and incentives motivate customers to support your business.

Customer Data and Consumer Trends

A loyalty card app collects customer information to send users to push notifications about special deals and other benefits for making purchases. Additionally, it offers information about customers’ trends, tastes, and purchasing patterns for tailored marketing.

Enhanced Cart Value

Your store can cross-sell and up-sell products after collecting consumer data. You can provide extended warranties for bought equipment and complementary accessories; discounts on the associated purchases are another option.

Reducing Unproductive Customers

A well-designed loyalty card app enables client segmentation, allowing successful and unprofitable customers to be identified. It aids in directing your marketing strategy toward customers who will pay off.

Better Customer Communication

A loyalty card app makes customer communication much more straightforward. You may announce new products, encourage sales, and provide services with direct client communication.

No competition regarding price with your competitors

You are constantly engaged in competition with your competitor(s). You need to have a lower price than your competitor(s) to attract customers. By introducing loyalty programs, you don’t run the risk of losing your customers anymore.

Launching a loyalty program gives your customers a loyalty card, which helps them get a discount or points; by doing so, you retain your customers.

Increase Customer Lifetime Value

Customer Lifetime Value (CLV) is your relationship with customers. A loyalty program helps you to know what the CLV is for each customer. With this data, you can also make further plans and strategies.

For instance, the CLV can give you data about the behavioral patterns of your customers, and with the help of this, you can reward them at each step of the loyalty program, thereby increasing CLV.

It helps to build personal relationships.

CLV provides a company with valuable data to use to chalk out strategies. With the help of this data, the company learns many things about its customers’ buying patterns.

The company can then match its customers’ requirements, which makes the customer feel valued.

Disadvantages of Loyalty Card Apps

A loyalty card app has the following drawbacks:

Maintenance Necessary

An efficient loyalty card software will need regular care and maintenance, and you must alter and refine it according to your client’s wants. It can take a few tries before you settle on an effective strategy.

Lower Profits

There is a delicate line between your business’s profit and the client loyalty benefits you give. It’s simple to fall into the trap of providing consumers with such excellent service that you fail to make a profit.

Inconsistent Profitability

Your profitability with the loyalty card app may vary due to the consumers’ shifting purchasing habits.

Restrictions on Loyalty Data

A loyalty card app may provide information about a customer’s preferences but does not give you a complete picture of their purchasing patterns.

Factors Of Developing a Loyalty Card App

The price of developing one of the best loyalty card apps depends on many factors, as follows:

- Complexity – An app for a loyalty card with more capabilities will cost more than a simple app.

- Tech stack – The cost of building an app may vary depending on the technologies used.

- Integrations with third parties could result in third-party service fees or commissions for your loyalty card app.

- Development team – Several factors can affect the hourly rate of development teams—in smaller companies.

FAQs

Are cash cards loyalty cards?

You can get your Pag-IBIG revenues, savings rewards, and other benefits on your Pag-IBIG Loyalty Card, which mainly serves as a cash card. It also functions as a rewards card where you can get special offers from more than 300 partner companies on things like groceries, tuition, restaurants, and more.

What do you refer to as a loyalty card?

A typical rewards program involves opening an account for a company's customer participating in the program, then issuing the customer a loyalty card, which may be paper or plastic.

What makes a loyalty card worthwhile?

A loyalty card provides more substantial rewards. The client earns points each time the card is scanned, which can be redeemed later. You can obtain the company's rewards by exchanging the earned points. Discounts, cashback deals, or other products may be available.

Summing Up

These some of the best loyalty card apps help a person avoid the problem of forgetting his/her Card at home or elsewhere as a person always carries his/her phone everywhere with him/her; the Card can be stored on the phone, and this saves the person from going through the hassle of finding his Card.

If you want to sell video games online, click here.

You can also make money on Winwalk by walking.